Southeast Asia financial comparison startup Jirnexu lands $3M to expand to digital banking services

By John Russel for Tech Crunch

Malaysia-based financial comparison startup Saving Plus has closed a $3 million Series A round to move into new digital banking services. The company has also renamed itself Jirnexu.

The company was founded in 2012 by its CEO and former Citi banker Yuen Tuck Siew to provide better financial choices for consumers via banking comparison sites. Arriving home to Kuala Lumpur following more than decade in the UK, Siew struggled to rebuild his personal finances in the same way as he’d done when he moved to the UK, where the likes of Money Supermarket provide clarity and options for consumers.

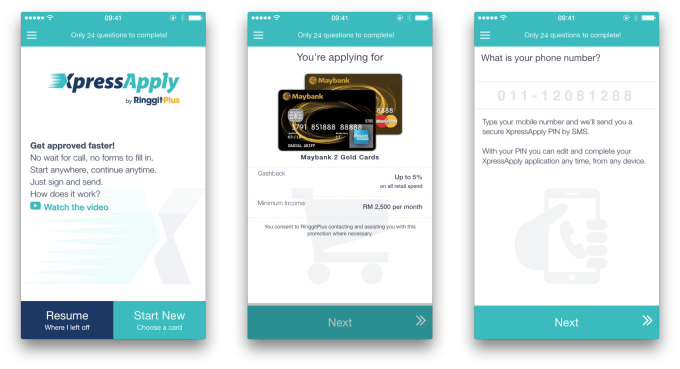

Jirnexu operates comparison sites RinggitPlus in Malaysia and KreditGoGo in Indonesia, but now it is branching out into services for banks with XpressApply, a platform that lets financial institutions tap the internet and digital media to reach consumers. More specifically, the service, a white-label version of which will launch in the second half of this year, is used to handle credit card, loans and other banking applications online.

This new funding is led by DMP with participation from Celebes Capital, NTT DOCOMO Ventures, Nullabor, Tuas Capital Partners and Anfield Equities, and has been earmarked to develop XpressApply and other digital-first products for banking.

Jirnexu is working with banks and financial organizations to offer XpressApply as an online solution that can reduce the process of applications to around 10 minutes. Beyond removing paperwork, it helps consumers get quicker and more accurate decisions and, for lenders, it allows for closer engagement with potential customers.

Siew said that, by cutting out call centers, customer conversation rates can be as much as 200 percent higher, while call center complaints are seven times higher than initial complaint volumes from XpressApply, he claimed.

“We want to change the way banks and insurance companies behave [and] make sure that the consumer can get what they want online,” he added.

Despite a push into digital services for banks, Jirnexu remains committed to the consumer-facing side of the business. The startup has raised $4.5 million to date, and Siew is working towards a Series B round later this year that would be used to expand its online comparison sites into more countries in Southeast Asia, and develop other bank-focused products.

Already, he said, the two comparison sites reach “tens of millions of visitors”, generate 450,000 leads for banks and “tens of thousands of approved customers and accounts”. But, with the launch of XpressApply, Jirnexu is trying to bring a more Western and on-demand approach to personal finance in Southeast Asia.

“Southeast Asia is riding a boom in internet and mobile offerings,” Siew said in a statement. “Whether you book a ride with Grab or shop online with Lazada, consumers are expecting the same anytime-anywhere access to all services including their personal finances.

“The first financial services company who can meet the consumers’ rising expectations will be the winner. That’s why my vision is clear and simple — I want to build the Amazon of personal finance in Southeast Asia, a full stack technology driven platform that enables service and value leadership to the consumer.”

As for that rebrand, Jirnexu means “prosper” in Maltese. Siew said the company came up with it with a little help from an unnamed investor, and that it was important to find a name that was both symbolic and not likely to be misconstrued in other languages. That can be challenging in Southeast Asia, where there is plenty of cultural and linguistic fragmentation across the region’s biggest six countries.

First appeared at TC