Moneytree broke business barriers in Japan by speaking the language of fintech

By J.T. Quigley for TechinAsia.com

Starting a new business is hard. Starting a new business in a different country can be even harder. Starting a new business in a different country that requires the vast majority of domestic financial institutions to support it is damn near impossible.

For some expat entrepreneurs in Japan, language and culture barriers are the least of their worries. Convincing local venture capitalists to back their idea, in a country known for its corporate conservatism and a general propensity toward risk aversion, is far more likely to keep a startup founder awake at night. Especially when, as is the case with many growth-stage startups, external funding pays the bills.

For Moneytree, founded in Tokyo in 2012, just being recognized as a Japanese startup when its co-founders aren’t Japanese has been an uphill battle – even after landmark fundraising from the country’s top-three megabanks: Mitsubishi UFJ, Mizuho, and Sumitomo Mitsui. No startup, Japanese or otherwise, had ever brought the trio of direct rivals together for the same financing round. At least not that the banks are willing to talk about.

“It’s very hard to convince Japanese institutional investors to invest in a startup run by foreigners,” Paul Chapman, Moneytree co-founder and CEO, tells Tech in Asia. “Even post-raise, people still ask us where our headquarters is, ‘Where is Moneytree originally from?’”

Breaking the language barrier

Chapman, an Australian, has resided in Japan off and on for more than a decade. While an undergraduate at Monash University in Melbourne – where he studied Japanese, business, and finance – Chapman co-founded and served as CTO of e-recruitment startup cvMail. It focused on a similarly conservative client base as his current venture: legal professionals in Australia and the UK. Chapman saw it through to acquisition by Thomson Reuters in 2007. He later became an IT director and sales manager at EnWorld, a recruitment company based in Tokyo.

Along with American co-founders Mark Makdad and Ross Sharrott, the trio established a boutique iOS and Android app development studio called Long Weekend in 2009. Makdad and Sharrott are also long-term Japan residents, and all three are fluent Japanese speakers.

“It took about four years to be able to read a newspaper; including one and half years living in Japan as a full-time student,” Chapman says. “Conducting business meetings and investor presentations requires specialized language, and an understanding of Japanese business rituals. Let’s put it this way – we’re still learning.”

In 2012, Moneytree was born. Chapman took the role of CEO, Sharrott became CTO, and Makdad dove into product and business development. SoftBank had been the only iPhone carrier until AU began selling the 4S early that year, and investors were skeptical about iPhone development in a market that was stuck on feature-rich flip phones – affectionately referred to as “gara-kei” (Galapagos phones) for evolving independently from the rest of the world.

The few iOS developers in Japan were largely focused on gaming, and the group saw a chance to enter the domestic financial technology (fintech) vertical while the country’s online banking services were desktop-focused and fragmented.

Banking on trust

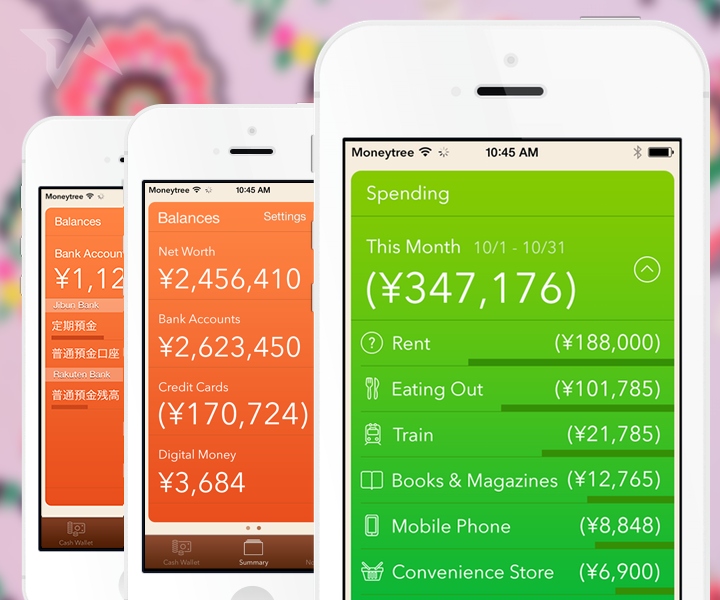

Put simply, Moneytree helps users to get a snapshot of their personal finances. They can input multiple bank accounts, credit cards, and even Japan’s ubiquitous loyalty cards into the app to visualize spending habits, account balances, and receive alerts when payments are due or points are set to expire.

A premium feature for businesspeople allows users to flag purchases in the app as work expenses, then export the data in a variety of formats to be sent to their employer. There’s also an enterprise version for aggregating corporate accounts, which the startup touts as a first for Japan.

Of course, to access this data, financial institutions have to agree to work with Moneytree in the first place and give the startup access to highly sensitive customer data.

“When we started making the app, people told us we couldn’t do it without the support of the banks,” Chapman says. “One well-known VC even said not a single Japanese person would register their accounts with us. By the time we won [Apple’s] App of the Year award in 2013, the banks had started to take notice – but were still not ready to be seen working with Moneytree.”

Six months after being recognized by Apple, Chapman says that several banks had started to whitelist Moneytree’s IP address.

“By the time we were seeking funding, we knew the banks were a natural fit because they needed fintech and we needed money,” he adds.

Moneytree began as an iOS exclusive, but a web version went live last month. All that’s left is adding Android support, though the startup is tight-lipped about its plans for that platform.

Be local, think global

Moneytree isn’t without rivals – at home in Japan or abroad.

In the US, Mint provides many of the same services that Moneytree provides – and it’s been around since 2006. Mint’s meteoric rise in the personal financial space culminated with aUS$170 million acquisition by Intuit – the maker of Quicken and TurboTax. Mint is only available for users in the US and Canada.

MoneyForward, Moneytree’s most direct competitor in Japan, was also founded in 2012. It announced a US$13.3 million series C round on the same day that Moneytree announced its investment from the trio of Japanese megabanks and US-based enterprise software giant Salesforce.

The amount of Moneytree’s series A round remains undisclosed, but sources close to the deal say the amount is in the millions of US dollars. The startup previously raised US$1.6 million in seed funding from DG Incubation and angel investors, including former directors from MasterCard, Morgan Stanley, and PayPal.

The Moneytree app has more than 850,000 total downloads to date, and Chapman says it has a retention rate of 70 percent among active users. As of last November, MoneyForward boasts 3 million users for its personal finance product and more than 400,000 enterprise users. It also has a number of financial industry investors, including Mitsubishi UFJ and Credit Saison, one of Japan’s biggest credit card issuers.

While both Moneytree and MoneyForward focus solely on the domestic market, the former is offered in English, giving expats access to their financial data without the need to memorize difficult kanji characters. This, coupled with Moneytree’s global mindset (half of the current 18 team members are non-Japanese), could give it an edge when it comes to penetrating foreign markets.

Moneytree CEO Paul Chapman.

Apart from the banks and Salesforce, the startup has two additional heavyweights in its corner when the time comes to scale. Moneytree became the first fintech partner for IBM’sAPI Economy initiative in Japan last October. A month later, it was also accepted into the MasterCard Labs’ Start Path accelerator, one of just four fintech startups selected from an international pool of hundreds of applicants.

So, does the startup that’s worked so hard to be recognized as Japanese have plans to expand globally?

“There’s still massive opportunity in Japan, and we’re always looking for ways to reach new segments,” Chapman says. “But that being said, from day one, Moneytree was designed with universal values and appeal in mind. The app offers a unique feature set that we believe can be very competitive in a number of markets.”

The service is set for release in an unspecified “Southern Hemisphere” country by the end of the year, which is rumored to be Australia. If that’s true, scaling Moneytree in Chapman’s own backyard should at the very least prove less challenging than Japan.