Are Bank-Blockchain Partnerships Putting the Cart Before the Horse?

By Tanaya Macheel for American Banker

With so much interest in blockchain applications for financial services, there seem to be a lot of announcements of proof-of-concept trials at banks, but few finished products.

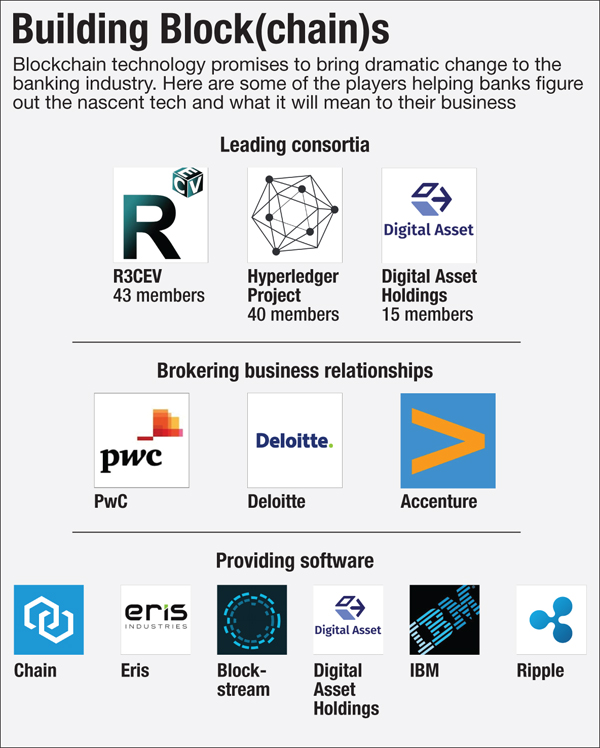

By now, most of the largest banks are participating in industrywide blockchain standard-setting activities, partnering with startups and taking different approaches to determining which use cases would improve upon existing technology. Once the bricks are laid, banks will be ready to build on top of them, the thinking goes.

By now, most of the largest banks are participating in industrywide blockchain standard-setting activities, partnering with startups and taking different approaches to determining which use cases would improve upon existing technology. Once the bricks are laid, banks will be ready to build on top of them, the thinking goes.

“That in itself is half the battle,” Ian Lee, head of Citigroup’s Acceleration Fund, Global Lab Network and strategic partnerships, said at the Consensus 2016 conference in New York this week.

The problem, however, is that “you can’t just approach it through frameworks and theories,” Lee said. “You have to learn by doing.”

When banks began warming to the idea of blockchains last year, their first instincts were to take an internal lab approach to their research. Now, the importance of partnering with outside fintech firms is becoming more and more pronounced as banks try to understand the “desirability, feasibility and commerciality” of blockchains, Citi’s Lee said.

Unfortunately, the industry is “confused” about how to partner effectively, he said.

“You have to be along that journey with your own engineers but also with partners,” Lee added, citing Citi’s partnership with a startup called Chain. “Designing the right model with the right players and right aligned incentives is actually very difficult.”

Chain, founded two years ago, has taken a rare approach. Rather than trying to get scores of financial institutions to agree on standards, it has quietly focused on building software that incorporates the privacy, security and other specifications of a small circle of bank partners. The result is a complete, market-ready blockchain product actually employed by financial institutions today, the company says.

“Scale before fit is dangerous,” said Adam Ludwin, chief executive of Chain, in an interview at the Consensus conference. “It creates overhype that leads to disappointment later.”

Chain’s product, a blockchain protocol it’s calling Chain Open Standard 1, allows organizations to securely and swiftly move distributed data, such as a financial asset, Ludwin said. Capital One, Citigroup, Fidelity, First Data, Fiserv, Mitsubishi UFJ Financial Group, Nasdaq, State Street and Visa are using it, Chain says. The first version of the software was made available to the broader industry this week.

Chain Open Standard 1 is “a software engineering effort, not a financial engineering effort,” Ludwin said. Financial institutions can use the software however they like, but the company’s aim is to deliver something that will solve their problems today rather than get trapped in an Alphonse-and-Gaston routine.

“We can’t outsource our thinking and get it right,” he said. “People are looking at other people to try to give you the answer and no one’s going to give you the answer in this space except for you.”

That Chain’s product announcement coincided with the blockchain industry’s largest conference seemed appropriate for its theme, “Making Blockchain Real.” The number of attendees nearly tripled, to 1,500, from the inaugural event in September and there was a noticeable increase in financial services leaders recruited to speak this time around. Those developments reflect the time, money and thought that financial institutions have invested in the young industry since 2014, when bitcoin, the digital currency powered by the original blockchain, hit mainstream news headlines.

The commitment of top bank executives to supporting employees on costly innovation initiatives is an important indicator of how well they’ll work with outside partners, Jeremy Wilson, Barclays’ vice chairman of corporate banking, said at the conference.

“They are probably the last people to understand something like this,” Wilson said. “Leaders need to establish the latitude.”

Chain started in 2014 as a provider of application programming interfaces for bitcoin. It ended that business in December.

At the conference, Chain demonstrated a permissioned blockchain — that is, a siloed one not connected to the bitcoin blockchain. Attendees were invited to play a game on this chain. Those registered to play used their phones to visit a website where they received digital tokens entitling them to different prizes, such as erasers. Players were encouraged to trade with other conference goers with the incentive of winning a grand prize (tickets to the musical “Hamilton”) for doing the most trades. Each trade of the digital assets was recorded onto the event blockchain. All prizes could be redeemed at the Chain booth and those exchanges were also recorded on the blockchain. It logged about 500 registered players and more than 1,000 trades in 30 hours.

Chain worked one-on-one with each of its financial institution partners to understand their needs for the blockchain protocol it would engineer and on which partners can now build new solutions specific to their organizations.

“To get to scale, invest in building a great company,” Ludwin said. “Start with, what problem are you solving? Starting with use cases, you could get stuck.”

It wasn’t until mid-April that Chain and its partners convened as a group to discuss and experiment with the technology and invite other industry executives to observe.

“Not hiring salespeople was our strategy to staying focused on a core set of partners through which we would understand and learn what our product was going to be,” Ludwin said. “Until you know what you want to build and why, you shouldn’t start selling it.”

First appeared at American Banker