Cryptoassets: Flow & Reflexivity

By Jonathan Cheesman and Chris Burniske

twitter @cburniske, formerly led @ARKInvest’s cryptoasset efforts.

We may look back on this time as the “Crypto Tax Crisis of 2018,” as thanks to tax liabilities we’re witnessing the most concentrated period of net fiat outflows that the cryptoasset ecosystem has experienced in its short life.

These large flows have a first and second order effect. First, they can severely impact asset prices in illiquid markets, with large sells single handedly crashing prices in thin order books. Secondly, and more perniciously, a strong enough slump induced by concentrated selling in an illiquid crypto market can set off reflexivity beyond what we normally experience in the traditional capital markets.

Reflexivity is most commonly thought of as an internal feedback loop, where investor perception becomes a self-reinforcing reality. As a result, asset prices can be fed solely by the signals of other investors, or variables endogenous to the process of investing, as opposed to exogenous variables that are more representative of an asset’s fundamentals.

We hypothesize that crypto’s heightened reflexivity is driven by uncertainty and confusion around the early-stage technology, virality of communication mechanisms, lack of standardized valuation frameworks, regulatory paranoia, and majority retail participation. All of these characteristics are amplified by the liquid nature of this emerging asset class, which creates sub-second informational signals that violently feed back on themselves.

Below we explore potential tax outflows, outline an approach to quantify the reflexivity of cryptoassets, and discuss the potential for future research to track the evolution of this phenomenon.

Flow

While everyone in the US is aware the April 17th tax deadline is approaching, not everyone knows Japan’s deadline was March 15th. Given both nations are premier participants in the crypto markets, there is reason to believe tax selling has been largely behind the Q1 2018 slump in cryptoassets.

On Thursday, Tom Lee of Fundstrat estimated US households alone may owe $25bn in capital gains tax. Before walking through the assumptions behind such an estimate, we should note these are assumptions to dimension the situation — you are free to disagree.

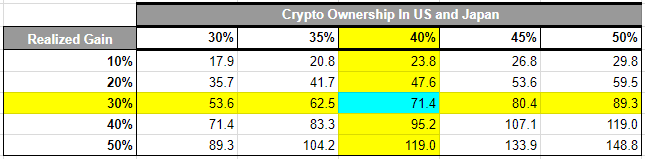

From January 1 to December 31, 2017, cryptoassets grew from $17.7bn to $612.9bn in aggregate network value, a potentially taxable gain of $595.2bn. We estimate the combined share of cryptoasset ownership for the US and Japan at 40%¹, and assume conservatively that 30% of this gain was realized in 2017.² This gets us to a taxable gain of $71.4bn, shown in the table below, along with scenarios for other assumptions:

If you assume the average taxation rate for the gain of $71.4bn is 35% (US short and long term capital gains are 50% and 20%, respectively, and range from 15–55% in Japan ), then we arrive at a tax liability of $25bn. A $25bn tax liability doesn’t mean all of it will necessarily be paid, or even that crypto will have to be sold to pay it.

Therefore, if one assumes 75% of this liability is dutifully paid, and 75% of it is paid by selling cryptoassets, then the fiat outflow amounts to $14bn, about equal to the aggregate value of cryptoassets at the start of 2017.

If you think we’re too conservative, then a situation where the US & Japan own 50% of all crypto, and realized 50% of gains in 2017, but tended to their taxes in the same manner (75% of liability met, and 75% of it met by selling crypto), then the fiat outflow more than doubles to nearly $30bn as shown below:

You may disagree with some of our assumptions, including our interpretation of tax law, the ownership share represented by the US and Japan, percent of gains realized, or fraction of tax liabilities met, but regardless of your assumptions it’s hard to find another period that represents a more concentrated and sizable outflow of fiat from the crypto markets.³

Amplification

Flows into or out of an asset do not necessarily result in a 1 to 1 move in the price of that asset, and particularly during periods of high trade volume in the same direction (i.e., consensus buying or selling), flows can be magnified into much larger moves in the price of the underlying.

Such magnification is related to a combination of the first and second order effects of selling that we discussed in the intro — liquidity and reflexivity — which we will combine into one metric we call the fiat amplifier.

The fiat amplifier aims to investigate the impact of a net dollar put into crypto, or a net dollar taken out of crypto, and how that impacts network values.There are many questions related to this multiplier, such as how it varies between inflows and outflows, across different cryptoassets, and ultimately, through time.

Historically, the fiat amplifier has been stubbornly hard to pinpoint given the fragmentation of fiat onramps, and lack of standardization around exchange reporting. As shown above, however, this tax crisis gives us an opportunity to quantify a large, specific flow and examine the fiat amplifier effect. And in crypto we’ve learned to never let a good crisis go to waste.

In the height of the 2017 bull market, Chris estimated the fiat amplifier to be anywhere from 2–25x depending on the assumptions used, while an analyst at Citibank found it to be 50x for some cryptoassets. That was in a time of heavy inflows, which is very different from the current period of heavy outflows.

Turning to the current bear market, we can divide the loss in network value thus far in 2018 by the estimated tax liability outflow, to define a maximum fiat amplifier. Dividing the $590bn drop from early January highs to present, by our estimate of $14bn net outflows, yields a maximum fiat amplifier of 42x. If instead we use the more aggressive $29bn estimate of outflows, then the maximum fiat amplifier drops to 20x. It is important to recognize these amplifiers represent the maximum, as if net outflows have been greater due to FUD, then that would dampen this ratio by increasing the denominator.

Reflexivity

George Soros used the term reflexivity within the financial markets to define when price becomes a fundamental driver in its own right, and with the fiat amplifier we have attempted to quantify the reflexivity of crypto, though it is an admittedly early attempt.

We posit that cryptoassets, in their current immaturity, have a heightened degree of reflexivity relative to the traditional capital markets for several reasons:

- The technology is extremely young, and unlike typical early stage investments these assets are marked to market intra-second

- Communication within crypto is particularly viral given the integration with Twitter, Telegram, Reddit and more

- There are few valuation frameworks, relative or fundamental, and they remain sparsely used by market participants

- Regulatory paranoia remains rampant as nations evolve their frameworks, with negatively perceived announcements creating market contagion

- Participation is largely retail, sometimes with minimal understanding of the underlying technology, leading to mass indexation off of momentum

It is our hypothesis that the reflexivity of crypto will dampen over time as the technology matures, valuation frameworks standardize, regulatory clarity improves, more institutions enter the market, and exogenous fundamentals strengthen (i.e., adoption).

We would love to see further work on this topic, and as suggested by Alex Evans, it might be best to start by teasing apart the first and second order effects, as opposed to lumping everything into the fiat amplifier. From there, a longitudinal approach to track patterns over time, as well as a more granular focus that investigates individual cryptoassets could both prove fruitful.

Conclusion

The experience of the last six months should serve as a lesson for cryptoasset investors about the sensitivities of the current crypto market structure, and the importance of being cognizant of flows and their second order effects. As for where we currently stand, concentrated tax selling is likely nearing completion, and reflexivity has driven sentiment to bearish extremes.⁴ Now we must wait and see how far the reverberations of reflexivity take crypto, before the market returns to a focus on fundamentals-driven growth. As always, we will continue to observe with interest and equanimity.

Thank you to Alex Evans, Cathie Wood, Steve McKeon and Joel Monegro for their thoughtful feedback.

Footnotes:

(1) Combined, USD and JPY average about 50–75% of trading volume for most cryptoassets (per CryptoCompare), so this 40% number could be considered conservative.

(2) Bear in mind that all “in kind” (i.e., crypto-crypto) trades are taxable events in the US, so a large amount of exchange volume will qualify for short term capital gains. Though, many will also disagree on this point for 2017, which was prior to the recent US tax reform that made such in-kind transactions explicitly taxable events.

(3) In addition, cryptoassets are 60–80% lower in price, which means for those that waited to raise capital from crypto, the effective sales in “crypto-units” could be magnified significantly.

(4) For example, on April 1st, 2018, Bitfinex data showed that bitcoin margin shorts exceeded margin longs for the first time in 2018.