Apple’s Fight to Lure Japanese From Cash Starts at Turnstile

By Gareth Allan for Bloomberg

Apple Inc.’s plan to allow Japanese customers to use iPhones to pay for their daily commute underscores the potential for digital payments to grow in a nation where people still prefer to hold cash.

Japanese have for years been using rail passes that double as electronic money cards, which a growing number of retailers now accept for payments. Yet people have tended to restrict e-money purchases to small items, and Japan trails countries including South Korea and Singapore for digital settlements as banknotes remain widespread.

That presents an opportunity for Apple, whose next iPhone in the country may include technology called FeliCa, the mobile tap-to-pay standard developed by Sony Corp. that’s in cards such as the Suica and Pasmo rail passes, people familiar with the matter saidlast week. By tapping Japan’s expanding FeliCa infrastructure, Apple could foster growth in e-money usage through its Apple Pay service and entice more people to buy its phones, which are the top sellers in Japan.

“Apple are doing this because they want to sell more iPhones,” said Greg Pote, chairman of the Asia Pacific Smart Card Association. “Assuming that Apple does offer more services based on FeliCa and possibly supporting services like Mobile Suica, this would be attractive to their customers.”

Other technology giants are also looking at getting into Japan’s mobile-payments market. Google parent Alphabet Inc. will tie up with Mitsubishi UFJ Financial Group Inc. on its Android Pay platform, a person with knowledge of the matter saidWednesday. Starting as early as Japan’s autumn, users of certain Android-based mobile phones will be able to use MUFG’s debit cards for transactions made through Android Pay, the person said, confirming an earlier Nikkei newspaper report.

NTT Docomo Inc., the nation’s largest mobile carrier, introduced the FeliCa technology in its phones in July 2004. There are now more than 300 million e-money cards and devices in Japan — about 2.4 for each member of the population, central bank data show.

The nation’s mobile payments network has expanded more than seven times since September 2007 to 1.9 million terminals in May. That’s larger than the 1.3 million terminals in the U.S. and 320,000 in the U.K., according to research from Let’s Talk Payments and the U.K. Cards Association.

For a QuickTake explainer on mobile payments, click here.

“The attraction for the user is convenience and in some cases points or a little bit of savings, and on the issuer side, the handling of cash is very expensive,” said Gerhard Fasol, president of Tokyo-based consultancy Eurotechnology Japan.

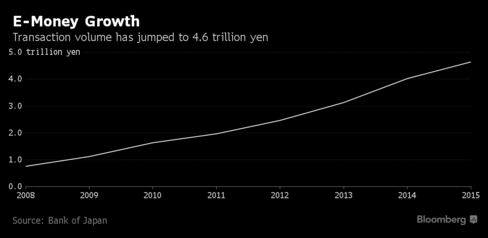

Yet e-money settlements remain dwarfed by credit cards and especially cash. E-money transactions climbed 15 percent to 4.6 trillion yen ($45 billion) in 2015, Bank of Japan data show. That’s about a tenth of the 49.8 trillion yen in credit-card payments, which rose 7.7 percent last year, according to the Japan Consumer Credit Association.

Cash is still used for most retail transactions because automated teller machines are ubiquitous and people are comfortable carrying large amounts of money due to Japan’s reputation for low crime, said Eiichiro Yanagawa, a senior analyst for consulting firm Celent, who questions whether Japanese will switch to e-money on a large scale. “Are we really that dissatisfied with something in our day-to-day lives?”

Japan’s use of non-cash payments is low compared with other countries. Credit and debit cards and e-money make up only 17 percent of the nation’s retail consumption, versus 85 percent in Korea, 56 percent in Singapore and 35 percent in India, according to a 2015 report by the credit association. Usage in the U.S., which includes data only for credit and debit cards, exceeds 40 percent.

E-money tends to be used for small transactions in Japan. The average sale processed with the technology in May was 993 yen — less than $10, BOJ data show. Generating profit from low-value retail sales is difficult, which is one reason why banks are largely absent from the e-money space, according to Celent’s Yanagawa.

Low Fees

“It’s difficult to see this working as a fee business,” said Yanagawa. Such small transactions are more valuable when they can lead to other revenue, such as by fostering customer loyalty for retailers, he said. Large store operators such as Aeon Co. and Seven & i Holdings Co. are pushing their Waon and Nanaco-branded e-money cards.

Hitomi Aono, a 21-year-old student in Tokyo, says she spends around 1,000 yen a month at convenience stores and vending machines with her Suica card, which saved her once when she forgot her wallet. As an iPhone user, she would consider adopting mobile-based services “but they would need to be easy to understand,” she said.

“I’m trying not to spend too much while I’m studying, but I can see myself using e-money more when I finish school and start working.”

First appeared at Bloomberg