Venture capital deals hit speed-breaker

By Meera Siva for the Hindu Business Line

Fall in deal valuations and fewer exit opportunities affecting new investments

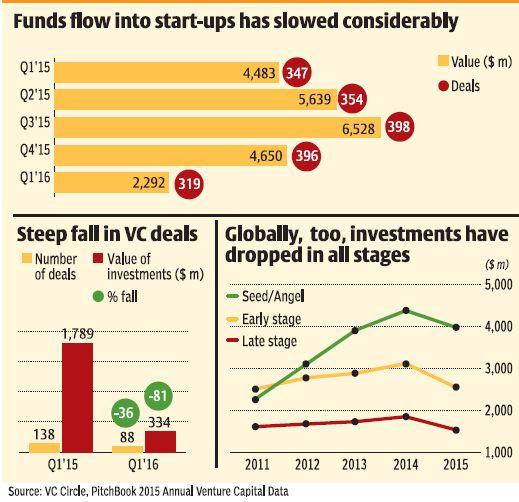

Venture capital investments plunged from $1,789 million in the first quarter of 2015, to $334 million in 2016. The number of deals fell 36 per cent to 88 in the same period. Falling valuations in the start-up space and fewer opportunities for exits appear to be turning investors cautious.

Venture capital investments plunged from $1,789 million in the first quarter of 2015, to $334 million in 2016. The number of deals fell 36 per cent to 88 in the same period. Falling valuations in the start-up space and fewer opportunities for exits appear to be turning investors cautious.

“Venture capital funds rely on follow-on funding for a secondary market exit. They now fear that they may not obtain a follow-on round of financing in a conservative climate,” says Peesh Chopra, Managing Partner at Peesh Venture Capital. He says that valuation worries and the slowdown in China have led to many funds re-thinking their India bet.

This is the second quarter where venture capital and private equity deal volumes and value are on a downtrend. Investments hit a high in the September quarter of 2015, when $6,528 million was invested in 398 deals. It slipped to $4,650 million across 396 deals in the third quarter of 2015.

The fall in investments appears to be a global trend. Data from Pitchbook, on US venture capital industry, show that investments in 2015 fell across all stages, after touching a peak in the second quarter. Capital invested in the fourth quarter was down 17 per cent from the yearly high and was 11 per cent lower year-on-year.

Valuation worries

Experts think that the recent cut in Flipkart’s valuation is affecting sentiment. Typically, falling valuation multiples are the early warning signal, says Thillai Rajan, Professor, Department of Management Studies, IIT-Madras. “Investors first become conservative and lower valuation multiples. Due to the less attractive terms, entrepreneurs also hesitate and the deal flow slows,” he explains.

Issues in specific sectors have also hurt sentiments. “The new regulation on e-commerce companies and high profile failures in hot investment areas such as food delivery have made investors wary of putting in their money,” says N Muthuraman, Director, RiverBridge Investment Advisors. Another long-term issue that is affecting deals is the lack of exit opportunities. Data from VC Circle show that the number of exit deals declined 56 per cent in the first quarter of 2016. Deal value plummeted 70 per cent to $508 million in the same period.

Typically, acquisition by private or public companies is the common route available to many start-ups. Currently, we see larger well-funded start-ups such as Snapdeal and Practo acquiring smaller ones to grow organically, says Radha Kizhanattam of Unitus Seed Fund. Data show that M&A activity continues to be robust.

Positive outlook

While the downtrend may not reverse in the next two quarters, market participants are bullish on the long-term outlook. They note that the failures would bring much-needed focus back to business fundamentals such as revenue and profitability as well as rational cash-burn.

Kizhanattam says that the trend of funding every other hot-sector company will stop and caution will be exercised in picking the team and evaluating the economics. Many family offices in India are launching huge local funds and the attractiveness of the Indian market will help reverse the downtrend.

“Core sectors such as education, healthcare and financial services have a lot of unsolved problems and offer ample opportunities for growth,” she says.