FacePay?

TECHCRUNCH: What if buying something was as easy as Liking it? You’d probably buy a lot more, and buy it through whoever made it so damn simple. Becoming that conduit for payments means more than racking up transaction fees. For the portal to purchase influences not just how you buy, but what. Today, purchases are fragmented, and so too is that influence. We buy online and offline. Cash, Credit, PayPal, and now Apple Pay. In turn, influence splinters into ads run on television, print, digital, billboards, and other channels. Whether we want something already or not, the ads are supposed make us more intent on actually spending our money.

But there’s a disconnect. A gap between the intent and the purchase. A hole in the funnel where conversions leak out. There’s friction.

And Facebook hates friction almost as much as it loves connection. Eliminating unnecessary steps is almost gospel at Facebook, preached from the product all the way up to the person in charge. Mark Zuckerberg wears a grey t-shirt almost every day to remove the friction of deciding how to dress so he focus elsewhere. Facebook split Messenger off into its own app to save you one extra click on the Messages tab.

Now Facebook has set its sights on making money simple too.

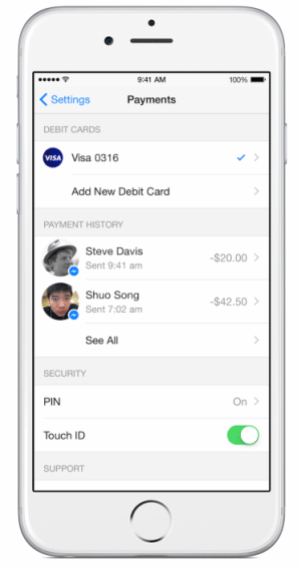

Last month, Facebook introduced payments to Messenger. In any messaging thread, you’ll be able to tap a “$” button, enter how many dollars you want to send, and instantly transfer that money to a friend.

That’s useful, but it’s probably just the start.

With the new Messenger feature, Facebook added an easy way to connect a debit card to your account. Before, it let you connect a credit card, debit card, or PayPal account to buy ads or virtual goods in games. But now Facebook has a mobile-first, zero-fee payments system, complete with passcode protection and a transactions history, all baked into Messenger.

What Facebook does with payments over the next few years could redefine its business.

Retailers Crave Connection Too

Recently, Facebook has strengthened its relationship with merchants. Rather than keep them at arm’s reach as external entities, its starting to treat retailers a bit more like people.

Facebook began work a few years ago on a feature called “Auto-Fill”. When you went to make purchases in some partnered ecommerce apps and mobile sites, an “Auto-Fill With Facebook” button would appear. Tapping it would fast-switch you into Facebook, then instantly switch back to the store having pulled payment information you had on file with Facebook already. All the billing and shipping info would be automatically populated so you could quickly confirm the purchase without doing a ton of typing.

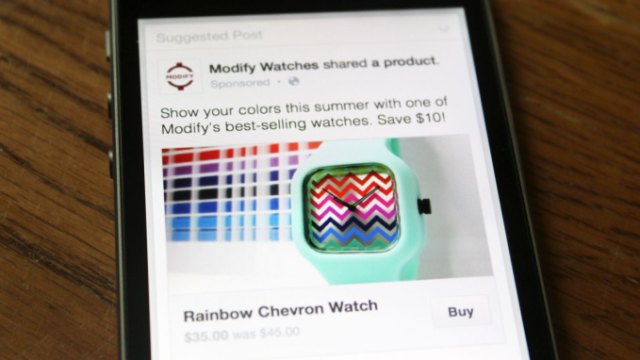

It’s also been experimenting with a “Buy” button for its commerce ads. The idea is that you could checkout in-line from the News Feed rather than having to leave Facebook to complete your purchase on a third-party site. This cuts out a big step from the conversion funnel, giving buyers fewer chances to change their mind and dump their shopping cart.

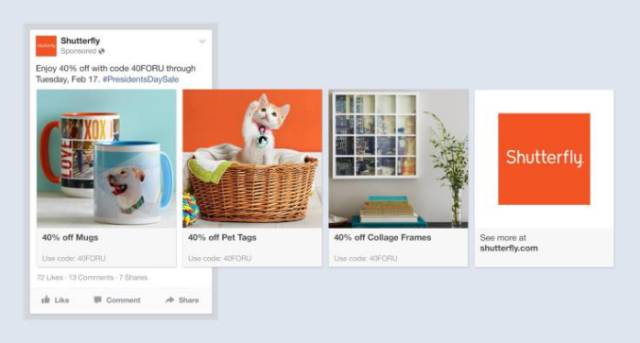

In February, Facebook launched a new ad unit for ecomerce. These product ads let businesses show off several specific items for sale, instead of just one or the retailer as a whole. This mirrors Facebook push to let people share richer content over the years, from multi-shot photo stories, to Instagram Layout collages, to auto-play video.

Facebook also acquired personalized shopping search engine TheFind last month. This levels up Facebook’s ability to tune what products are most relevant to which users. Those product ads could get better targeting. Facebook could help a sporting goods retailer show a yoga mat and sneakers to someone interested in hippie stuff, but then the same sneakers paired with bicycle shorts to an avid cycler that lives in a more rural area.

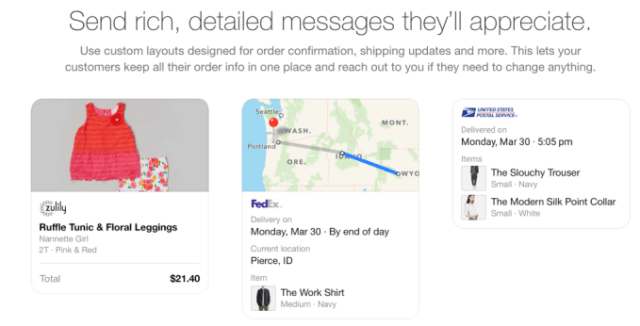

Just a few weeks ago, Facebook revealed its most ambitious plan yet to make retailers feel like your friends. It plans to let you message with them. The new Messenger For Business platform previewed at Facebook’s F8 conference will let users making ecommerce purchases to connect with the merchant over Messenger. There, they could get receipts, request changes to an order, or receive customer support in a single message thread rather than a slew of separate emails.

Each of these moves could make Facebook a better portal to commerce, which could attract ad dollars and teach it more about what people want to see so it can tune its News Feed.

Frictionless Commerce

But what’s especially worth pondering is what happens if Facebook becomes the way you actually pay for these purchases. Suddenly, having a mobile-first way to swallow up credit card numbers in Messenger has potential far beyond friend-to-friend payments.

But what’s especially worth pondering is what happens if Facebook becomes the way you actually pay for these purchases. Suddenly, having a mobile-first way to swallow up credit card numbers in Messenger has potential far beyond friend-to-friend payments.

For purchases on third-party sites and apps, Facebook could let you auth in and process the transaction for you. No more typing your payment details again and again. Handling receipts, changes, and support through Messenger would be a natural extension.

Even more important could be how becoming a payments system could turn commerce ads on Facebook into full-fledged storefronts where you can buy and checkout without ever leaving the social network.

It could take time to come to fruition, but if the company seizes on the opportunity, buying something on Facebook could go from:

- See a Facebook ad for a store or single product

- Click through and wait for the storefront to load

- Select what you want to buy

- Manually type in your payment and shipping information

- Complete the checkout process

- Get an email receipt

- Email or phone to make any changes

- Get an email shipping confirmation

To:

- See a relevant, specific product in a Facebook ad targeted to you

- Tap the “Buy” button

- Confirm the purchase as your payment info has been auto-filled

- Get a single Messenger thread with your receipt and confirmations where you can chat to make changes

After traditional ecommerce product retailers, Facebook could turn its new purchase flow on utility services. China’s WeChat lets you book taxis and buy movie tickets from within its messaging app. As I wrote when I reported a week before F8 that Facebook would launch a Messenger platform, first up is content apps for richer sharing and customer-to-business chat. But sources tell me that if Facebook likes how these phases of the platform go, it’s looking into building in simple ways book services like on-demand taxis.

With less friction comes more buying. We’ll have to wait if Facebook monetizes its identity layer in commerce just by selling ads, or potentially by collecting data insights on purchasing trends, or even scoring a share of sales revenue.

But as long as Facebook can dangle more sales in front of retailers, they’ll make it richer somehow.