Top 10 “Stay Away” ICO Directions in 2018

Fraud among Cryptocurrencies

Undoubtedly, there are cryptocurrencies capable of succeeding and achieving goals. At the same time, there are many more ordinary frauds in the field of cryptocurrency, and they are doomed to failure. Every investor should know this, since the production of cryptocurrencies does not have a controllable unit — no one regulates emissions. This means that this financial instrument does not have a regulator that controls the amount of the issued currency. Besides, the cryptocurrency isn’t bound to any material values, such as gold, for instance.

In principle, all fraudulent transaction types that are conducted with conventional electronic money are applicable to cryptocurrencies. In addition, the huge and fast-growing rate of Bitcoin, Ethereum, and other successful projects encourages users to invest without paying attention to details. Many people associate the cryptocurrency industry exclusively with super-profits, regardless of what the currency is, who has created it, and with what purpose.

It’s very difficult, and sometimes even impossible, to distinguish a fraudulent ICO from an ordinary, honest project. Therefore, before investing, you must absolutely monitor the project and follow simple rules of financial security.

First, carefully study the white paper (the most essential document of any ICO) and the product presentation suggested by the authors. For instance, if the authors of a banana-cultivation ICO project suggest that any investor can visit their plantations in Laos, make sure they are serious with their intentions. Not many people have the opportunity to go to this country in order to see banana groves in some remote province. Similarly, you will not go to an oyster farm on the island of Tahiti, or any gas field in Antarctica.

Therefore, if the geography of the project is far from your location, it is hardly worth investing in.

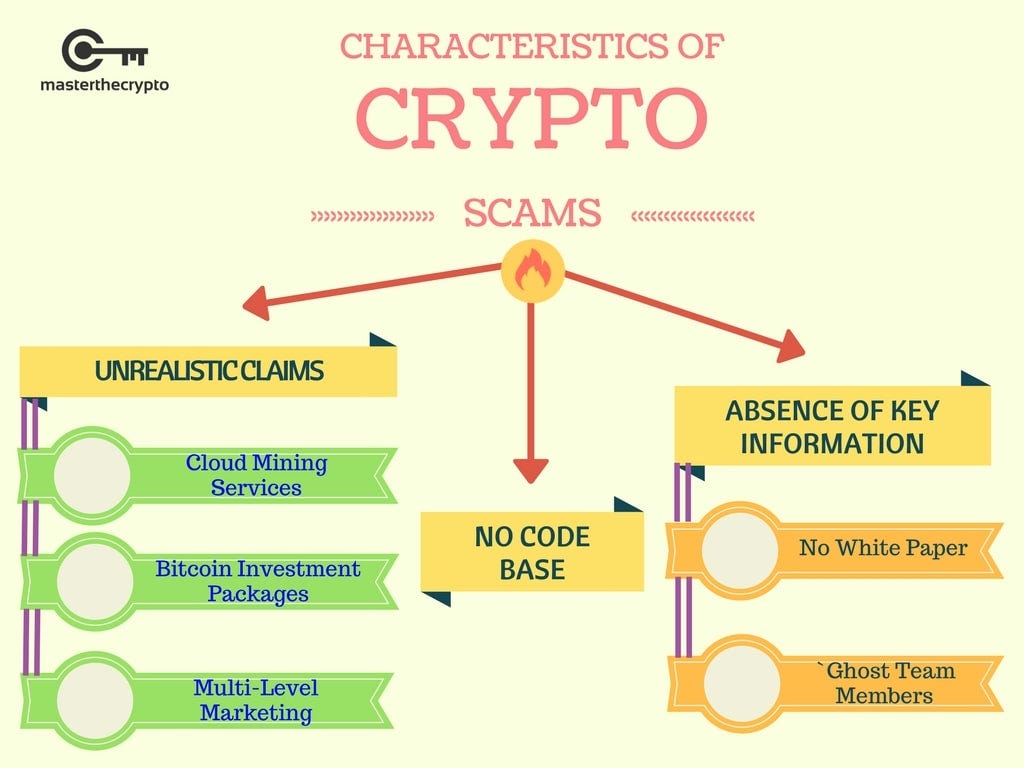

10 Probable ICO Fraud Indicators

In the cryptocurrency business, the chance of losing money is much higher than the chance of earning it. Thus, it is vital to carefully study all available information to make a constructive decision about the possibility of investment.

We carried out a small bit of research to reveal evidence of possible ICO fraud.

The Promise of Huge and Instant Income

One of the main indicators of the fact that the project has been falsified, and which should act as a red flag to warn the reader, is the promise of big profits or huge discounts. It is clear that nobody can actually predict the future price of a cryptocurrency: whether it will decrease or increase over time, or, at least, remain stable.

So, why are there so many ICOs claiming they can bring huge income immediately? The answer is obvious: to lure you in, take your money, and disappear.

Poorly-Constructed White paper

A white paper is a document describing the main purpose of an ICO and justifying the necessity for blockchain and a new cryptocurrency. A good white paper convincingly explains its goal, why it is necessary to create a new token, how it will encourage users to use the newly-created network/application/product/service, and how it will be implemented. If a white paper doesn’t explain clearly enough the need to create a coin, or does not provide detailed information on its use, that’s a clear sign to revise your idea of the project’s reliability.

No Team Visibility

For investors, it is essential to see the people working in the company, and to have the ability to check their skills, background, and achievements. Who are these people by profession, and do they have the appropriate knowledge? Look for their profiles on LinkedIn, Twitter, Facebook, and Medium to find information about their past and how long these people have been working in the cryptocurrency arena. Vast experience in the crypto space means that the team has the appropriate knowledge and is able to offer something new. If there is no data on the team available online, this is usually a bad sign.

No Community Channels

Reliable ICOs always have a site that presents the key concepts of their idea (white-paper explanation, roadmap, the need for the token, token economics, etc.), as well as communication channels for people who follow the project (email addresses, chat rooms, accounts on Twitter or Medium). Is the team trying to update their data and keep their followers up to date on news and project developments? If the organizers allocate part of the funds for further development on the basis of the established network, the site should have appropriate resources and educational tasks for developers. If these really do appear, you need to figure out how good they are. To do this, you can contact the developers, who should be able to estimate the ICO.

Project Results Unavailable

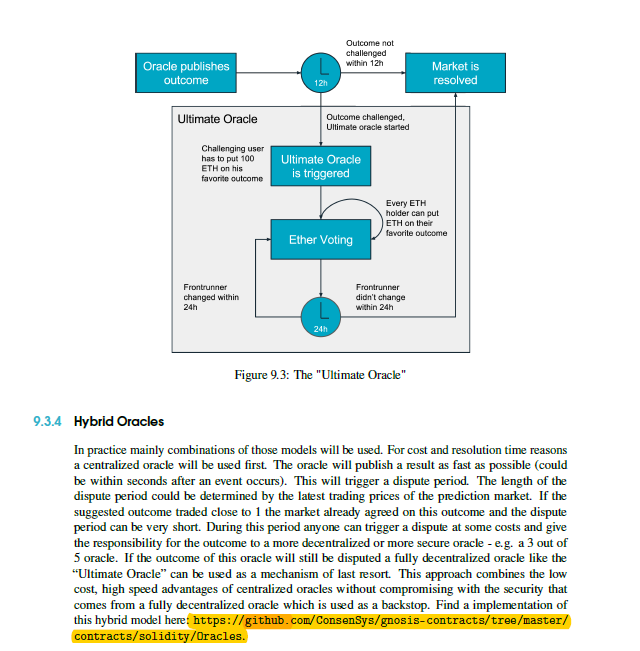

How can an investor know whether a project is actually developing and progressing, and whether it has a working prototype for the product or a POC/MVP? Many of the projects use GitHub to show the working code and collaborate with the community. This is a good way to track progress. Reliable ICOs have a roadmap with future plans as well as a record of achieved goals. This allows you to see how well the team is working on the implementation of its promises.

No Competition

Perhaps the proposed white paper provides persuasive arguments in favor of creating a new cryptocurrency and presents details of its implementation. However, at the same time, it does not say that alternatives already exist. The investor’s task is to assess the correctness of the statements presented (such as “new approach,” “unique method,” etc.) and compare them with existing coins. To do this, you can estimate what 20–30 of the biggest cryptocurrencies offer, and compare it to what the new coin is promising. Comparing new offers with preexisting, available, and well-proven ones is the best way to predict the future of the ICO you’re interested in. If the project team states that a cryptocurrency already exists for this purpose and promises that their token will provide a better solution, then this also needs to be rechecked.The project should clearly indicate why it is better at solving a particular problem, and provide persuasive arguments to prove this statement.

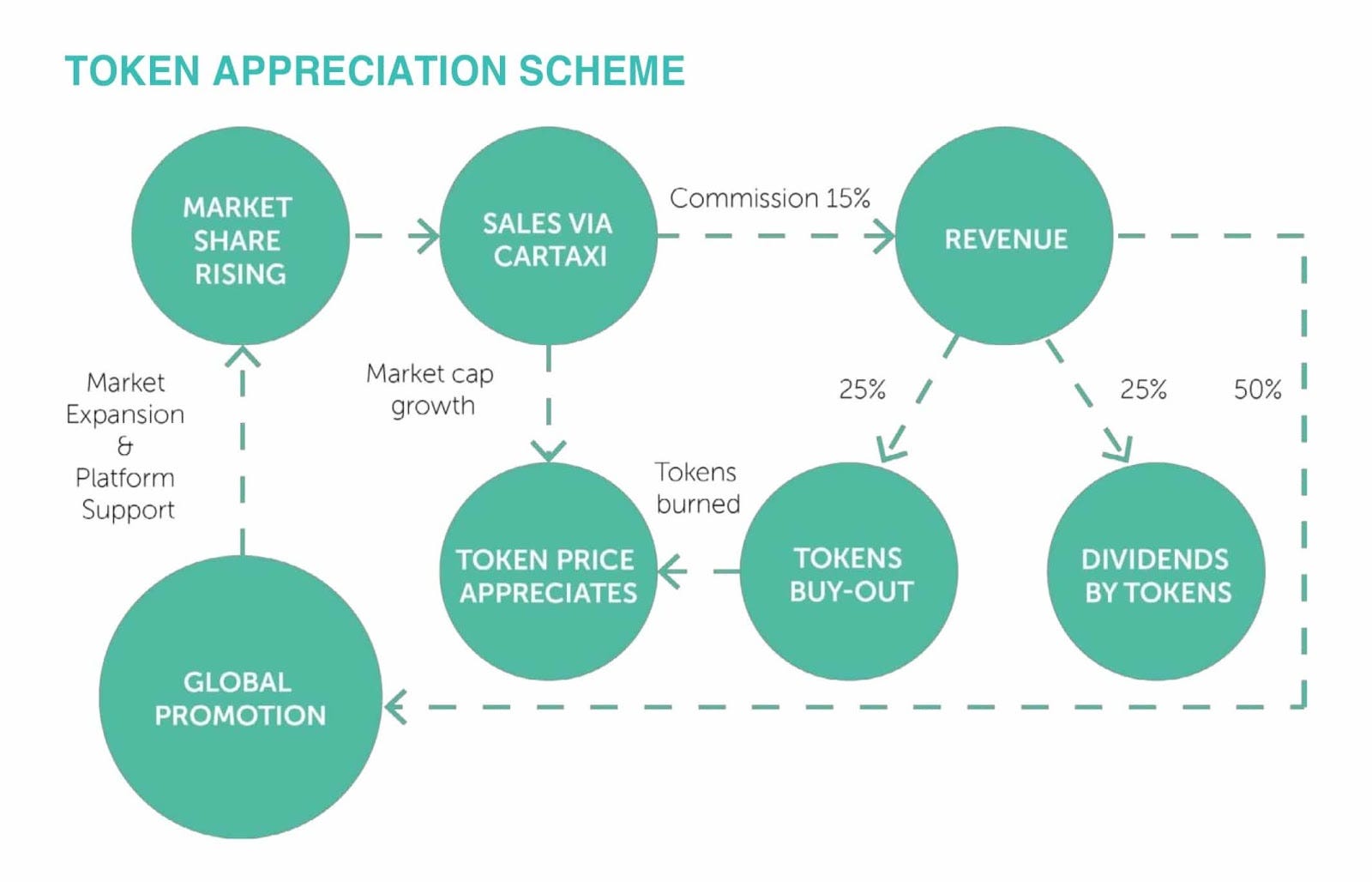

No Token-Allocation Scheme

How much money is needed to create the new product/application? How many tokens will be allocated for the team? In a perfect ICO, the project receives a small amount, but it grows together with the development of the company as particular stages of work are completed. If the team receives a large number of coins in advance, before real financing, this is a bad sign.

The timespan between coin issue and the progress of the project motivates the team to work further, rather than simply allowing them to cash in on a successful ICO. You need to know whether your ICO is “no-limit” or whether it has a limit on the amount of collected funds (hard cap). It is important to find out how many tokens will be issued, and whether the company has plans for further emissions. As a rule, projects with a so-called abstract program (“bring a friend and get paid for it”) also do not end well.

Huge Marketing Campaign/MLM

If a large portion of tokens is spent on marketing the project, this is usually a bad sign. Carefully study all documents, paying attention to those parts in which you find the acronym “MLM.”

MLM, or multi-level marketing, is a well-known scheme that is often considered fraudulent. MLM companies simply build a pyramid, placing the company on top of it. New participants are attracted by the prospects of easy earnings in the form of referral bonuses. All they need to do is deposit a small amount of money — in this case, cryptocurrency. These participants receive income, which is created by the initial deposits of others. An excellent example of such a fraudulent scheme is Onecoin. However, many other coins do the same, beautifully calling their structure “MLM.”

No Investor Rights or Guarantees Presented

If a white paper does not provide information on investor protection and reimbursement opportunities, then it is already suspicious. As a rule, creators of ICO projects only appeal with their name and the good names of celebrities. Also, the project’s website should contain as many contacts and and as much legal information as possible, which should be understood and described in the most detailed manner.

No Registry

An ICO is created to bring profit for both investors in and authors of the project, which is what makes this form of attracting capital so popular. Unfortunately, not everyone thinks about registering an ICO on time, taking advantage of the lack of strict regulation regarding this matter in most countries. The further success of the project depends upon the right choice of country. The most favorable countries for an ICO today are the U.S., Australia, and Great Britain.

A Final Word

If you have firmly decided to invest in a new cryptocurrency, hoping that in the near future, your investments will pay off a hundredfold, be very careful in choosing the project. Don’t let yourself be tricked by unskilled scammers who use cheating words and cheap developments for deception. Learn to recognize more sophisticated fraudulent schemes. If you are lucky, you’ll find yourself involved in a new cryptocurrency, which may change the future and humanity.