How Loyalty Programs Will Shape Mobile Payments

By Brian Yurcan for American Banker

Credit card rewards programs were born in the heyday of plastic and paper. As payments go digital, banks will have to make sure their loyalty programs keep pace.

For example, Wells Fargo recently upgraded its options for customers to keep tabs on their points. Cardholders can now see their rewards alongside their other accounts, they can view them on any platform (mobile, tablet or desktop) thanks to responsive design and they can set up automatic redemptions toward deposit accounts, some credit lines or for certain merchant gift cards.

“Success for us means customers engaging with [the rewards] platform,” said David Patron, head of loyalty solutions for Wells Fargo.

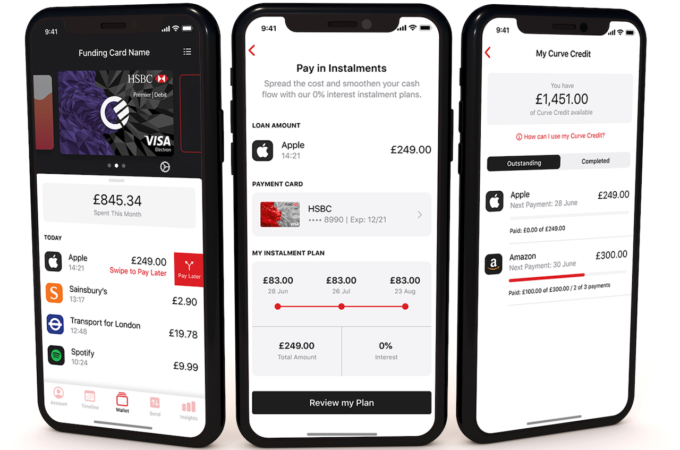

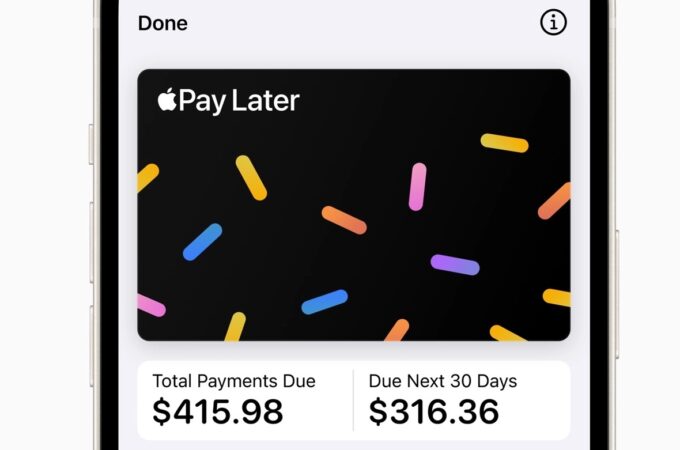

While the move may seem small in the scheme of mobile banking, the digitization of loyalty rewards programs is the underpinning of the adoption of mobile payments. For decades, banks have fought hard to ensure that their cards are the ones their customers grab first by offering perks. But the meaning of “top of wallet” is evolving.

“The way people shop and the way they interact with loyalty programs has changed,” said Lars Holmquist, senior vice president for the Americas at Collinson Group, a customer behavior research and consulting firm. Banks still have a long ways to go, he adds.

“The traditional financial services firms actually have a clear opportunity to deliver highly engaging, digitally driven loyalty initiatives due to the wealth of data they collect,” Holmquist said. “They need to go further in terms of using this data to improve targeting and segmentation to appeal to distinct audience groups.”

Mobile payments and digital wallets haven’t quite reached mass adoption, in the U.S., but they are popular among the mass affluent, a segment banks are typically desperate to reach and maintain as customers. According to a survey of more than 6,000 consumers in the top 15% of earners globally conducted by Collinson Group, 66% of U.S.-based respondents reported using digital payments “whenever they can.” Additionally, a good chunk of this group are swayed by incentives — 23% say they use digital coupons on their smartphones.

The findings are perhaps welcomed news to banks, as many continue to wonder if digital wallets and mobile payments will catch on in the U.S. The desire to use them is there, at least among the mass affluent, said Holmquist.

“Digital wallets are a fascinating category, the expectation was that everyone was going to immediately adopt this [payment method],” he said. “And we are finding there is still a tremendous turf war regarding which digital wallet or wallets will win out long-term. So adoption is happening more incrementally. But I think we can expect to see digital engagement continue to soar over the next three to five years.”

Several banks and observers see a natural connection between rewards and the adoption of mobile wallets. For instance, JPMorgan Chase is pairing with retailers for its Chase Pay mobile wallet, which is expected to launch later this year.

Trends globally also portend a rise in mobile payments adoption in the U.S., he said. For example, 46% of those polled overall in the survey reported using a mobile wallet, with that figure being only 28% for U.S. respondents.

“The payment method people use is driven largely by what payment mechanisms are available,” said Enoch Malisa, head of card issuing for Barclays Africa’s Retail and Business Bank business outside of South Africa.

Like Holmquist, Malisa said this means banks need to start tailoring loyalty and rewards programs to this digital environment. For example, using geo-location a customer’s phone can alert them when they are near a shop that participates in a merchant reward program with Barclays.

“With the large proliferation of smartphone devices, it’s only natural people will use it for payments,” he said. “People always have their phone on them, so it’s the most convenient tool to drive payments going forward.”

First apepared at AB