Zenefits Just Raised $500 Million At A $4.5 Billion Valuation

TECHCRUNCH: Zenefits today said it has raised $500 million in a round led by Fidelity and TPG at a whopping $4.5 billion valuation. The company, which allows small- and medium-sized businesses to manage human resources services in a much simpler fashion, is one of the fastest-growing SaaS businesses ever, and in an interview, Zenefits CEO Parker Conrad said the big round was raised to keep the company growing as quickly as it already is.

“If you think about it like we’re driving a car, we want to go extremely fast at an extremely high speed, and go very far,” Conrad said. “And if you want to do that you’re gonna burn a lot of gasoline. So this round we had to do the mother of all pit stops for gas and beef jerky, to continue building at the speed that we’re going.”

Still, such rapid growth doesn’t come without a cost. Our sources previously told us that the company expects to lose more than $100 million in 2015, which dwarfs the amount of money it burned through in 2014. Raising venture capital financing is an important way to shore up against those losses and still sustain the incredibly rapid growth a company like Zenefits has experienced.

The numbers fit in with what we earlier reported, but the notable thing here is that over the course of Zenefits’ most-recent financing process, the valuation has grown by billions. Earlier, we had heard the valuation could be around $3 billion, and that it could go as high as $4 billion. That number apparently went up once again — a sign that interested investors are bidding it up in order to get into one of the most sought-after startups.

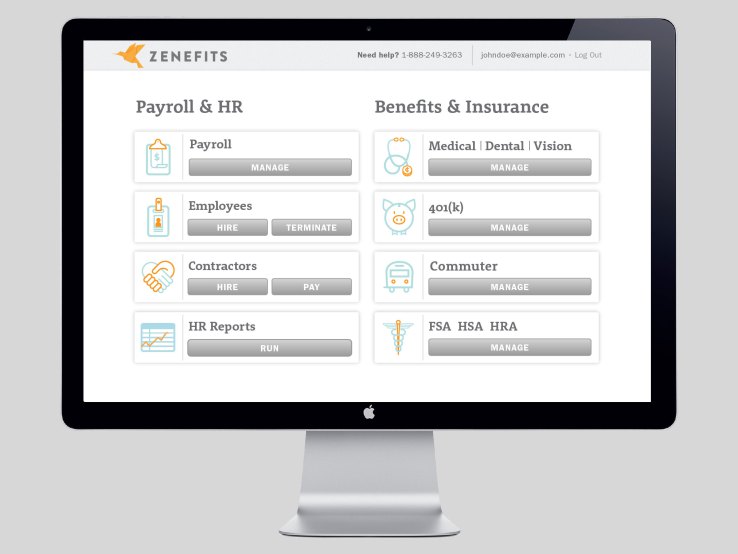

Like many other modern enterprise services, Zenefits aims to have a much easier onboarding process for payroll and benefits for employees.

The company offers its HR services dashboard to employers for free, and makes money by receiving commissions from insurers. Zenefits also said as part of the announcement it has signed up more than 10,000 companies in the U.S. and that it closed more business in March this year than it had in around the first year of its life. Zenefits said it now manages over $700 million in health insurance premiums, as well.

The company said it’s on track to hit annual recurring revenue of $100 million by January 2016, and hit $20 million in annual recurring revenue in January this year. Since launching in April 2013, the company has gone to a valuation of $4.5 billion in just about two years. In June last year, the company was valued at $500 million as part of its series B financing round.

“The faster you grow, the more capital you burn, because of this dynamic that revenues span over time and the costs are front-loaded,” Conrad said. “If we want to grow that quickly it requires a lot of capital to do the plan that we want to go out and do. Obviously we can grow less quickly and do it on a lot less capital, but we’re in this fortunate position where there are a lot of investors that see our SaaS metrics and say, holy crap this is going to be extremely profitable, all the numbers make a lot of sense.”

A lot of that is going to come in the form of headcount, our sources tell us. Last year, the company said it wanted to hire around 1,300 employees over the next three years, and it had around 500 by the end of 2014.

Previously we heard that number would quadruple by the end of 2015. Zenefits is well on its way to that, saying that it has around 1,000 employees in the announcement today. The company has also made a number of high-profile hires, including Yammer CEO David Sacks, who joined in December last year.

Ashton Kutcher’s Sound Ventures, Insight Venture Partners, Founders Fund and Khosla Ventures also invested in Zenefits, and previous investors Andreessen Horowitz, IVP and Jared Leto participated, as well.

This latest Zenefits round is notable too for making the company Andreessen Horowitz’s largest investment to date.

“In my experience, the momentum that Zenefits has achieved in two years is unprecedented. Zenefits has brought the benefits of software to a massive industry that had yet to embrace technology at scale,” said Lars Dalgaard, General Partner at Andreessen Horowitz, in a statement. “And their potential market includes tens of millions of employees, using multitudes of different business applications in companies of all sizes. We’re thrilled to have led the A and B rounds and to have doubled down again in the C round.”

Read more about Zenefits: Tech’s Next Big Legal Clash Will Be Over Selling Insurance by Wired

Also read: Will Automated Driving Kill The Auto Insurance Industry? by Fast Company