Mobile Payments on the rise

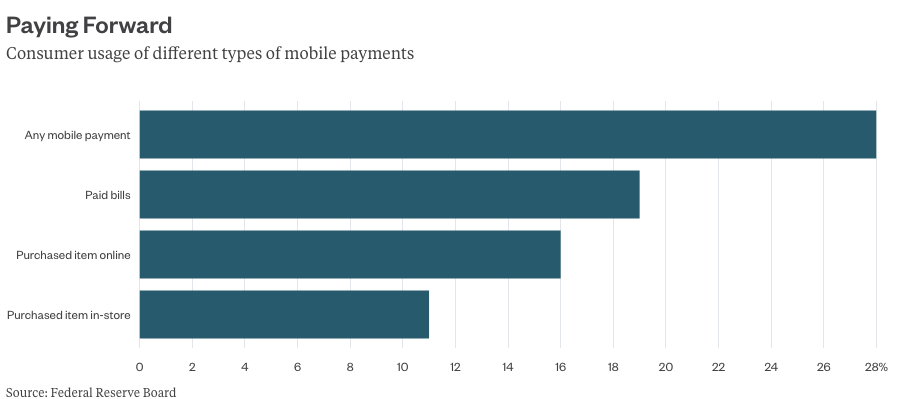

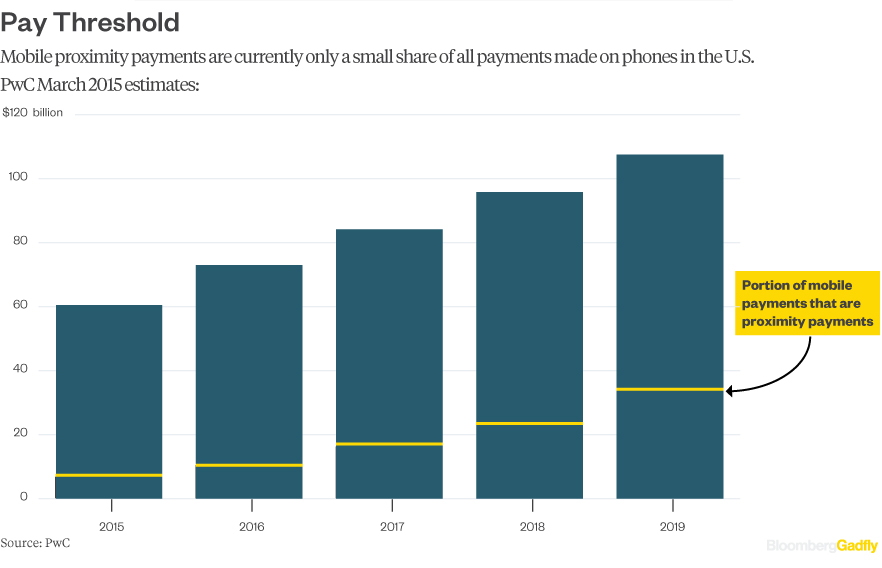

Since then they’ve had to dial back expectations. [su_pullquote] There are several factors that will determine if the rapid growth in peer-to-peer lending will continue. [/su_pullquote] In 2015, the transaction value of in-store mobile payments in the U.S. was $6.8 billion, according to consulting firm PwC. That translates into roughly 10 percent of smartphone owners having made in-store mobile payments, according to data from Forrester and the Federal Reserve Board.

To wit: Apple Pay is the leading in-store phone payment provider (in terms of availability). It announced last month that it had 2 million U.S. locations. Google says that its Android Pay service has 1-1.5 million locations. (Note that “locations” include such locales as doctors’ offices, vending machines and parking pay stations in addition to regular retail outlets.)

Although the National Retail Federation says there are nearly 4 million domestic retail establishments, that figure represents a basket of traditional retail outlets — many of which aren’t included in Apple and Google’s numbers noted above. So this makes it difficult, if not impossible, to estimate what percentage of the retail payments market Apple and Google have captured on a location-by-location basis.

While the size of the mobile payments market hasn’t reached the heady levels predicted a few years ago, PwC still expects the value of transactions to grow from its current total to about $34 billion in 2019 (though as we’ve seen in the past, these estimates have a way if unwinding).

There’s another reason to believe in-store mobile payments may become more commonplace, and it has nothing to do with phones.

Credit cards — at least the new chip cards known as “EMVs” — are also fueling the market’s growth. New sales terminals that read chip cards also include “near field communication” technology, which allows consumers to wave their phones near a terminal to make purchases. So growth in EMV terminals could boost in-store phone payments as well.

Businesses have a huge incentive to switch over to the new chip cards. When scammers use old credit cards for fraudulent transactions, it is now retailers and not credit card companies that have to absorb the loss — providing yet another incentive for retailers to go mobile.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story:

Rani Molla in New York at rmolla2@bloomberg.net

To contact the editor responsible for this story:

Timothy L. O’Brien at tobrien46@bloomberg.ne