Rocket Internet’s new financials show hits and misses

By Osman Husain for TechinAsia

Publicly-traded German startup machine Rocket Internet released Q1 2016 financial results for some of its portfolio companies today.

The selected results do suggest improvements in things like net revenue, how much customers are spending (aka gross merchandise value, or GMV), and gross profit. But overall profitability remains elusive and unlikely to be achieved this year.

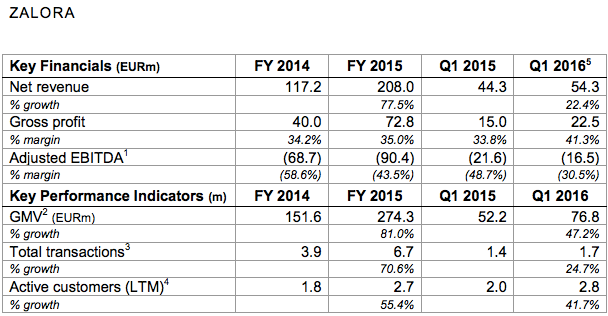

Rocket’s Global Fashion Group (GFG), which was downgraded in value by a colossal US$2.4 billion recently, posted an overall loss of approximately US$60 million this quarter. Zalora, which is part of GFG, registered a loss of US$18.3 million, despite net revenue increasing by 22.6 percent to US$60.4 million as compared to the same period last year.

Jabong, Rocket’s struggling fashion store in India, did not have a stellar quarter either. Net revenue increased by a modest 14 percent year-on-year to US$36 million with an overall loss of US$13.2 million.

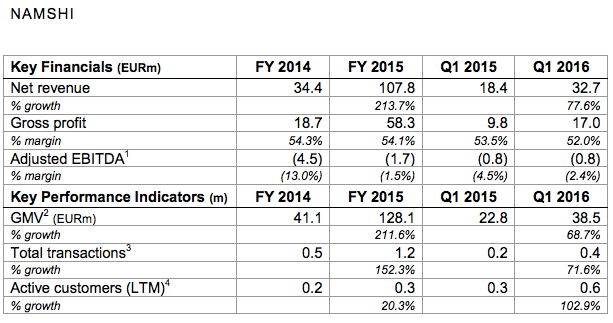

But Rocket may have an ace up its sleeve. Namshi, its fashion site which operates in six countries in the Middle East, recorded impressive results. The startup’s net revenue grew by 77.7 percent to US$36.4 million. Gross profit was almost US$19 million, representing 73.5 percent improvement year-on-year.

Surprisingly overall earnings remained flat, with Namshi posting a loss of US$890,000 – the same figure as Q1 2015. This could be because of a strategy to offer discounts to win over more consumers and think about profitability at a later stage. In any case, the future of Namshi looks positive.

Foodpanda also managed to retain its steady growth momentum. Revenue almost doubled to US$11 million, with overall losses decreasing by 30 percent to US$14.5 million. A point of concern for the company is that losses have continued to outstrip revenue, a trend that is definitely not sustainable.

The online food delivery startup still sits on a US$100 million pile of cash which should, theoretically, last it a couple of years at least. And with capital expenditure decreasing sharply, it means Foodpanda is content with its current state of operations and will now look to drive value out of its existing user base.

Rocket Internet itself was upbeat about the latest report, noting that the selected portfolio startups have made “significant progress on their path to profitability.”

“We are convinced that these companies will continue their positive development in 2016,” added Oliver Samwer, CEO of Rocket Internet.

But it doesn’t seem as if the positive sentiments were shared by investors. Rocket Internet shares were down by 3.12 percent on the Frankfurt Stock Exchange since the start of the day’s trading. They’re currently exchanging hands for US$23.94, some distance below their initial offering of US$41.50 in October 2014.

Rocket’s newest financial report made no mention of the Amazon-esque Lazada, which Alibaba took control of in April by buying a majority stake for US$1 billion.

Converted from Euros. Rate: EUR 1 = US$1.11

First appeared at TechinAsia