A Matter of unity – Banks & Fintechs

By Igor Pesin, Life.SREDA VC

Today several capital cities of Asia pretend to be the fintech hubs of Asia… However most of their activities are aimed to only attract attention (media PR, conferences, awards) and unite local talents around fintech (accelerators, coworking-spaces, hackathons) – but not to help them to build real businesses: to launch products (not to test them in different “sandboxes”); to develop and grow it and then scale to other Asian markets. Fintech can’t exist within one country – you have to be a gateway to the borderless digital world. The real fintech hub is not the place where the most of buzz and PR is produced, but where the real financial innovation and technology is created.

Startups in Asia as well as western fintech-leaders expanding to Asia, are getting tired of the buzz around the industry, and are looking for a real help and support for their businesses.

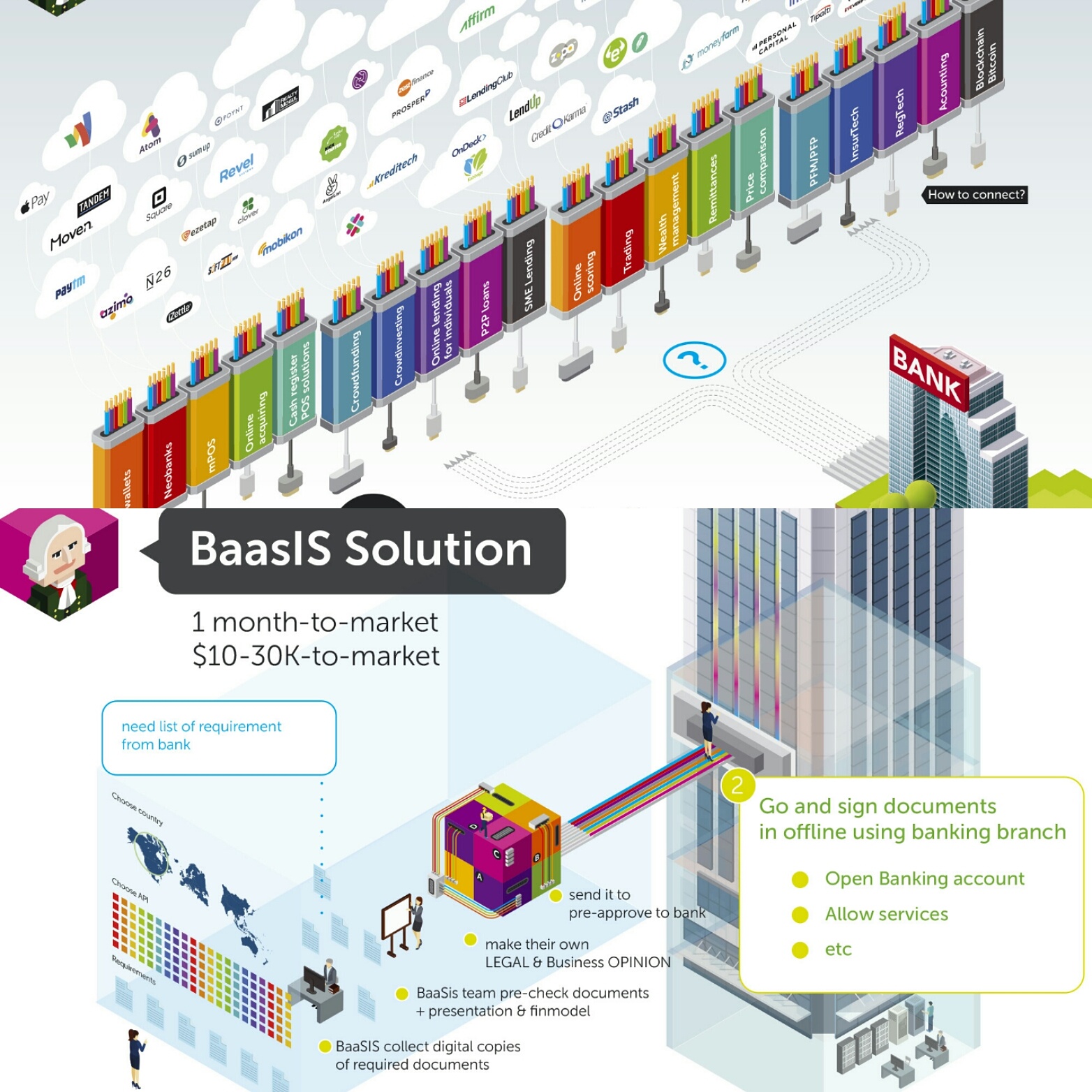

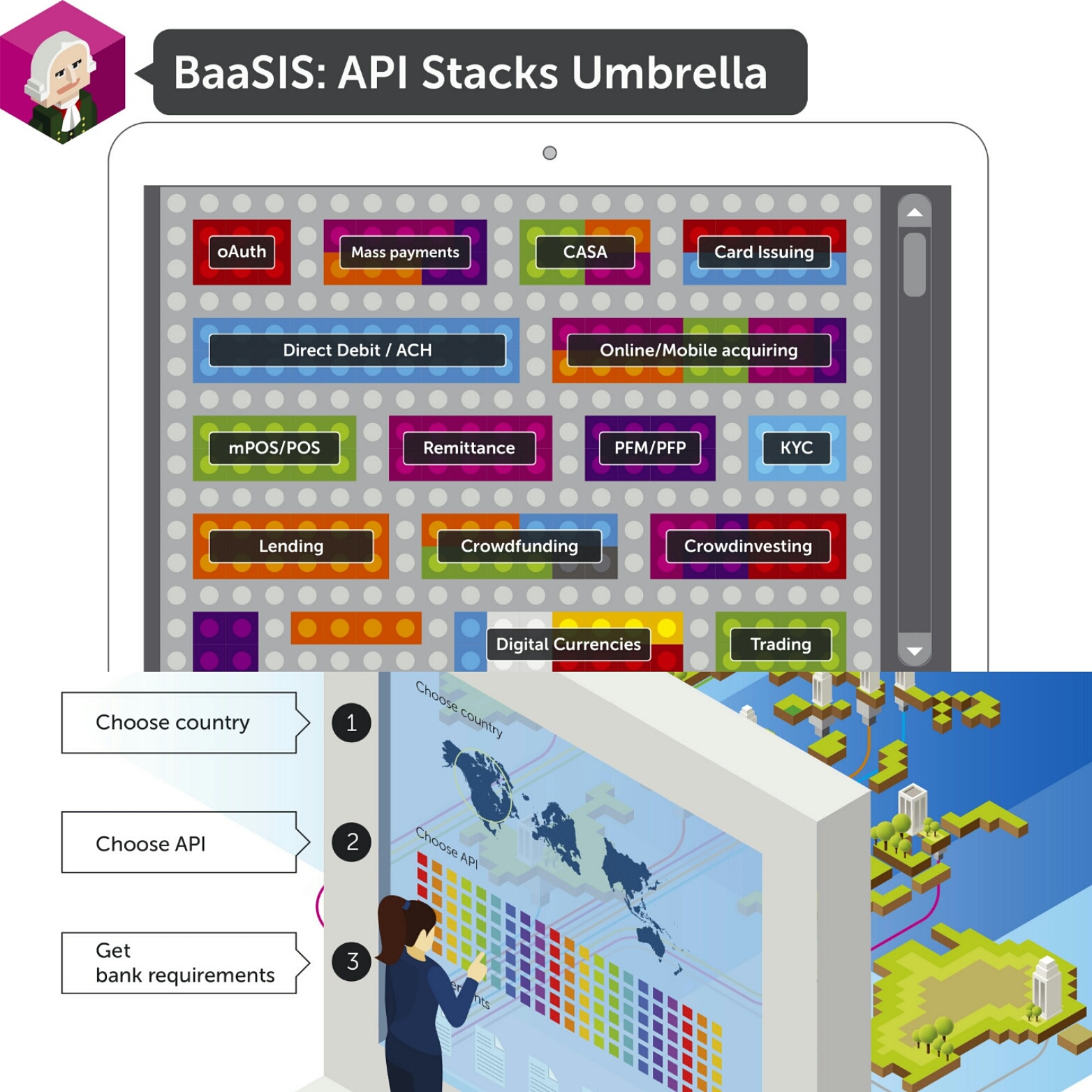

BAASIS is a software platform with an API layer connecting banks and startups that helps to unify and transfer information from banks to fintech in a standardized manner, functioning as a middleware and consists of a standardized suite of APIs that enables an effective flow of information. Fintech ventures and their systems do not need to communicate directly with the core banking systems. It solves this problem of fintech by providing a common, unified infrastructure layer that will enable a simplier and faster launch in different countries.

BAASIS is a pan-Asian platform, meaning that it will connect banks from different countries and allow fintech startups to easily scale from one market to another. So, BAASIS plays a role of ecosystem-builder: connecting banks, startups, regulators from different markets.

This project will not only “help” by different marketing and coaching activities as most of accelerators do, but also is responsible for a technical launch of any fintechs (for seed-stage), as well as foreign fintechs to come to the region. In addition it would help any Asian fintechs to go abroad (scale).

With BAASIS project investments in fintechs, hosted on bank-as-a-service infrastructure, VC investments will be less risky due to clear understanding of tech developments. Bank-as-a-Service platform will allow startups to launch cheaper and faster their financial products, that will provide more effective usage of VC-money, because it it will allow startups to scale to the new markets that would improve their traction and drive valuation.