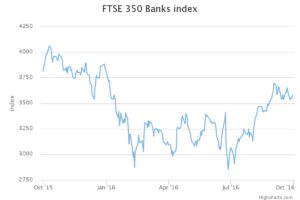

Since the credit crunch in 2008, banks have been struggling to adapt to their new environment. Low interest rates coupled with meagre yields in the financial markets mean banks can generate fewer profits from the deposits they collect, the loans they dole out, and the market services they provide.

While government schemes such as Funding for Lending have propped up some of the banks’ operations, they have dampened activity in other areas, for example by subduing market volatility with vast quantitative easing programmes.

Even insiders admit that the sector is still going through a rough patch. Tidjane Thiam, who took over as boss of Credit Suisse in 2015, described big European banks as “not really investable” this week.

Many European organisations are giving up on “universal banking” and have rowed back their investment banking activities, although their efforts to reshape themselves have yet to produce any real improvement in returns.