50 years on: How credit cards changed our relationship with money

By Simon Read for BBC

Fifty years ago this week Barclaycard issued the first credit cards in the UK.

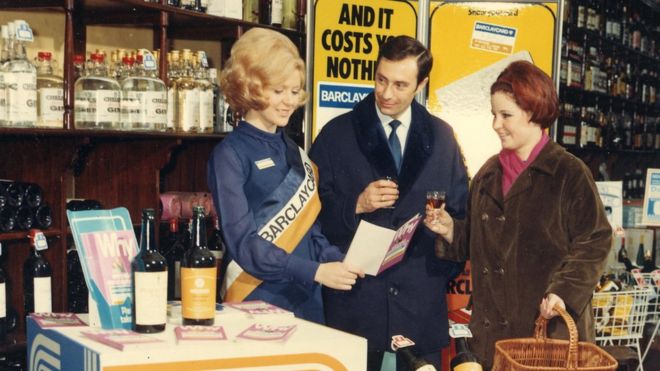

Half a century on, consumers are used to a range of convenient ways to pay, but back in 1966 there was a feeling of change when people tried to brandish their exciting new plastic cards.

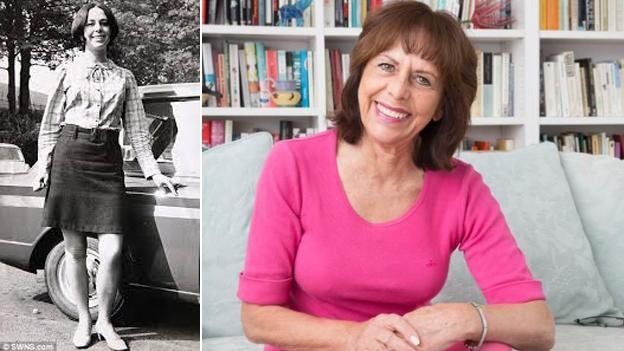

“When it arrived I didn’t really know what it was,” admits Liz Hodgkinson, who was a fresh-faced 22-year-old just out of university.

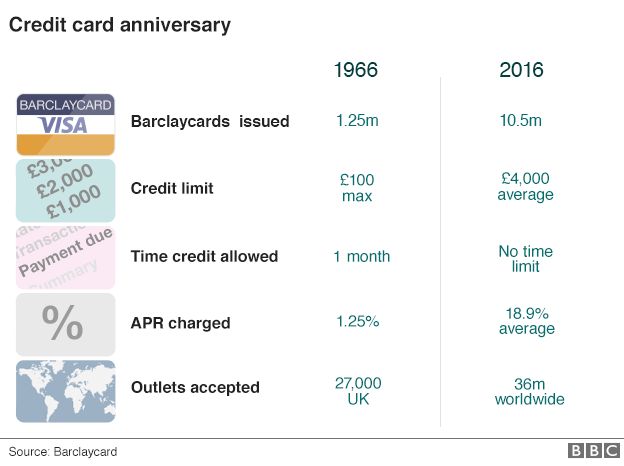

The company sent out some 1.25 million plastic cards to Barclays customers from 29 June 1966 and while some sent them back or never used them, many, like Liz, a writer, embraced the new way of paying.

“There was an explanatory letter from Barclays which said it was issuing the cards to its best customers. It was a terrific revolution as far as women were concerned as previously you had to have a male guarantor to get credit.”

Image copyrightANDREW CROWLEY

Image copyrightANDREW CROWLEYAt the time, the bank said: “[Barclaycard’s] purpose is to reduce the use of cash in shopping and other transactions and the scheme is designed to appeal not only to those who must travel and spend a good deal of money in restaurants, but also to the everyday shopper throughout the country.”

It also stressed the benefits to retailers and businesses by pointing out that the card would help in “reducing or eliminating the book-keeping now needed to maintain customers’ credit accounts.”

‘Made me feel special’

Once she’d worked out its advantages, Liz used her card as soon as possible.

“I realised that I could buy something without having to pay for it there and then and could have three weeks’ grace. It meant I didn’t have to wait until payday.

“It made me feel very special. My husband banked at Lloyds at the time so didn’t get one.”

In fact it took Barclays’ High Street rivals six years to respond.

Then and now

By the time a group comprising Lloyds, NatWest and Midland (now HSBC) launched the now-scrapped Access card in 1972, there were 1.7 million Barclaycard holders.

Today the company says it has 10.5 million consumer customers as well as many more business customers.

In the intervening period, the world of plastic cards has changed completely.

In 1966 Barclaycard charged an annual interest rate of 1.5% but expected payment by the end of the month.

The idea of revolving credit, where a card can be used to maintain a longer borrowing, only started in 1967 when Barclaycard offered up to three months’ credit. Now, of course, it’s possible to be in debt to a credit card for a lifetime and the average interest charged on outstanding balances is 18.9%.

The borrowing limits in 1966 were much more modest, too. Cardholders were offered up to £100 worth of credit. Now the average is around £4,000, the company says.

Looking ahead, plastic cards will take over from cash to become the UK’s most frequently used payment method by 2021, reckons Payment UK.

The growth will be driven by “the next generation of account holders”, says the UK Cards Association as “younger people are more likely to embrace new technologies such as contactless cards and mobile payments.”

Image copyrightBARCLAYCARD

Image copyrightBARCLAYCARDBut the older generation is getting in on the act, too. Liz Hodgkinson, now 72, reveals: “I have an app on my phone to make contactless payments,” although she admits: “It was set up by my grandson!”

Debt warnings

While the introduction of plastic in 1966 may have given cardholders like Liz a feeling of confidence, the evolution of the credit card also meant the danger of getting into debt very much became a reality.

“I was elated to get an Access card when I was aged 18,” says Karen Wake, 55, a pension expert. But her happiness didn’t last. “By the age of 25 I had built up £30,000 worth of debt.

“I worked hard to pay it off in five to six years and have had no debt since then,” she says. “Despite the fact I now work in the financial services industry, that didn’t equip me to manage my finances at a young age.”

Today, many people happily use credit cards for convenience – often earning rewards or cashback – while paying the balance off every month to ensure there are no charges.

But overspending and building up long-term debt remain big problems.

Mike O’Connor, chief executive of the debt charity Step Change, says: “The average credit card debt we see is £8,403 and last year we dealt with more than 200,000 people with £1.7bn of credit card debts.”

He says the Financial Conduct Authority should reform the market to ensure that credit cards work better for consumers, especially those in financial difficulty.

“Small changes to existing rules, such as increasing minimum payments from 1% to 2% of the balance or fixing minimum repayments so that they don’t fall as the balance declines, could save people thousands of pound and cut years off repayment periods,” says Mr O’Connor.

First appeared at BBC