Fintech role in retail revolution

Key findings from the industries of POS, tablet – based cash registers and pre-order services.

Read our full research “Money of the Future”.

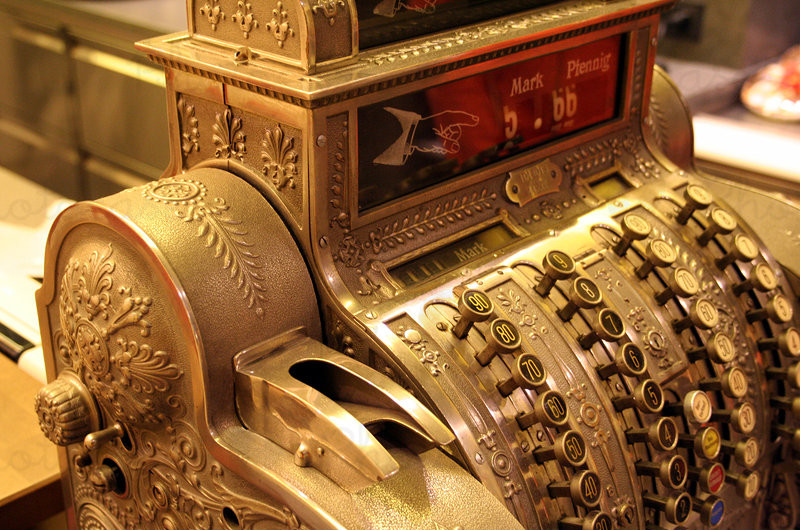

Invented in the 1870s, the cash register was the very first “point-of-sale system” mechanizing the transfer of money. Today, small business owners are opting for something more portable: smartphones, tablets and other mobile terminals, equipped with point-of-sale apps. Beyond making it easier than ever to swipe a credit card and add tip, POS apps are paving the way for contactless payment through smartphone apps like Google Wallet and ApplePay — which rolled out in the U.K. after it debuted in the U.S.— to become the new norm.

There are many such systems marketed to small businesses, the most popular of which include Poynt, Square Stand, Shopkeep, Shopify POS, Groupon Breadcrumb, Clover, E la Carte, Toast and Revel. They cater to different kinds of businesses offering customizations to accommodate diverse food and retail vendors. Vendors can check in on their business stats remotely from the cloud, seeing that day’s transactions in real-time, tracking inventory, and linking to accounting software. But not all mobile POS systems are created equal. Here’s a quick look at how they serve.

POYNT (US)

In 2014 Osama Bedier introduced what he deemed the future of payment terminals: a developer-friendly payment point of sale that accepts everything from Apple Pay to Samsung Pay, Android Pay, and chip-based credit cards. In order to deliver on the promise of the new payment terminal, Poynt needs to ramp up manufacturing.

In 2014 Osama Bedier introduced what he deemed the future of payment terminals: a developer-friendly payment point of sale that accepts everything from Apple Pay to Samsung Pay, Android Pay, and chip-based credit cards. In order to deliver on the promise of the new payment terminal, Poynt needs to ramp up manufacturing.

In October 2015, the company announced a series B round of $28 million to help it build and ship terminals before the year is out. Growth equity fund Oak HC/FT led the round. Stanford-StartX Fund, Matrix Partners, Webb Investment Network, and Nyca Partners also contributed. Initially, Bedier says he plans on shipping “tens of thousands” of units.

The Poynt payment terminal is an evolution of the tablet-as-point-of-sale trend. It features two touch screens, one for the merchant and another one facing the consumer. It’s capable of taking near field communication-based payments as well as traditional magnetic stripe credit cards and has a QR code reader. Bedier tried to account for all possible payment types that might take off with consumers over the next few years. He also wanted to make the Poynt terminal flexible. Though it can act as a portable all-in-one solution, it can also act as a simple payment terminal connected to a larger point-of-sale system. Basically, the Poynt terminal can be as smart or as dumb as a merchant needs it to be.

Unlike PayPal and Square, Bedier said Poynt can integrate with existing payment systems. This is big. While small merchants accepting credit cards or chip-and-pin cards for the first time may be keen to adopt Square’s or PayPal’s models, Poynt is betting that larger merchants, who have already paid a lot of money on infrastructure, may be resistant to overhauling their point-of-sale systems just to accept chip-based credit cards. Bedier said he’s targeting a broad range of merchants, who process $50,000 to $10 million in sales annually.

To better integrate with businesses, Poynt is relying on a network of developers to build out its app platform. The Poynt OS is Android-based and already works with a variety of software platforms and payment processors including Intuit, Bigcommerce, Vantiv, Kabbage, and Vend.

Like Square and PayPal, Poynt has timed its U.S. hardware release to coincide with the liability shift. In October, Visa and MasterCard relinquished responsibility for fraudulent chip card transactions made on terminals that aren’t equipped with a chip reader.

The Poynt units cost roughly $299 each, well above the cost of chip readers by PayPal ($149) and Square ($49). VeriFone also has its own multi-payment terminal on the market, which also goes for $300. In order to capitalize on the shift to chip-based credit cards, Poynt will need to move quickly to capture merchants who haven’t already been wooed by other new payment terminals.

In the same time, Rede, a subsidiary of Itaú Unibanco, and Poynt announced an exclusive partnership that will make the Poynt Smart Terminal available to millions of merchants in Brazil beginning in 2016. The partnership with Rede ensures that Brazil will be the first country outside of the U.S. to offer Poynt devices.

“Brazil has a very sophisticated payments market, truly one of the most advanced in the world. This makes it the ideal country for us to introduce the Poynt Smart Terminal internationally,” said Poynt founder and CEO, Osama Bedier.

“This new partnership will allow Rede to offer a pioneering and innovative solution for electronic payments in Brazil. We will provide applications to improve the shopping experience through the Poynt Store, build a cloud connection to the countertop, and develop enhanced services to create new revenue streams for the merchants and offer more convenience for the customers,” said Milton Maluhy Filho, CEO of Rede.

A company in the Itaú Unibanco conglomerate, Rede (www.userede.com.br) is responsible for acquiring and processing credit and debit card transactions for the largest Brazilian and international card brands. It offers its clients a range of products and services for enhancing the performance of their businesses such as online means of payment solutions, anticipating receivables, providing terminals, management reports, among others.

REVEL (US)

In August 2015 iPad point-of-sale platform maker Revel Systems has raised $13.5 million in funding from ROTH Capital Partners to fuel its rapid growth. A follow-up to Revel’s Series C, which it announced in November 2014, the new capital brings that round’s total to about $113.5 million, valuing the company at more than $500 million. The company, which is eyeing an initial public offering, also disclosed that financial software developer Intuit was an investor in its Series C.

In August 2015 iPad point-of-sale platform maker Revel Systems has raised $13.5 million in funding from ROTH Capital Partners to fuel its rapid growth. A follow-up to Revel’s Series C, which it announced in November 2014, the new capital brings that round’s total to about $113.5 million, valuing the company at more than $500 million. The company, which is eyeing an initial public offering, also disclosed that financial software developer Intuit was an investor in its Series C.

Revel is preparing to expand into international markets quickly, targeting European and Asian countries where some of its clients already have franchises, says co-founder and chief technology officer Chris Ciabarra. Its enterprise users have as many as 2,000 retail locations, but Revel also serves small- to medium-sized businesses. The company now has about 14,000 to 15,000 terminals installed and that amount is growing at about 1,000 terminals per month. The company plans to complete one more round of funding before holding an IPO in the next 18 to 24 months, Ciabarra says.

Ciabarra says Revel will continue differentiating from other tablet POS systems by including a wide array of features in its software suite so it can handle deliveries and shipping in addition to payment processing. This allows Revel to compete with enterprise software like Micros System, which was acquired by Oracle for about $5.3 billion last year. Revel also recently added Ethernet connections for clients who want to use iPads to handle transactions but can’t rely on wireless connections, such as sports stadiums and government agencies.

Lisa Falzone is the Co-Founder & CEO of Revel Systems, an award-winning iPad point of sale solution for single and multi-location small businesses and enterprises. A graduate of Stanford University where she was a competitive swimmer, Lisa led her Silicon Valley-based startup since its creation in 2010 and has been pivotal in turning the often “old school” perception of point of sale on its head, beating out established competitors and new market entrants alike.

Lisa’s achievements as a young female entrepreneur have been recognized through numerous prestigious awards such as Forbes ’30 Under 30′, Forbes ‘Women To Watch: Eight Rising Stars’, Business Insiders “30 Most Important Women Under 30 In Tech”, San Francisco Business Times ’40 Under 40′, and Business Journal’s “Upstart 100”. “I’m most proud of building Revel Systems. I built it from the ground up, and now we’re at 300+ employees, raised over $115 million dollars , and growing over 200% a year.”

“We offer businesses the centralized management platform from which they can run their entire business – from CRM and loyalty programs, to intelligent reporting and employee management, Revel is the platform from which you can run and monitor your entire business. We offer a complete solution for business owners, allowing them to streamline operations and increase their bottom line – and in that way go above and beyond the mobile payments space.” Liza Falzone, CEO of Ravel Sestems

To differentiate itself in a saturated market, Revel Systems launched in October 2015 branded mobile apps for merchants. The white label service has an upfront fee of $8,900. Merchants will also have to pay $119 per store location, per month. Its new app-building service lets merchants create a mobile marketplace which can be designed to handle pre-orders for food pick-up, delivery, and retail shipping.

It can also show users a list of nearby store locations. Like its physical point-of-sale system, Revel’s white label apps will accept a variety of payments including PayPal and Apple Pay. Revel designs and makes apps in collaboration with merchants, and then handles the process of getting the app into app stores.

Through Revel’s custom mobile apps, merchants also have an opportunity to get deeper insights into customers. Cofounder and CTO Chris Ciabarra said that using beacon technology, his point-of-sale system will be able to recognize nearby customers, so merchants can pull up a profile when a customer walks in the door. Merchants can also develop their own loyalty programs for customers through the app.

Stanford University was the first institution to develop a mobile app for its students through Revel. The new Stanford app will let students pre-order meals from the cafeteria and pick them up on arrival, which means no more long cafeteria lines.

In December 2015 Revel Systems announced that the company has opened a new London-based office that will serve as the central hub for its business in the EMEA market. The new location will allow Revel to build its presence in the United Kingdom and more effectively service its growing customer base throughout Europe and EMEA. Revel currently has an office in Italy, and plans to add offices in France and Germany over the coming months. Outside of Europe, Revel also has offices in New South Wales, Australia, and an IT division located in Vilnius, Lithuania as well as sales offices in Tempe, Arizona and New York City.

Revel Systems has experienced growth of 250 percent over the past 12 months, with Australia becoming the business’ second largest market behind the US. Revel currently has more than 20,000 iPad POS terminals deployed globally in restaurants, retail establishments, stadiums and grocery stories, among other locations.

In Australia the Apple iPad-based POS software currently has 1,000 terminals operating across the country including George Gregan’s GG Express, Charlie Lovett and Croissant Express café outlets and Qantas Business Lounges.

“We have now reached a capitalization of $500 million and are targeting listing on the New York Stock Exchange or Nasdaq over the next two years,” says chairman of Revel Systems, Sean Tomlinson. “Australia is now Revel’s second largest market with 40 staff across Sydney, Perth, Brisbane and Melbourne, with an office now open in Singapore to progress our expansion across Asia.”

E LA CARTE (US)

E la Carte announced it has been named by Fast Company as one of the magazine’s World’s 50 Most Innovative Companies for 2015 – E la Carte ranked number 26. “We could not be more honored that E la Carte’s innovative approach using technology to transform the restaurant industry and enhance the guest experience has been recognized by Fast Company,” said Rajat Suri, founder and CEO of E la Carte, in a company press release.

“This award places E la Carte alongside businesses worldwide that are fearlessly innovating and leading the way to the future. The recognition is a testament to our hard work and success thus far, and we look forward to continuing our efforts to elevate Smart Dining to the next level.”

Currently, E la Carte’s restaurant partners include Applebee’s, Genghis Grill and Johnny Rockets, with well over 50,000 Presto tablets deployed nationwide. Guests using the Presto tablet can browse full menus with photos, place orders, play games, and pay their bill directly on the tablet. Guests can also split checks and redeem gift cards without waiting for assistance from the server.

SHOPKEEP (US)

In December 2015 ShopKeep announced that President and CEO, Norm Merritt, will be stepping down as head of the company for personal reasons. Nearly two years since Norm assumed leadership at the company. During the same period, Norm expanded and strengthened the company’s leadership team with the appointments of Etie Hertz (SVP), Andrew Gorrin (CMO), John Baule (CFO) and Michael DeSimone (COO). Michael DeSimone, who was formerly CEO of Borderfree, a publicly traded company sold to Pitney-Bowes in 2015, will serve as ShopKeep’s acting CEO.

In December 2015 ShopKeep announced that President and CEO, Norm Merritt, will be stepping down as head of the company for personal reasons. Nearly two years since Norm assumed leadership at the company. During the same period, Norm expanded and strengthened the company’s leadership team with the appointments of Etie Hertz (SVP), Andrew Gorrin (CMO), John Baule (CFO) and Michael DeSimone (COO). Michael DeSimone, who was formerly CEO of Borderfree, a publicly traded company sold to Pitney-Bowes in 2015, will serve as ShopKeep’s acting CEO.

The company has raised nearly $100 million in venture capital from investors such as Canaan Partners and Activant Capital. Its last round valued the company at around $200 million on a pre-money basis, according to a person familiar with the deal. ShopKeep already has more than 20,000 storefronts in the United States and Canada. Business owners can set-up their registers in minutes, accept cash and credit cards with their choice of processor, view real-time sales on their smartphone and easily track inventory and staff. ShopKeep was founded in 2008 and is headquartered in New York.

ShopKeep was founded by former wine-shop owner Jason Richelson, who said he was fed up with the software available to small merchants and the cost of legacy systems. Richelson is still with the company as chief strategy officer.

Similar to Square, New York-based payments startup ShopKeep makes point-of-sale software for small businesses, with tools for managing transactions, inventory and customer information. But unlike Square, ShopKeep earns revenue primarily through its subscription software business.

According to ShopKeep ex-CEO Norm Merritt, this model puts his company on a much faster track toward profitability than the one used by Square.

“We’re the anti-Square,” Merritt said. “We have better unit economics,” he continued. “We don’t have a large swath of customers that cost us money like Square does. Significantly superior gross margins coupled with very low churn are proof points that our model is superior.”

ShopKeep charges businesses $49 a month, per register. Its software is made to run on an iPad, which the company sells along with other hardware used by its merchant base — mainly restaurants, bars and specialty retail shops generating average sales of $400,000 a year. Merritt said ShopKeep’s customer acquisition payback (the time it takes until they start making money off of a customer after accounting for what it spends to acquire one) is less than a year. That means a new ShopKeep customer becomes very profitable in a relatively short amount of time.

“Square attracts merchants who have a very low check average and thus a typically high processing rate,” Merritt said. “These low-end merchants will join Square in droves because of Square’s flat 2.75 percent fee — however, they each cost Square money as the fee is lower than Square’s cost.”

ShopKeep acquired a payment processor over the last year, so the company now generates revenue from transaction fees, too. But as opposed to having a flat processing fee like Square, ShopKeep uses the Interchange Plus method of pricing. “We charge what the banks charge (Interchange) plus a small mark up,” Merritt said. “For merchants whose transaction size is over $10 on average, we can beat Square’s flat rate every time and we make money every time.”

Merritt said Shopkeep has 20,000 business customers and is projecting revenue between $30 million to $40 million for 2015. Square has more than two million active merchants and did $560 million in sales in the first six months of 2015 alone. Merritt says ShopKeep is not profitable today because it is reinvesting in its sales and marketing divisions.

Merritt said 2015 revenue will end up more than double last year’s total and he expects that they’ll at least double revenue again in 2016. Merritt is also eyeing an IPO within the next two years. “We have a long runway having just announced a new round of funding and are intently focused on building a strong, lasting and profitable business, as opposed to rushing anything and then underperforming.”

In September 2019 ShopKeep baught Ambur, a payments service for restaurants, food trucks and other food and drink establishments. ShopKeep will keep the product alive as it integrates it, and will be taking on Ambur’s 1,500 customers in the process.

The terms of the deal were not disclosed, and Norm Merritt, ShopKeep’s CEO, simply said, “It was a good deal for all parties.” Even with a lot of M&A underway, there are a number of startups in the market offering payment services — with nearly as many focusing specifically on food and drink retailers. This particular acquisition made sense, Merritt says, because Ambur was a particularly strong cultural fit for his company.

In July 2015 Shopkeep announced $60 million in Series D funding. Led by investor Activant Capital with support from existing investors, ShopKeep planned to use this injection of capital to aggressively grow its overall US customer base, strengthen industry partnerships, and launch international operations, starting with the UK this month. Steve Sarracino, founder of Activant Capital, joined ShopKeep’s board of directors as a result of this investment. ShopKeep has raised $97.2M in funding to date.

With its $60 million of funding in hand, ShopKeep has been on a mini buying spree this year to grow its business to the next level to compete more with the bigger players. That has included buying Payment Revolution to add payment processing to is platform, and Merritt says there will be others to come. “There will be more consolidation,” he predicts. “The players that have the infrastructure to serve merchants in the long haul are the ones who will lead it.”

The company is currently on track to process $6 billion in payments on its platform on an annualized basis from some 20,000 merchants, making it smaller than Square ($30 billion in 2014), and Shopify and LightSpeed POS (both at $10 billion processed on an annualised basis).

In March 2015 the company has acquired another startup, Payment Revolution, and will now offer payment processing as part of its point-of-sale platform, under a new name, ShopKeep Payments[15]. This is an agnostic solution, which is capable of working with the likes of Apple Pay but also whatever other payment methods and mobile wallets come down the pipeline. The terms of the deal are not being disclosed but from what we understand, it is a tech and talent grab, with Payment Revolution’s CEO, Etie Hertz, taken on a new role at ShopKeep as SVP of Payments. “We speak to a lot of merchants every moth and a lot of them are looking for partners for payments processing, so we would pass them off to Payment Revolution,” said Merritt in an interview.

As for what areas that might touch, he notes that e-commerce has not been as much of an emphasis for ShopKeep in the past, but the trend for omnicommerce — where people have seamless experiences of discovering, buying and selling goods and services wherever the buyer may be — is definitely a strong one that ShopKeep will be looking to be more active in going forward. It’s also currently talking to a number of third parties also for partnerships to develop this area.

CLOVER (US)

The recent wave of digital payment options available to consumers has helped foster a spate of innovative technologies for receiving payments. To stay in the game, longtime point-of-sale purveyor First Data launched in June 205 its latest tablet-based system: the Clover Mini. The Clover Mini is a small point-of-sale system that’s aimed at competing with Poynt, former Google Wallet lead Osama Bedier’s recently launched point-of-sale.

The Mini will accept NFC-based payments from mobile wallets like Apple Pay, Android Pay, and even the soon-to-launch Samsung Pay. It also has a card slot for chip and PIN credit cards. The tablet-sized terminal has a PIN pad, multiple USB ports, and full Wi-Fi capabilities, as well as an input for an Ethernet cable.

President Guy Chiarello joined First Data in 2013, he knew things needed to change: “The company lost its way around product innovation, and as a result these other players got into the marketplace,” said Chiarello. First Data had acquired Clover in 2014, a mobile payments app that allowed users to quickly check out. After the acquisition it pivoted it into a sleek white terminal complete with an app store, so merchants could tailor their own experience.

Point-of-sale terminals are no longer just about a simple transaction, they’re about being the entire backend of a business. For example, since Square launched its initial dongle, it’s built out a system for booking appointments, managing inventory, invoicing, and analytics; it even offers cash advances to certain customers.

Poynt is also staying competitive by offering an app marketplace populated by third-party developers. At a roughly $300 price tag, it’s also far cheaper than most terminals on the market. The company won’t reveal exactly how much the unit will sell for, because First Data has a network of banks that sell units on its behalf and the price can fluctuate, but it’s fair to assume the price will be in the $300 range.

Bank of America Merchant Services launched the Clover Mini. “The launch of Clover Mini is a response to our small business clients, who tell us they want streamlined capability and innovation,” Tim Tynan, CEO of Bank of America Merchant Services, said in a statement. “The built-in layers of security protection also give business owners peace of mind, so they can focus on what matters most, their customers and growing their business.”

After that First Data announced the availability of Clover Go. The EMV-enabled card reader plugs into an iOS or Android tablet or smartphone and works with a Wi-Fi or cellular connection, enabling businesses of all sizes to accept payments outside of a traditional brick-and-mortar setting, according to a press release. Clover Go provides multimerchant and multi-user functionality, allowing business owners to toggle between different store locations and grant access to an unlimited number of employees. Business owners can also choose whether to use Clover Go as a standalone device or take advantage of its interoperability with the full Clover product suite.

“While the Clover platform serves businesses of all sizes, Clover Go is especially beneficial for businesses with mobile workforces or entrepreneurs just starting out who want to accept transactions while complying with the EMV liability shift,” said Dan Charron, executive vice president of head of global business solutions of First Data.

ALLSET, COVER AND RESERVE (US)

Many people definitely had moments where they frantically flagging down a waiter because everything’s taken longer than expected, leaving them to try to pay the check and get to their next meeting in just a few minutes. One (sad) solution is to eat at your desk, but Allset is taking a different approach, by making the sit-down lunch process more efficient. You can make a reservation, place your order and even pay directly from the app. Then when you get to the restaurant, you just tell them your name, and you should get seated and served in short order.

There are other services tackling reservations, payments or both, but didn’t combined with food ordering in this way, with the goal creating a faster dining experience. In fact, Allset says it can shave up to 40 minutes from your meal time.

“We’re creating a better way for busy people to have lunch,” said Allset CEO Stas Matviyenko. “Our goal is to help people take a real break, save time, and enjoy the full restaurant experience.”

The service launched in San Francisco last year, and the company says it’s serving 1,000 orders each month across 50 restaurants. As of today, Allset is also available in Manhattan, with initial restaurants including Palma, Les Halles, Mari Vanna and Brasserie Cognac. Les Clos in San Francisco says it has actually seen a 25 percent increase in lunch sales since partnering with Allset.

“The weekday lunch rush is a frenetic time for businesspeople and restaurants alike,” Mickey Bruce, Owner, The Lunchpad. “We’re excited to be one of the first adopters of Allset in an attempt to help diners enjoy a great sit-down meal without the stress of watching the clock. On the business side, we’re looking for the app to bring in new customers, speed up table turnover, and increase lunch sales by 10%. We’re glad to say it plays nice with other reservation apps we use as well. With Allset, I believe The Lunchpad’s delivering a customer experience that many of our lunchtime diners are looking for.”

Aj Agrawal, CEO of Alumnify, for in Inc. magazine: “This past year I received 200 pitches from food companies. This one was my favorite.” “Recently the struggle I had been facing was that I could never actually sit down at a restaurant for lunch. I’m the kind of person who wants to get in and out of lunch during the workweek in less than 60 minutes, which is a constant struggle when you work in San Francisco. Last week my colleague Daniel asked me to get lunch with him. “I can’t,” I told him, “I only have an hour.” Going to a restaurant, sitting down, ordering from the menu, waiting for you food, and eating and leaving is simply not something I can fit into my day. Looking through my emails, I found a company who pitched about solving my problem. It was called Allset.” Here are a few reasons why the Allset has won the award for Aj’s favorite food app of 2015: 1. I don’t have to order takeout every time I want to eat something fast; 2. I can now go to a restaurant during my lunch break; 3. I have more options when it comes to eating. “Part of the reason for the app’s early success is the timing. Everyone is busy today, and everyone is looking for ways to save time. So Allset offers busy people the shortest, frictionless way to a sit-down meal at a restaurant.” “I believe Allset became groundbreaker for the food tech market in 2015 and will look forward to see its launch nationwide.”

For consumers, this allows users to book tables, and order and pay for their meals, which will be available as soon as they arrive at the restaurant at their desired time. Users can customize their experience by asking for a table near a window, and can include special instructions for their meal’s preparation. For restaurants, the platform promises quicker table turnover, which can be helpful in times like a crowded lunch rush. When using Allset, a $1 fee is charged to the diner for the entire group (even if the order is for multiple guests), while $1 is also charged to the restaurant.

In March 2015 Cover, a mobile payments app that focuses specifically on the dining experience, has announced the launch of the service in Los Angeles. Cover lets diners check-in to a restaurant and split the bill via mobile, offering an Uber-like dining experience. The app launched in New York back in October of 2013 and has since raised a total of $7 million in funding, according to Crunchbase.

Cover subscribes to a more targeted attack on mobile payments, which has proven to be an incredibly difficult space to tackle. Rather than focus on the entire peer-to-peer space, Cover approaches mobile payments in the moment that they’re most commonly needed: when the check comes. Cover is currently available across 240 restaurants in New York, San Francisco, and now, Los Angeles.

Reserve, the app promising to serve as your “personal dining concierge,” announced that it has raised $15 million in Series A funding. The company was incubated at Expa, the startup studio created by StumbleUpon and Uber co-founder Garrett Camp. Reserve has now raised a total of $17.3 million. The round was led by Human Ventures Capital (a new firm created by Reserve co-founder Joe Marchese, whose ad tech startup True[x] Media was acquired by 21st Century Fox in December) and by Expa. To use Reserve, you provide the time window when you’re looking for a reservation, then the app gives you a list of recommended restaurants in your area.

Reserve, the app promising to serve as your “personal dining concierge,” announced that it has raised $15 million in Series A funding. The company was incubated at Expa, the startup studio created by StumbleUpon and Uber co-founder Garrett Camp. Reserve has now raised a total of $17.3 million. The round was led by Human Ventures Capital (a new firm created by Reserve co-founder Joe Marchese, whose ad tech startup True[x] Media was acquired by 21st Century Fox in December) and by Expa. To use Reserve, you provide the time window when you’re looking for a reservation, then the app gives you a list of recommended restaurants in your area.

Once you’ve chosen one or more restaurants from the list, the app will work to get you that reservation — if it can’t find something at the location(s) of your choosing, it will come up with openings at similar restaurants in your time window. Co-founder and CEO Greg Hong noted that despite the app’s name, it doesn’t just handle reservations. It takes care of payment, too, using the credit card information that you’ve entered into the app.

That can save you an awkward wait at the end of your meal — and Hong said that even when you don’t have to wait a million years for your check, all the social cues around fighting over the bill and filling out the tip can take “a delightful experience” and make it “very transactional.” (Plus, adding a bill-splitting feature is at the top of the team’s to-do list.) At launch, Reserve was available in New York, Boston, and Los Angeles. Since then, it launched in San Francisco, added more restaurants (bringing the total to more than 110).

OPENTABLE (US) AND QUANDOO (GERMANY)

Leveraging its vast network of eateries, OpenTable made a foray into the mobile payments business last year. The company billed the new feature as a way to streamline the dining experience by alleviating the hassle of paying the check at the end of the meal. With the new system, users can add a credit card to their accounts. When a customer sits down at a participating restaurant, the reservation is automatically linked to the corresponding table and tab. He or she can view the itemized order through OpenTable’s mobile app, specify a tip and pay via iPhone without waiting for a bill. A brief perusal of the Terms of Service make it clear that OpenTable knows plenty about its customers.

Among information the company purports to collect: name and contact information, current and prior reservation details, order history, dining preferences, demographics and precise location data. The company pairs such user data with information from “Third Party Platforms.” The wording here is purposefully vague, but it is certainly plausible that the company could use outside research firms to cobble together a whole host of personal information like income, age and spending habits. For users who make payments via the mobile app, OpenTable reserves the right to share its customer dossier with the restaurant “for its own purposes”.

Restaurant reservation service Quandoo, a major European rival to OpenTable, was acquired by Japan’s Recruit in a deal worth 27.11 billion yen, that’s around $219 million. Berlin-based Quandoo, which was founded in 2012, took a strategic investment from Recruit — via its RGIP venture capital fund — in October 2014, and in March 2015 the Japanese company has returned to snap up the remaining 92.91 percent of the company to give it 100 percent ownership. Quandoo is an online reservation system that is used by over 6,000 restaurants in 10 countries in Europe, South Africa, Lebanon and Singapore. The company said that it is seeing particular momentum in Germany, Italy, Austria, Switzerland, Turkey and Poland, but it did not provide more specific figures. Quandoo closed $25 million in new funding in summer 2014 to increase the competition with OpenTable and expand into Asia and Latin America. Recruit is likely to help on that front, particularly in Asia.

TOAST (US)

Toast, which develops restaurant point-of-sale technology that is built on the Android operating system, has raised $30 million in Series B funding. Bessemer Venture Partners led the funding round for the company, which has been backed by GV, the venture firm formerly known as Google Ventures. GV’s earlier investment was led byRich Miner, a co-founder of Android. In recent years, many investments have been made into point of sale systems that largely run on iOS for iPad.

When Chris Comparato joined his former colleagues at Toast, a service that includes a point-of-sale tool for restaurants, raising new financing to continue scaling the company was near the top of the list. Comparato says the company has more than 1,000 customers, growing from “hundreds” to “thousands” in the past year or so.

“In general, our vision is to really enable a world where restaurants of all different sizes deliver the best customer experience by leveraging [an online service that includes point-of-sale],” he said. “That means providing a better experience for waiter and waitress who want to create orders much more nimbly, or a better guest experience for customer and patron, and we feel tech can be an enabler.”

Of course, raising financing wasn’t the only thing on Comparato’s mind. Numbers one and two on his list, he said, were expansion of sales and marketing across the U.S. and expanding the company’s research and development efforts. Both of those are capital-intensive because they require increasing headcount at the company — which already has more than 170 employees, he said.

Another goal for 2016, he said, was to add a suite of tools that allow Toast to integrate with other services. For example, Toast may offer a delivery tool, but restaurant owners may want to go with other services instead. Instead of forcing restaurants to rely on Toast’s in-house services, they will hopefully be able to integrate with other services, he said.

Among those milestones, Toast recently reached around 140 employees and plans to add more than 15 new employees every month, according to Ellie Mirman, Toast’s vice president of marketing. The company also recently upgraded its space, going from 7,000 square feet in Cambridge to 40,000 square feet at the new Hatch Fenway co-working space, giving it the capacity to more than double its workforce to 250, possibly within the next year, Mirman added.

That’s a far cry from the 15 or so employees it had at the beginning of 2014. On the funding side, Toast recently disclosed that it raised nearly $3 million in debt financing from five unnamed investors and that it’s looking to raise an additional $15 million. The company, which had raised about $7 million before.

And the company now finds itself competing against … Oracle, which last year bought Micros, one of the dominant makers of cash registers and related software, for $5.3 billion. (At the time, Micros had its technology installed in more than 330,000 locations, and employed 6,600 people.) NCR, with a market cap of $5 billion, is also a major established player in the market for what are sometimes called “point-of-sale systems.”

Every quarter, the startup holds an employee hackathon to encourage employees to work on enhancements to the product — or develop future product concepts. They have 24 hours to work as teams, and last Thursday, they were presenting the projects from their summer hackathon. (Comparato noted that several team members had stayed in the office all night.) Among the projects were software that tried to predict a restaurant’s future sales based on day of the week and weather, and a tutorial that could make it easier for employees to learn how to use Toast.

But several of the hackathon ideas suggested that once Toast attracts enough restaurants to its point-of-sale system, it may start building apps and services for consumers, like a way to pay your check quickly by tapping your table number into your phone (or Apple Watch), or sending a digital gift certificate to a friend. Comparato says consumer-facing apps could debut as early as 2016.

GROUPON BREADCRUMB (US)

At the beginning of 2015 year, Groupon considered spinning off its restaurant software business, Breadcrumb. But Groupon has decided to hold onto the business for now, according to sources, and some big changes have happened as a result. First, Breadcrumb founder Seth Harris, who has run Groupon’s restaurant software and payments business since his startup was acquired in 2012, has left the company.

At the same time, Groupon has cut about 20 positions in the Breadcrumb unit, according to a spokesman, out of about 80 to 100 people that sources say worked in the group. In a statement, Groupon’s Bill Roberts said:

“Breadcrumb is a great business, and we’ve made some operational changes to better position it for accelerated growth. There were some position eliminations as we chose to reallocate resources to other areas.” Rudd Davis, who joined Groupon last year in the acquisition of his startup, Swarm Mobile, is replacing Harris.

Part of the thinking behind the acquisition of Breadcrumb was that it would allow Groupon to build closer relationships with small businesses and make it easier for them to redeem Groupon deals, which might lead to their doing more business with Groupon. Breadcrumb, however, also has a host of high-end restaurants as customers who don’t regularly do business with Groupon beyond their software and payments relationship. It’s not clear why Groupon has decided to hold onto the business after talking to potential acquirers earlier this year about a partial spinoff or sale.

Over the past few years, Groupon has looked to evolve from solely a daily-deal business reliant on email offers to one that also sells products on its marketplace. But the transition has been bumpy, and Groupon’s stock is currently trading at its lowest point in more than two years.

In May 2015 Groupon has been expanding its footprint beyond daily deals for some time, and the company is doubling down on its investment in its restaurant point-of-sale system Breadcrumb with a new app designed to bring live sales data to the iPhone. With Breadcrumb Live, the company is offering restaurant owners the ability to pull up sales information, check counts, performance trends and other analytics, even when they’re away from their business.

Now with Breadcrumb Live, Groupon is extending the functionality of its Breadcrumb Pro platform to mobile phones. The app itself is free, but requires business owners to subscribe to the Breadcrumb Pro service on a monthly basis with plans that start at $99 per month for 1 iPad and go up to $399 per month for up to 10 iPads.

The idea is that a restaurant, bar or club owner can purchase this system to allow staff to manage tables, customize menus, handle checks, set schedules, track tips and keep tabs on the business in general from any web browser or iPad.

BreadCrumb Live, meanwhile, is about bring the business’s key data and trends to the iPhone, offering details like total net sales, average check size, top categories, revenue trends, traffic and customer trends, number of guests, data on comps and voids, and more. In other words, it’s largely designed for the owner or manager who needs to stay on top of the business at any time, even when he or she is away from the venue itself.

SHOPIFY POS (CANADA)

Shopify is a leading cloud-based, multichannel commerce platform designed for small and medium-sized businesses. Merchants can use the software to design, set up and manage their stores across multiple sales channels, including web, mobile, social media such as Pinterest and Facebook, brick-and-mortar locations, and pop-up shops.

The platform also provides a merchant with a powerful back-office and a single view of their business. The Shopify platform was engineered for reliability and scale, using enterprise-level technology made available to businesses of all sizes. Shopify currently powers over 175,000 businesses in approximately 150 countries, including: Tesla Motors, Budweiser, Wikipedia, LA Lakers, the New York Stock Exchange, GoldieBlox, and many more.

Shopify has released a new app, Shopify POS, that adds more functions, refines the user interface a bit and adds point of sale capabilities, allowing users to take payments via the app. Users can link their existing Shopify account and stores or create brand new ones. Cash and credit cards are acceptable by manually entering them in or using a free card reader from Shopify, similar to a Square reader. You can also track sales, view reports on how your business is doing and even get customized projections. You can manage your storefronts consummately, with the app allowing you to change or add items with a few taps. You can even take a picture with your phone and add it in as an item for your store.

The app also has automatic tax figuring by location, order synchronization with all your other terminals, browsing and searching collections of items, emailing customers their receipts and even adding customers to order tracking so they can get a better look at the progress of the product from their initial click on the “buy” button until it arrives at their door. Notes viewable by both the customer and the merchant, or just the merchant, can be added to any order.

Finally, the app and service come with 24/7 customer service. If the thought of having an all-in-one storefront is appealing enough for you to want to give Shopify’s service a spin, getting started is free. Fees are $9 a month, along with 2.7 percent of each transaction, relatively low for this sector. This mean the app and service aren’t for everyone, but if your business is a bit too big to manage or you’d like to save yourself a little bit of number-crunching headache, hit up the source link.

In September 2015 Shopify announced the launch of its new credit card reader that will allow Shopify merchants in the U.S. to securely accept chip and pin, tap, and swipe credit and debit cards as well as contactless payment technologies like Apple Pay. “With our new card reader, our merchants will be able to accept all of the most popular forms of payment available on the market today.” All U.S.-based merchants that pre-order the new card reader will be enrolled in Shopify’s Liability Shift Protection Program. This protection program covers merchants against fraudulent chargebacks made using Shopify’s existing swipe credit card reader until the new card reader is received. “Shopify merchants can pre-order the new card reader for $99, and accept credit cards with rates as low as 2.2%.”

In October 2015 Uber partnered with Shopify to power same-day deliveries for its merchants in New York City, Chicago, and San Francisco. The companies, according to a statement, plan to “roll out additional cities over time.” UberRush had been operating in an experimental capacity in New York for about a year, with today serving as its “official launch.”

Uber is already transporting more than just people throughout its most popular cities. In addition to UberRush, it has launched a grocery delivery service called UberFresh and a food delivery service called UberEats. Its competitor in the courier space, Postmates, has partnerships to make deliveries for giant companies like Starbucks, Apple, and Walgreens. Uber may be starting with smaller merchants via Shopify, but according to reports, larger brands won’t be far behind.

In July 2015 the company expanded the capabilities of its iOS point-of-sale system with the launch of nearly a half-dozen apps for the platform, allowing merchants to add custom features to their point-of-sale solutions without having to upgrade to a more expensive POS platform. The apps are available now via Shopify’s existing App Store, and include those that will help merchants run promotions, upsell to customers, turn their Wi-Fi into a marketing tool, offer wholesale discounts to select customers, plus print invoices, labels, receipts and more.

The current lineup available today includes loyalty card app Appcard, Ultimate Sales Manager, Turnstyle (the Wi-Fi app), Supple Wholesale and Order Printer. Four of these apps are made by third parties, while one is Shopify’s own.

To download any of these apps, merchants can visit Shopify’s App Store, and head to the new, dedicated section that features apps for the POS. Then it’s just a matter of clicking the “Get” button to install the app. Once installed, merchants can then access these apps in a number of ways, depending on what type of app it is.

For instance, apps that affect checkout flow will be available by clicking a button (the one with three dots) at the top right of the screen, while other apps are able to be accessed after the guest checks out. All the apps and their associated settings are also found in the Apps section of a merchant’s Shopify Admin, the company says.

Developers can build apps using the Shopify POS App SDK, and are able to set their own pricing. However, Shopify will offer guidance on pricing when apps are submitted to its store for review, the company says. In addition, Shopify takes 20 percent of sales for these apps and the developers keep the remaining percentage. Like the Shopify App Store, which has grown to over 1,000 apps since its launch in 2009, the company wants to expand the number of apps for the Shopify POS in much of the same way.

In April 2015 Shopify had filed an F-1 document, indicating that it will sell shares to the public market. The company indicates in the filing that it will raise $100 million in its IPO. Shopify has raised $122 million to date. At the time of its last capital raise, Shopify was valued at $1 billion, something that TechCrunch noted is nearly unheard of for a Canada-based technology startup. At that time, we reported that Shopify was diversifying into offline commerce.

ALBERT (Australia)

Commonwealth Bank of Australia expects tens of thousands of its new Albert point-of-sale devices to appear in Australian restaurants, cafes and retail stores, transforming payments and gathering richer data. CBA customers will be able to use Albert, a wireless, 7-inch Android tablet with touchscreen. Launching the new Albert device, CBA’s managing director of payments and cash management Gary Roach also confirmed the bank’s German technology partner Wincor Nixdorf would distribute the device internationally, creating a new revenue stream for the bank offshore.

Commonwealth Bank of Australia expects tens of thousands of its new Albert point-of-sale devices to appear in Australian restaurants, cafes and retail stores, transforming payments and gathering richer data. CBA customers will be able to use Albert, a wireless, 7-inch Android tablet with touchscreen. Launching the new Albert device, CBA’s managing director of payments and cash management Gary Roach also confirmed the bank’s German technology partner Wincor Nixdorf would distribute the device internationally, creating a new revenue stream for the bank offshore.

The Albert is a wireless, seven-inch Android tablet with a touch screen, a secure EMV [Europay, MasterCard and Visa] interface for accepting chip and PIN cards, technology to enable contactless payments, a receipt printer, and 3G and Wi-Fi connectivity. Customers of CBA with enough cash turnover will be able to access the Albert devices as part of the bank’s existing merchant plans.

The Albert runs on an open-source platform and CBA expects external application developers to help merchants customise their customer experiences. CBA has developed eight apps that will come pre-loaded onto the device, including a cash counter and an app to split bills. Other apps will be developed by the bank along with merchants and third-party developers and made available through the CBA-controlled Pi App Bank. Some 800 developers have already registered to build apps for the device.

MOBIKON (Singapore)

At a time when food-related tech start-ups have started downsizing by sacking employees to manage costs better, Mobikon, a Pune- and Singapore-based start-up is swimming against the tide. The start-up is ramping up operations and plans to partner with 10,000 restaurants in India and South East Asia over the next two years; it will hit the road hit the fundraising highway in the next 2-3 months.

Mobikon builds software that caters to the whole spectrum of the restaurant business such as marketing, increasing engagement with customers, and reservations, among others.

The company, founded in 2009 by Samir Khadepaun and Salil Khamkar, currently works with 2,000 restaurants in India, Manila, Singapore, Kuala Lumpur and Dubai. At present the revenue split between India and SEA is in the ratio of 50:50. Khadepaun feels that in future revenues from International market may go ahead of India. So far Mobikon has 4 million diner profiles and has generated till now over 2.5 million reviews.

Khadepaun said that the sky-high valuations that the food-tech segment saw made several players enter the business. “Because of this competition restaurants now ask for freebies and freemium offers. Even when we go to restaurants they ask us for freebies,” he added. Khadepaun also believes that what differentiates them with other start-ups is that they have not got into the crazy valuations and fund raising game.

In November 2015 Delight Foods which sells Indian food brands online, has raised Rs 4 crore ($605000) from a family office and Mobikon, is planning to expand into Southeast Asia. Delight Foods will use the funds raised for marketing, brand building, increasing product categories and expanding operations to beyond the NCR.

In that time Mobikon has partnered with Bank of the Philippines Islands (BPI) in Manila to expand its footprint in the Southeast Asia market. This will be a win-win situation for both the parties as BPI will provide Mobikon’s platform and analytics dashboards to restaurants which help BPI bank to gain higher share of mind among its merchants and position the bank as a highly contemporary leading bank in Philippines.

“This deal is a breakthrough for us. We will be looking at similar partnerships as we scale in different regions. When everyone is going after discounting, physical acquisitions and spending more dollars, Mobikon is going a smarter way of partnerships and would use the same model to further scale in India and other regions besides Manila. These tie-ups are in line with our expansion plans across S.E. Asia and would provide a value proposition to merchants,” said Samir Kadhepaun, CEO of Mobikon.

In October 2015 Mobikon has raised funding from fintech-focused Life.SREDA and Qualgro, an Asean fund. In July 2015 Mobikon has received $2.3 million in new funding led by returning investor Jungle Ventures. Mobikon said in a release that it will help the company expand its tech capabilities and expand to new geographies such as Jakarta and the United Arab Emirates.

“This strategic funding will boost Mobikon’s expansion in South East Asia. Qualgro and Life.SREDA, besides the funding, brings in a huge network of mPOS and Cloud POS players which will help Mobikon to scale quickly,” said Mobikon’s co-founder and chief executive officer Samir Khadepaun, who started the company in 2009 with Salil Khamkar.

Restaurants typically use different software ad platforms for various functions such as reservations, ordering and accounting. Mobikon brings all of that on a single dashboard, making it easier for its clients to manage operations across multiple locations. Its automated marketing software also makes it easier for restaurants to get feedback from customers and run targeted campaigns, such as invitations to a referral programme or complimentary products for high-value customers.

In August 2015 Mobikon announced that it has acquired Singapore-based Trii.be. The company said that the acquisition has expanded its reach to over 300 outlets in Singapore and over 1,700 outlets across Asia, with India accounting for more than 800 restaurants. Some the leading brands on Mobikon’s platform are Little Italy group, Pan India Foods, Pizza Express in India, Red Carb, NIU in Manila, Swensens, Select Group, Secret Recipe, Alt Pizzas in Singapore.

8 MORE POS STARTUPS THAT WANT A PIECE OF SEA’S CONSUMPTION BOOM

It’s no secret that SEA’s growing economy is largely fuelled by brick-and-mortar consumption. While not immediately obvious, this presents great opportunities for tech startups, namely those offering creative solutions for point-of-sale (POS) systems at the checkout counter.

Traditional POS systems consist of a basic computer, barcode scanner, receipt printer, cash drawer, and card reader for debit or credit transactions. Until recently, these devices, which are ubiquitous in the archipelago, were archaic and limited. But several new firms are making headway with POS tech. Brick-and-mortar merchants now have increased freedom and options when using their sales equipment. POS systems in Indonesia are becoming easier to use, more affordable, and more versatile, as they can now be linked up with your tablet or smartphone. Cloud computing has recently been introduced. In no particular order, here are five POS startups that are shaking things up in Indonesia.

MokaMoka from Indonesia is a mobile POS startup that lets users do nearly everything via iPad. With Moka, users can ring up transactions, accept payments, and create reports. Everything done through Moka is stored in its real-time cloud. With Moka’s cloud tech, Indonesian business owners can manage multiple stores and instantly know what the best-selling items are at different locations. Moka also allows for instant inventory checks. Users can get all their sales intel without leaving home. The app also lets merchants track and manage employee activity. Moka monetizes through a subscription business model to the tune of Rp 250,000 (US$19) per month.

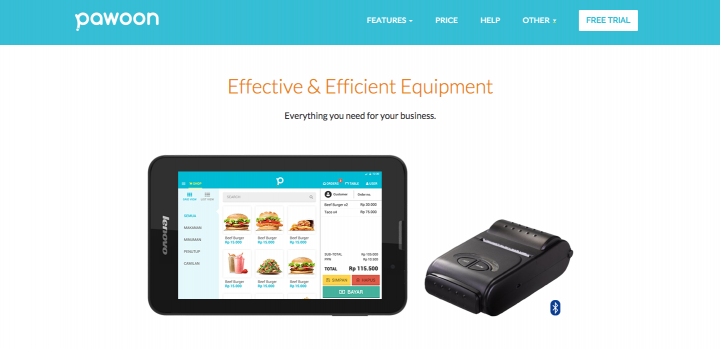

Pawoon While Moka uses iOS as its preferred bread and butter, its direct cloud-based competitor Pawoon from Indonesia zeroes in on Android. The startup claims its product is well-suited for small and medium enterprises in retail, cafe, and restaurant businesses. According to Pawoon, its system lets users view reports, manage stock across multiple stores, and track customer behavior. Pawoon’s price breakdown is relatively simple. If your business has one POS machine in one location and processes less than 300 transactions per month, then its service is free to use forever. The second option allows for unlimited locations, unlimited POS machines, and unlimited transactions for Rp 199,000 (US$15) per month.

While Moka uses iOS as its preferred bread and butter, its direct cloud-based competitor Pawoon from Indonesia zeroes in on Android. The startup claims its product is well-suited for small and medium enterprises in retail, cafe, and restaurant businesses. According to Pawoon, its system lets users view reports, manage stock across multiple stores, and track customer behavior. Pawoon’s price breakdown is relatively simple. If your business has one POS machine in one location and processes less than 300 transactions per month, then its service is free to use forever. The second option allows for unlimited locations, unlimited POS machines, and unlimited transactions for Rp 199,000 (US$15) per month.

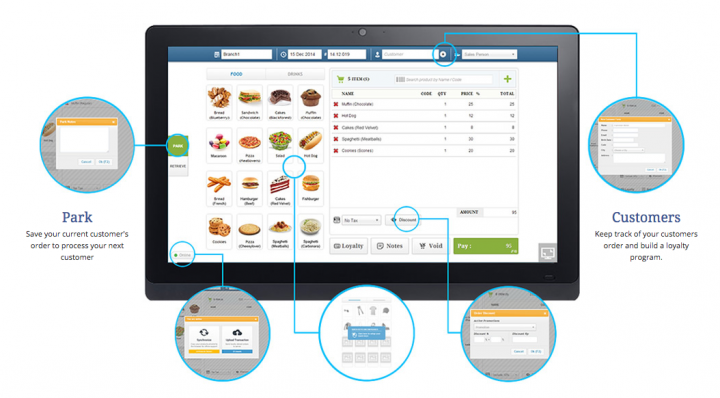

Olsera While Moka and Pawoon have chosen different operating systems, Olsera (also from Indonesia) is available on both iOS and Android. Olsera is also unique because it lets brick-and-mortar shop owners venture into ecommerce by building their own estores. Olsera’s cloud-based POS system is then applied to the merchant’s website and physical stores, and users can access inventory data, sales histories, reports, and analytics. Olsera has three different pricing options, depending on whether the merchant wants to run an online shop, a brick-and-mortar shop, or both. Monthly prices range anywhere from Rp 49,000 (US$3.75) to Rp 179,000 (US$14) with potential discounts, and the startup claims to offer personalized support for its users, day and night.

While Moka and Pawoon have chosen different operating systems, Olsera (also from Indonesia) is available on both iOS and Android. Olsera is also unique because it lets brick-and-mortar shop owners venture into ecommerce by building their own estores. Olsera’s cloud-based POS system is then applied to the merchant’s website and physical stores, and users can access inventory data, sales histories, reports, and analytics. Olsera has three different pricing options, depending on whether the merchant wants to run an online shop, a brick-and-mortar shop, or both. Monthly prices range anywhere from Rp 49,000 (US$3.75) to Rp 179,000 (US$14) with potential discounts, and the startup claims to offer personalized support for its users, day and night.

Dealpos

Fourth Indonesian startups – Dealpos – claims to be the first online POS software that offers offline browsing and check out functionality. The product lets merchants assign serial numbers to items, keep track of customer orders, and build loyalty programs. It also lets them create store promos, apply instant discounts, conduct transactions in multiple currencies, and convert them back to a base currency. Dealpos has a starter package for US$15 per month that allows for one outlet, one register, and three users. Its standard package costs US$25 per month, but allows for unlimited users. Each additional outlet costs another US$25 per month, and each additional register is another US$10 per month.

Fourth Indonesian startups – Dealpos – claims to be the first online POS software that offers offline browsing and check out functionality. The product lets merchants assign serial numbers to items, keep track of customer orders, and build loyalty programs. It also lets them create store promos, apply instant discounts, conduct transactions in multiple currencies, and convert them back to a base currency. Dealpos has a starter package for US$15 per month that allows for one outlet, one register, and three users. Its standard package costs US$25 per month, but allows for unlimited users. Each additional outlet costs another US$25 per month, and each additional register is another US$10 per month.

OmegaPos Fifth Indonesian player – Omega POS Cloud – is arguably the most traditional startup on this list, as the POS system software must first be installed on the cash register’s computer. However, the firm still incorporates cloud tech into its product, and store owners with multiple outlets can link all their inventory data together. Omega POS Cloud runs on Microsoft Windows, and the firm claims the software is applicable across the board, from restaurants, cafes, and clothing stores, to bakeries, mini markets, furniture shops, and more. Omega POS Cloud offers two pricing options. While the cost for ongoing cloud service is not listed, the starter kit costs Rp 599,000 (US$46) with six months of free cloud service. The second option is the “softcopy” which only applies to online sales, and costs Rp 125,000 (US$10).

Fifth Indonesian player – Omega POS Cloud – is arguably the most traditional startup on this list, as the POS system software must first be installed on the cash register’s computer. However, the firm still incorporates cloud tech into its product, and store owners with multiple outlets can link all their inventory data together. Omega POS Cloud runs on Microsoft Windows, and the firm claims the software is applicable across the board, from restaurants, cafes, and clothing stores, to bakeries, mini markets, furniture shops, and more. Omega POS Cloud offers two pricing options. While the cost for ongoing cloud service is not listed, the starter kit costs Rp 599,000 (US$46) with six months of free cloud service. The second option is the “softcopy” which only applies to online sales, and costs Rp 125,000 (US$10).

HaravanOne promising company from Vietnam in the mix is Haravan, Seedcom’s ecommerce platform startup. From the outside, Haravan (an alliteration of “Hai Ra Vang”, meaning to pick gold like you pick fruit) may resemble a Shopify for Vietnam. That’s precisely what Haravan is doing; it’s a platform for shops, retailers, and new SME ecommerce merchants to run their businesses offline and online. To the average Vietnamese user, it may look like a WordPress clone, where you can create a website using provided free and paid templates.

But Haravan takes WordPress and Shopify’s basic core concept and expands on it considerably, placing it firmly into a Vietnamese context. This is rare in Vietnam, where copying is rampant but shallow. Haravan is a case where the cofounders identified a problem and then found a model that fit. They started with Vietnam’s burgeoning underserved SME ecommerce market, researched various models, and ended up with Shopify.

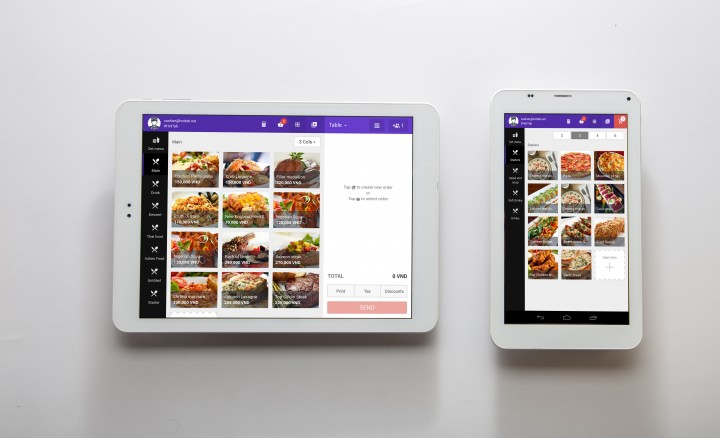

Hottab It’s easy to spot the rapidly rising number of hotels and restaurants in Vietnam. But despite the industry’s noticeable growth, managing a hotel or chain restaurant still takes a lot of work and innovation. That’s where Hottab comes in. It’s a new Vietnamese startup that offers a new solution for point-of-sale (POS) management for F&B business. Hottab provides service tablets and a POS system for food and beverage (F&B) businesses. A cloud-based system connects all devices using Hottab. It includes an application installed on tablet devices that allows waiters to create new orders. It also enables customers to self-order at the table.

It’s easy to spot the rapidly rising number of hotels and restaurants in Vietnam. But despite the industry’s noticeable growth, managing a hotel or chain restaurant still takes a lot of work and innovation. That’s where Hottab comes in. It’s a new Vietnamese startup that offers a new solution for point-of-sale (POS) management for F&B business. Hottab provides service tablets and a POS system for food and beverage (F&B) businesses. A cloud-based system connects all devices using Hottab. It includes an application installed on tablet devices that allows waiters to create new orders. It also enables customers to self-order at the table.

Storehub

Point-of-sale (POS) system startup StoreHub from Malaysia is considering to power its regional expansion and product development. Co-founder Fong Wai Hong said the company was open to strategic investors who can help StoreHub scale in the region and China, as well as open doors to possible technology partnerships.

Point-of-sale (POS) system startup StoreHub from Malaysia is considering to power its regional expansion and product development. Co-founder Fong Wai Hong said the company was open to strategic investors who can help StoreHub scale in the region and China, as well as open doors to possible technology partnerships.

“We want to expand in Asia Pacific, with a focus in Southeast Asia, and potentially China because we have a team there,” he said of plans for the next six to 12 months.

In the last quarter of 2014, StoreHub received two rounds of funding, one in the form of a MYR500,000 ($167,000) grant under Cradle Fund’s CIP 500 programme, and an angel investment of $100,000, in which the angel investor took up a low double-digit percentage stake in StoreHub. StoreHub’s customers now include big-name cafes, food trucks, retail outlets, mini markets and pharmacies. Its POS system is also integrated with three Malaysian banks – Maybank, CIMB Bank and Hong Leong Bank’s mobile POS (mPOS) credit card payment system, which technology is courtesy of another local startup SoftSpace.

KERU CLOUD (China)

In April 2015 Restaurant management software-as-a-service startup Keru Cloud announced it has secured RMB 66 million (US$10.7 million) in series B funding led by Baidu and Tianxing Capital (hat-tip to 36kr). Fangjinglin Investment and Kaixing Capital also participated in the round. This was Baidu’s second investment in Keru Cloud after a low-key contribution in April 2014.

The startup aims to be an all-in-one solution for restaurants and other businesses to go digital. It reports 3,000 restaurants nationwide, including Beijing, Shanghai, Guangzhou, and several more Chinese cities. By the end of this year it hopes to up that number to 20,000 merchants.

Offline, Keru Cloud’s flagship tablet app can be used by restaurant staff to input reservations, add parties to the queue, take orders, and run customer loyalty programs. For customers ordering takeout or delivery by phone, restaurants can take the orders, add customers to a database, and allow them to track the status of their order online.

Then there’s the mobile part of Keru Cloud, which is the coup de gras of what it has to offer. The startup creates a mobile web app through Baidu Connect and a WeChat public account for each of its client restaurants. These digital storefronts contain vital info like maps, menus, special discounts, and online ordering. A Baidu spokesperson tells that Keru Cloud “fits in very well with what we’re doing as far as connecting people with services.” The Baidu Connect program last reported 600,000 businesses on board, though we’ll likely seen an increase in that figure when the search giant’s next quarterly earnings are announced next week.

Searching for a local business signed up for Baidu Connect on Baidu Search will bring the user straight to the web app. In the case of Keru Cloud’s restaurants, this allows customers to do things like book a table, order takeout, or keep track of their place in a long queue. Baidu Maps and Nuomi, the daily deals site that Baidu bought from Renren last year, are incorporated into the web apps as well. In addition, Baidu Connect also gives businesses analytics and online marketing capabilities.

With its latest cash injection, Keru Cloud plans to enter into more service sectors, such as gyms, massage parlors, and spas. The startup will also increase investment in product development and expand its sales and operations teams.

ZOMATO (India)

In April 2015, barely five months after raising US$60 million, restaurant finder app Zomato has swallowed another US$50 million in a fresh round of funding from existing investor Info Edge, a public listed online classifieds firm, among others. This round brings the total funding in the six-year-old company to over US$163 million.

In April 2015, barely five months after raising US$60 million, restaurant finder app Zomato has swallowed another US$50 million in a fresh round of funding from existing investor Info Edge, a public listed online classifieds firm, among others. This round brings the total funding in the six-year-old company to over US$163 million.

Zomato has a presence in 22 countries, in many of which it is already the leading player. It claims to have a user base of about 40 million. Much of Zomato’s prior funding has been spent on overseas and national expansion. Last year, it went on an aggressive acquisitions spree, during which it acquired Urbanspoon, Yelp’s biggest competitor in the US. Besides regional expansion, the firm has also been making vertical expansions. It is working on transforming into an online food ordering site.

Other funded players in India that provide these services include Rocket Internet-backed FoodPanda, and multiple VC-backed TinyOwl.

In that time Zomato has acquired MaplePOS, a cloud-based point of sale product for restaurants at an undisclosed sum. It has already renamed the MaplePOS product to Zomato Base. Founded in 2011 by Delhi-based MapleGraph, MaplePOS offers restaurants features such as menu and inventory management, and has a built-in payment solution to accept debit and credit card payments. This is the first product acquisition for Zomato after it acquired seven companies in various parts of the world. On the acquisition, Deepinder Goyal, Founder and CEO, Zomato said:

“Zomato is the only food-tech company in the world which is building products for consumers as well as restaurant owners. There is a lot that can be done if we are able to build a technology platform that connects consumers to restaurants and vice versa, and we believe that a world-class cloud-based POS system is the first step towards building that platform.”

The detailed list of features in Zomato Base include menu management, inventory management, recipe management, customer relationship management, data analytics, electronic receipts, offline transaction support, payment gateway integration and a stealth feature which Zomato claims will change the way restaurants go about their business. In February 2015, Zomato launched its cashless product in Dubai.

P.S. STARBUCKS MOBILE EXPERIENCE IN US

Using the existing iOS or Android Starbucks apps, commuters can preorder from the full menu of drinks and pastries on their way to work, get directions and a time estimate as to when they’ll be done, walk into the store, grab them, and go. For Starbucks, it’s a way to reduce “line anxiety,” which the company believes is eating into sales. Dan Beranek, the company’s director of digital strategy who is leading mobile rollout, tells that when you couple a line with a commuter walking a block or two out of their way to grab a drink, it can add up to a daunting 15 to 20 minutes for a customer.

Coupled with the fact that Starbucks can actually make more money per transaction by channeling customers to order via an app, increase order accuracy by making customers validate every part of their order, and even one day, load-balance stores by shunting customers to emptier locations, the update becomes a no-brainer. (These same reasons are why companies like McDonald’s and Chipotle are both working on mobile-based ordering strategies, too.)

“Table stakes for us when we built this out was that we wanted every customer to be able to customize every drink just how they would with a barista,” Beranek tells me as we huddle over his iPhone, outside of the store. “We wanted mobile ordering to be an extension of the ordering experience. To do that, we had to offer every possible option.”

Any drink you select features a deep customization screen with every possible option inside, in a long list of toggles and subcategories that looks straight out of iOS Settings. That’s right, every possible option. Because Starbucks is so customization-focused, every drink has to be orderable in every conceivable way. This means there are over 80,000 potential combinations for each menu item. “One of the things that we’ve found is, because customers have to set their order just the way they want it, there’s been an increase in order accuracy,” Beranek says.

“When you communicate verbally with a barista, sometimes things are lost in translation.”

In June 2015 Starbucks announced the expansion of its “Mobile Order & Pay” system to 21 more states, including 3,400 individual café locations across the U.S.

Mobile Order & Pay first began as a pilot program in Portland in December 2014, and has expanded across Starbucks’ locations in a relatively short time frame thanks to the way it leverages the technology infrastructure Starbucks already has in place. The company said in March the feature was rolling out across the Pacific Northwest, including Seattle, as well as elsewhere in Washington, Idaho, Oregon and Alaska. At the time, Mobile Order & Pay was available in 650 stores. In total, there are over 4,000 locations that support mobile ordering – or more than half of Starbucks’ company-owned stores.

The company says the tests so far have gone well, despite some initial concerns about the technology from store managers and baristas. Today, mobile ordering is seeing consumer adoption for everything from quick coffee breaks for office workers to busy moms with kids in tow to commuters hopping off the bus and wanting to grab their drink quickly.

In April 2015 CEO Howard Schultz said, that “the latest quarter was a “stunning” one for Starbucks”. But perhaps more important were the numbers Starbucks gave on its signature My Starbucks Rewards program.

Last quarter, a record 1.3 million new members enrolled in the loyalty program to bring total active sign-ups to 10.3 million. “We are now seeing large numbers of last holiday’s first-time gift receivers become loyal, engaged, repeat Starbucks customers, supporting and contributing to the growth we are seeing across our global base,” Schultz said on the company’s earnings call.

More than $1.1 billion were also loaded on Starbucks cards during the same period, for 19 percent year-over-year growth. “We know that increased Starbucks cards sales drive increased My Starbucks Rewards membership, and in turn increased traffic and sales in our stores,” Schultz said.

Much has been made of Starbucks not just being a food company but also a tech company. Kevin Johnson, Starbucks’ recently appointed president and chief operating officer, hails from the tech industry. Starbucks is now processing more than 8 million mobile payments per week. “If there were one word to describe Starbucks’ record performance in the quarter, I think it would be innovation,” Johnson told investors. Sure, that’s corporate cheerleading. But it’s an awfully tech-y thing to say, too.

Starbucks calls it an “espresso shot” of a store. It’s just 538 sqft in the heart of Wall Street, and it has no armchairs to sit or power plugs for your laptop. There’s also no line to order. Starbucks claims, anyway. Instead, the pilot store has been streamlined for the quick in-and-out of commuters on their way to work. Right when someone walks in, they’re greeted at the door by an employee holding a mobile ordering terminal at a small bar.

They place their order from a limited menu, then walk to the main counter to pay and pick up their drink. “It’s a really small space, designed to keep customers moving through,” a spokesperson explains, “so, in theory, there wouldn’t be a line.” (Of course, it’s easy to imagine a line stretching outside the door, or the small space becoming Lord of the Flies In Suits during rush hour.)

The design is a radical departure for Starbucks. The Starbucks vice president of store design, Bill Sleeth, mentioned that the Starbucks engine—that line where you pass a menu, refrigerator, and pastry case—is key to the Starbucks experience. It’s, in essence, a proven business model, stamped into their store design across thousands of locations in the U.S. In the meantime, you can find the new store at 14 Wall Street. Starbucks plans to open four more of these espresso shot stores this year in New York.

Photo credits: Shutterstock, GettyImages, Photocase, Company profiles

Life.SREDA VC is a global fintech-focused Venture Capital fund with HQ in Singapore