Bitcoin Loses 25% in Five Days as Brexit Odds Fall, Ether Sinks

By Justina Lee for Bloomberg

Bitcoin plunged for a fifth day as concern Britain will vote to leave the European Union waned and a hack suffered by another cryptocurrency undermined confidence in such digital assets.

Bitcoin slid 6.1 percent to $573.84 as of 1:31 p.m. in Hong Kong on Thursday, data compiled by Bloomberg show, extending a precipitous drop from a two-year high reached just last Friday. The price has lost about 25 percent in the five-day period.

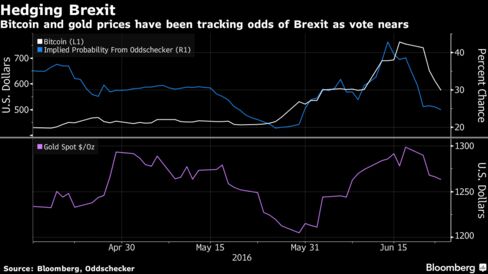

Bitcoin, like gold, has been tracking the odds of Brexit on the eve of the referendum on Thursday as investors speculated over such an outcome, which governments and central banks have warned may spark turmoil. Confidence in bitcoin was also shaken this week as another virtual currency ether plunged after a hack removed some digital money, while a bitcoin exchange temporarily suspended trading this week amid technical issues.

“With the Brexit deadline approaching we’re starting to see a genuine concern for what’s to come, and this of course has been reflected across the global markets space, which does include bitcoin,” said Ryan Rabaglia, head of wholesale product management at ANX International in Hong Kong. “We had a surprise earlier this week of a prominent exchange having technical difficulties. As it is in the world of bitcoin, when that happens, everyone panics and assumes the worst.”

News that the Decentralized Autonomous Organization, a cryptocurrency-backed venture capital fund, had been hacked spread last Friday, spurring a slide in ether, Coindesk reported. The DAO later confirmed the event on its blog. The attack was reminiscent of an earlier crisis. In 2014, Mt. Gox, a key bitcoin exchange, lost customers’ bitcoins, contributing to the halving of the price over the course of three months.

Hong Kong-based exchange Bitfinex said on its Twitter on Tuesday it was shutting down trading because of network instability.

The DAO hack “generally created a loss of confidence among many in the cryptocurrency community, many of which are also active traders of bitcoin,” said Aurélien Menant, chief executive officer of Gatecoin Ltd. in Hong Kong.

“We expect that there will be a price correction at around $500 or $450 and believe bitcoin will appreciate over the long term, especially with the long-awaited bitcoin ‘halving’ process to occur soon,” Menant added.

First appeared at Bloomberg