MOBILE PEER-TO-PEER PAYMENTS

By MBLM, the Brand Intimacy Agency

As has been well reported, the financial services industry is undergoing a dramatic transformation. FinTech (or financial technology) is changing the way we spend, save, sell, invest, and lend. From crowdfunding to personal finance, this $707B industry is growing, both in size and in scope. Peer-to-peer mobile payments are still a relatively modest $28B sector within this industry, but we believe they are on the cusp of mainstream adoption.

At 82 million users, at least one in four adults in the U.S. is expected to send money to a friend, colleague, or family member this way in 2016. That’s nearly half of all smartphone users in the U.S. (190M), which happens to coincide with roughly the entire population of millennials in the U.S. (83M). Given MBLM’s interest in brand relationships in the digital age, and the millennial generation’s role as a technology bellwether, we felt it was time for a Field Notes edition focused on the firsthand experience and assessment of this intriguing category

Challenge

We tested the mobile applications of six key players to evaluate the user experience of each app, based on ease of sign-up and use, how much we felt we could trust them, how many of our friends were using them, and how much we enjoyed the payment process. We spent a week taking the different services through their paces, determined to declare a winner.

Venmo is the youngest of the six brands we tested, but it has quickly become a favorite in mobile P2P among millennials. It became a part of PayPal when the FinTech pioneer acquired Braintree for $26.2 million.

- Market Entry: 2009

- Revenue: Approximately $100 million

- Notable: Recently opened up to businesses, Acquired by PayPal in 2013

Venmo could make it easier to find users who aren’t in your contacts.

PayPal is one of the largest online payment companies in the world, offering money transfers and payment processing, among other financial services. It was acquired by eBay in 2002 but was spun off into its own publicly traded company in 2015.

- Market Entry: 1998

- Revenue: $9.2 billion

- Notable: Recently revamped its app to highlight P2P payments, Recent Super Bowl TV spot was a first for the brand

PayPal would benefit from a more streamlined sign-up process.

Square provides several financial services, including payment processing devices and software, payroll services, and P2P transfers. Square’s first product was its Square Reader, which allowed users to accept credit card payments via the audio jack of a smart device.

- Market Entry: 2013

- Revenue: Unknown ($1.3 billion, Square Inc.)

- Notable: $Cashtags can be used to donate money to 2016 presidential candidates

Square Cash could do more to encourage users to integrate $Cashtags into social media to spread awareness.

Snapchat is the fastest growing social network. Over the past five years, its photo-messaging app has evolved to offer several new features, including text, P2P transfers, and animated lenses. Recently, Snapchat announced that its users watch 8 billion videos per day.

- Established: 2014

- Revenue: Estimated $300 million +

- Notable: Snapcash is powered by Square

Snapchat could take greater steps to ensure users that the popular social platform’s money transfer service, Snapcash, is safe and secure.

The social media giant’s messaging app has 800 million monthly active users from all over the world. It is accessible through a mobile app and Facebook’s website and offers communication via text and voice.

- Established: 2011

- Revenue: Unknown ($17.9 billion, Facebook)

- Notable: In 2015, Facebook announced that users will soon be able to connect with businesses through Messenger

Facebook Messenger could make its payment feature more obvious to its many users.

Google Wallet is the technology giant’s digital wallet and P2P payment service. As of 2015, Android Pay has replaced Google Wallet’s point-of-sale purchasing function, which is now only available when using a Google Wallet Card.

- Market Entry: 2011

- Revenue: Unkown ($75 billion, Alphabet)

- Notable: In 2011, PayPal sued Google for misappropriation of trade secrets after Google hired two former PayPal employees to work on Google Wallet.

Google Wallet could have a simpler user interface and more transparency about user account information.

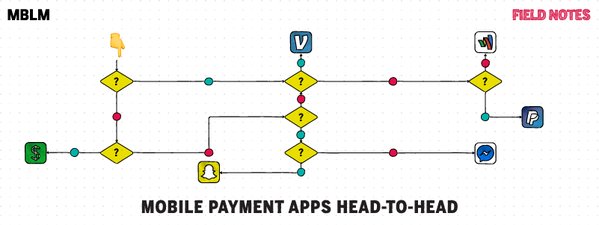

Pick the right app for you

Having trouble deciding which peer-to-peer mobile service is right for you? Let our handy flowchart be of assistance.

MBLM is the Brand Intimacy Agency, dedicated to creating greater bonds between people, brands and technology. With offices in seven countries, our multidisciplinary teams help clients deliver stronger marketing outcomes and returns for the long term. To learn more about how we can help you create and sustain ultimate brand relationships, visit mblm.com