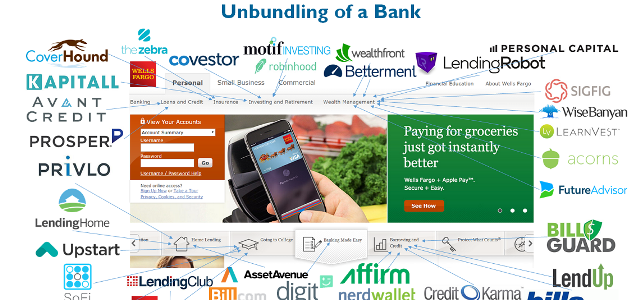

Disrupting Banking: The FinTech Startups That Are Unbundling Wells Fargo, Citi and Bank of America

CB Insights: Traditional banks are under attack from a number of emerging specialist startups. Here are the FinTech startups unbundling banking.

In November, Tom Loverro of RRE Ventures wrote that “banks are under attack” and showed a few of the major players leading this trend. Inspired by his post and Alexander Pease’s, we wanted to dig in and see how banks are being unbundled by startups. The graphic above details companies attacking bank services ranging from robo-advisers wealth management services like Wealthfront and Betterment to small business loan companies like OnDeck Capital and Kabbage to small business service providers like Zenefits and ZenPayroll, and many other areas.

As we detailed in our analysis of the startups disrupting FedEx, these emerging companies attacking Wells Fargo, Bank of America, Citi and banking more generally are not attacking them head on across multiple products. Instead, they’re attacking individual services & products (hence the term “unbundling”). Said another way, are banks going to be out-innovated and lose their edge not because of their incumbent, large competitors, but because emerging startups inflict upon them a death by a thousand cuts?

While many international players are also unbundling banks, this infographic focuses on US-based companies.