What Asian Banks Can Learn From Amazon About Working For Fintech

By Vladislav Solodkiy for Forbes

Last Friday, a very interesting deal remained almost unnoticed in the market – and how wrong that was! French banking group BCPE is acquiring German online-bank Fidor. Earlier this quarter, there were two similar news items – Chinese Ant Financial (owner of AliPay e-wallet) was considering taking a 25% stake in German Wirecard (Alibaba denied this information later), while the German fintech-holding FinLeap has launched solarisBank company.

What’s in common between the above mentioned news? All three players, among other things, are developing BaaS-platforms. Bank-as-a-service – leasing of banking infrastructure (license, payment processing, cards issue, and compliance) to other players (instead of developing or purchasing it), is a very new phenomenon, which is rapidly gaining momentum with increasing amounts of fintech startups. It is too expensive for startups to have their own banking license at the beginning (and it is not the main focus for them), meanwhile, they need new licenses and infrastructure for scaling to other countries. Negotiations and integration with a partner bank take too much time, effort and money, as far as traditional banks have their own core-business and KPIs, and yet do not have a clear strategy and skills of dealing with fintech startups in a fast and cheap manner. However, not only do fintech startups create demand for the new industry: telecoms and e-commerce giants are also interested in such middleware-platforms.

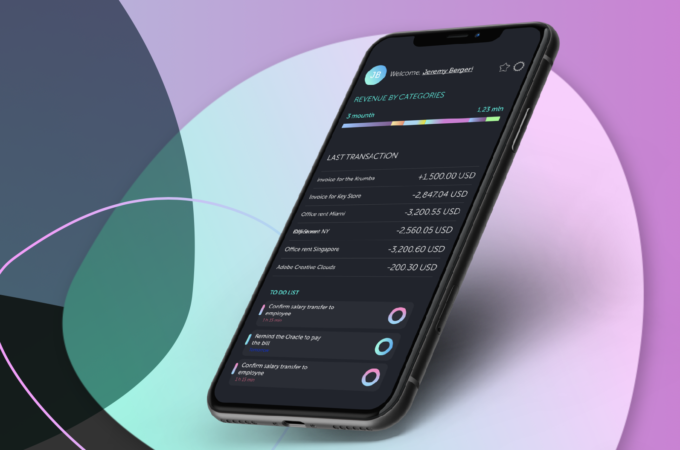

Availability of open APIs to banks and BaaS-platforms is critical for fintech startups, both for the start (3-5 times faster, cheaper and easier than today) and further international expansion, not “from scratch” in each country. (Illustration by Vladimir Belyakov Money Of The Future fintech-report Life.SREDA VC)

Let’s take a look at another interesting fact: in late April AWS (Amazon Web Services) reported a record profit, which amounted to 67% of the Amazon profits. Why is this fact interesting for banks and fintechs? Once Jeff Bezos has invested millions in creating an excellent infrastructure to support and scale Amazon’s business. At the same time, many new services, including the new e-commerce players, appeared on the market. Rather than compete with them, wait until they build their own infrastructure, and hope that it will take too long and will not be successful – he decided to lease his infrastructure to other players. Drawing an analogy with banks, Jeff Bezos did not consider other online-services as competitors or enemies, he decided to become the best partner for them, and make money from it. And the truth is if you set up an infrastructure for yourself – you bear costs. If you lease it to other players – you make an investment and get new revenue streams. Currently, AWS claims to turn from a cloud-storage to “the operating system for the internet”.

By connecting to a BaaS-platform banks could lease their infrastructure to fintech startups. This will greatly reduce the cost, speed up and simplify the launch and scaling for startups, as well as create new revenue streams for banks and expand their product line. Currently, all giants such as PayPal and Stripe have embarked on the expansion of their product offering by means of third party developers, whom they provide open APIs to work with their services and integrate them into external apps.

There are more than 60 insanely useful APIs forfrom fintech-startups across 12 segments now. (Illustration by Oleg Karaev Money Of The Future fintech-report Life.SREDA VC)

Over the last year, I met most of the banks and fintech startups in Asia (I used to invest in fintech mainly in the US and Europe). No bank has succeeded in creating its open APIs or has a clear agenda for the new services. As a result, startups spend about one year and up to 80% of their resources for the launch. While their American counterparts launching, for example, on the Bancorp’s BaaS-platform spend 80% of resources on product development, customer acquisition and service.

Another point is that BaaS-platform should be truly independent and cover the entire Asia-Pacific region (where each market is very different, as opposed to Europe). The nature of digital world is that you have to constantly scale to new markets; if you want to exist in one country, you shall start a traditional offline-business. Startups have to seek for a new bank and integrate from scratch on every new market. However, they do not want to depend on the “mood” of a partner bank and integrate into each country from the beginning. Whereas, having once integrated with the platform they can launch their services faster and cheaper, as well as expand to new markets without any obstacles.

This is especially important for the unbanked-markets – Myanmar, Laos, Cambodia, Vietnam, etc. Such a platform will bring them into line with the developed countries in terms of market accessibility for fintech-startups. Otherwise, companies will keep scaling to other markets, and these countries and their population will be isolated from the latest financial technologies (although they are vital to them).

Creation of BaaS-platform is especially important for unbanked-markets – local talents are not able to fulfill all verticals of fintech, and foreign startups will always choose developed markets to scale without ability to unify entry fee per market. (Illustration by Oleg Karaev Money Of The Future fintech-report Life.SREDA VC)

Eventually, we shall ask banks, particularly in Asia, whether they want to – using regulators support – continue to protect their local markets from the invasion of new players, “forcing” to make agreements with a partner bank, or they are willing to follow Amazon’s example and earn 67% profit from leasing their infrastructure.

Vladislav Solodkiy is managing partner at Life.SREDA, Singaporean-based fintech VC, and the author of “Money of the Future” semi-annual fintech-report.

First appeared at Forbes