Jeremy Allaire’s Bitcoin Startup Circle Takes $50M From Goldman Sachs, IDG

TECHCRUNCH: Circle, the Bitcoin startup that veteran entrepreneur Jeremy Allaire started, just raised $50 million from Goldman Sachs and IDG Capital Partners. It’s another sign that the finance industry’s most powerful players are starting to take the crypto-currency and its ecosystem seriously. All of Circle’s existing investors including Breyer Capital, General Catalyst Partners, Accel Partners, Oak Investment Partners, Fenway Summer, Digital Currency Group and Pantera Capital participated. Rival Coinbase recently did a large growth round too that involved the New York Stock Exchange and USAA.

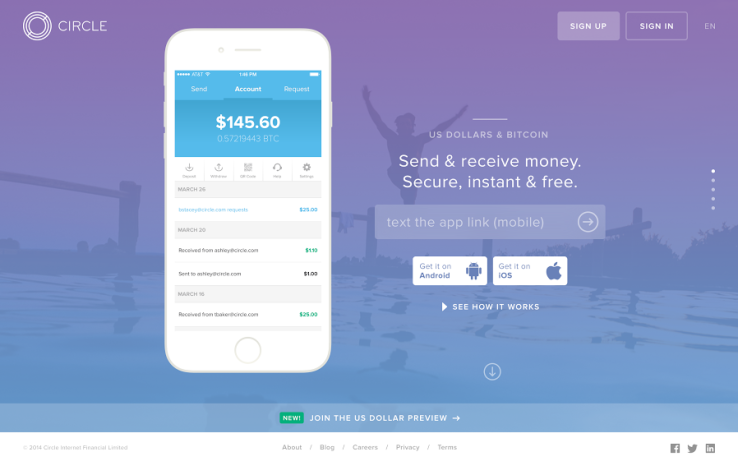

With the round, Circle is letting customers send and receive U.S. dollars as well as Bitcoin. The key point about this feature is that it takes advantage of Bitcoin’s promise in settling transactions and reaching consensus much more cheaply than traditional online financial transactions.

In its purest form, Bitcoin’s public ledger, the blockchain, allows multiple parties to transact with each other without a third-party mediator.

But of course, lots of third-party and more centralized institutions have emerged over time to serve as wallets, exchanges and merchant processors. They merely take advantage of the currency’s less expensive settlement costs. Circle is betting that dollar-based transactions will also be attractive to customers who don’t want to deal with Bitcoin’s price swings against fiat currencies.

“They can do this without knowing anything about Bitcoin and without exposing themselves to price volatility,” said Allaire, who previously took video company Brightcove public. “We really think of Bitcoin as a global interoperable payment network instead of a store of value.”

The other interesting part of the round is that Circle took funding from IDG Capital Partners, which is a well-established East Asian firm.

They could be a key partner in breaking into the Chinese market, which has an entirely different set of regulations around Bitcoin. Two years ago, after Chinese Bitcoin enthusiasts started piling into the market and driving up the price of the currency, the government intervened and ruled that banks couldn’t directly handle transactions. Transactions between private individuals are allowed, however.

“This could take a long time, but there is a savings glut in China where consumers have built up a lot of wealth. And now, the economy needs to shift toward a more consumer-driven model. Part of that involves Chinese consumers interacting with the rest of the world over the Internet,” Allaire said. “So I think there’s a need for services that will make it easier for Chinese consumers to spend globally. The Bitcoin network could be an attractive solution.”

Read more about Circle: Wired