Artificial Intelligence (AI) and FinTech

The speed of technological change is exponential. What was yesterday’s hot ticket quickly becomes tomorrow’s old news. We are living in the midst of a huge surge of interest and research in Artificial Intelligence (AI). It seems like every week there is a new breakthrough in the field and a new record is set in some task previously done by humans. If you don’t already know what IoT, AI, VR, AR, and bots mean, you better get up to speed immediately because these technologies are changing the way data is created, collected, interpreted, and communicated.

In the digital age, “data is money.” Financial services’ business models, processes, costs, risks, and user experience, amongst many other elements, are all getting upended in this wave of transformation. It is well known that financial institutions are coming under increasing pressure from tech giants and FinTech startups. To understand it better, check out this post.

While a lot of attention is focused around bots ever since the Facebook F8 last month, the real McCoy is AI (Artificial Intelligence)

Artificial Intelligence Beyond Bots

Artificial Intelligence (AI) is the theory and development of computer systems that can perform tasks that normally require human intelligence such as visual perception, speech recognition, decision-making, and translation between languages. AI can also be used to analyze the data produced by IoT, social media, mobile phones, and other sources to provide active learning analytics that can create a virtuous circle.

Not too long ago, AI seemed a distant dream for many. Today, it is all around us. We carry AI in our pockets, cars, and many of the web services we use throughout the day. Google Translate, Apple’s Siri, and even the automated voice that responds to customer care calls are all worthy examples of the presence of AI around us.

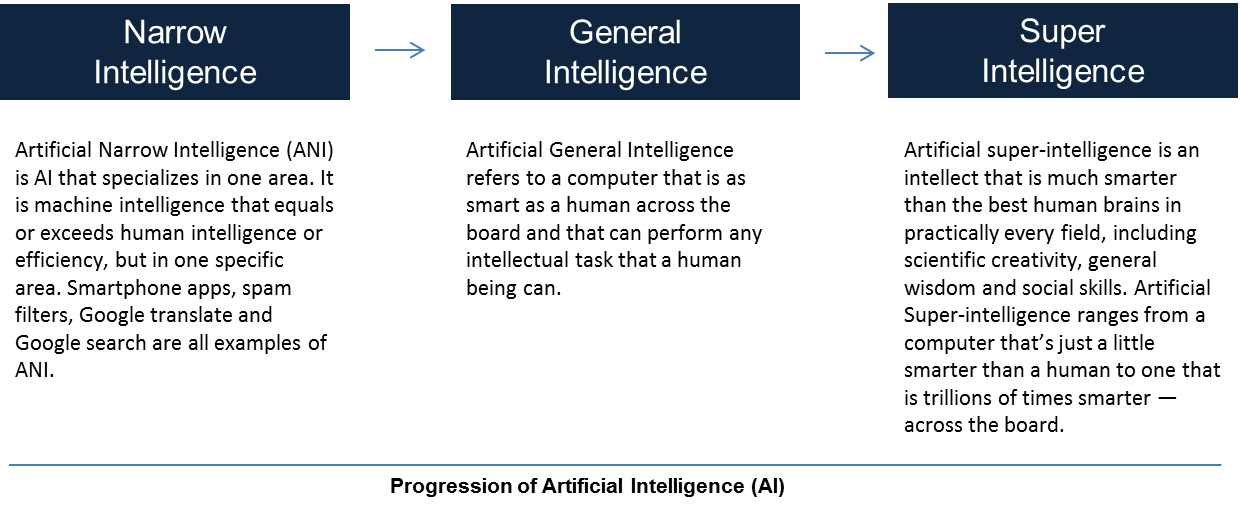

AI is not new to the world. Narrow Intelligence has existed for a long time. However, it is getting smarter by the day and progressing towards “general intelligence” on its path to “super intelligence.”

General AI means having a human or superhuman level of intelligence. While a specialized AI, or “narrow” intelligence,” can drive a car or play chess, it is not very useful outside its domain. Google Alpha Go is a remarkable example of “narrow” intelligence.

AI is an idea that has oscillated through many hype cycles over many years as scientists and sci-fi visionaries declared the imminent arrival of thinking machines. However, it seems we’re now at an actual tipping point. This time, the reality almost matches the rhetoric, driven by:

1. The decreasing cost of computing power

2. The availability of data

3. Better algorithms

A combination of the factors outlined above has led to the growth of consumer and business facing applications, most of which were not yet seen.

With the help of neural networks — vast networks of machines that mimic the web of neurons in the human brain — Facebook can recognize your face, Google can recognize the words you speak into an Android phone, and Microsoft can translate your speech into another language.

“Device to fade away. We’ll move from mobile 1st to an Artificial Intelligence 1st world.”-Google CEO @sundarpichai

In financial services AI is being similarly deployed in the back-end to power decision making in lending, trading, and financial analysis, and in the front-end to power the customer-facing services.

AI-powered machines in the form of bots are being “humanized” to become the main interface for interactions between financial services firms and potential or existing customers. Connected networks of bots mean that the next stage of “robo-advisors” will constantly be testing and improving their interactions with customers to provide maximum customer satisfaction and to optimize revenues.

Potential Use Cases for AI

The following are some examples of how AI can be deployed in financial services:

· Wealth Management for Masses (e.g. Smart Wallets, Trading)

· Customer Support, Transactions, and Helpdesks

· Data Analysis and Advanced Analytics

· Fraud Detections and Repetitive Tasks

· Underwriting Loans and Insurance

· Automated Virtual Assistants

Digital finance and commerce players such as alternative lending firms Lenddo, ZestFinance, and Affirm are already using AI-based technologies including evolutionary algorithms to help them learn, find, and act on existing and new data sets to underwrite loans and profile borrowers. However, use cases of AI go much beyond creating more “intelligent” systems or matching and testing data.

Consumer-facing systems such as text chats and voice systems can deliver human-like customer service or advice experience at a low cost.

Kasisto provides “text chat” software to financial services and commerce companies. Amazon Echo, Google Home, Apple’s Siri, Microsoft’s Cortana, and X.ai’s Amy are examples of voice systems, which can be adapted to the financial services environment. IBM Watson has a “virtual agent,” Eva, that enables their app users to complete transactions such as transferring money and paying bills.

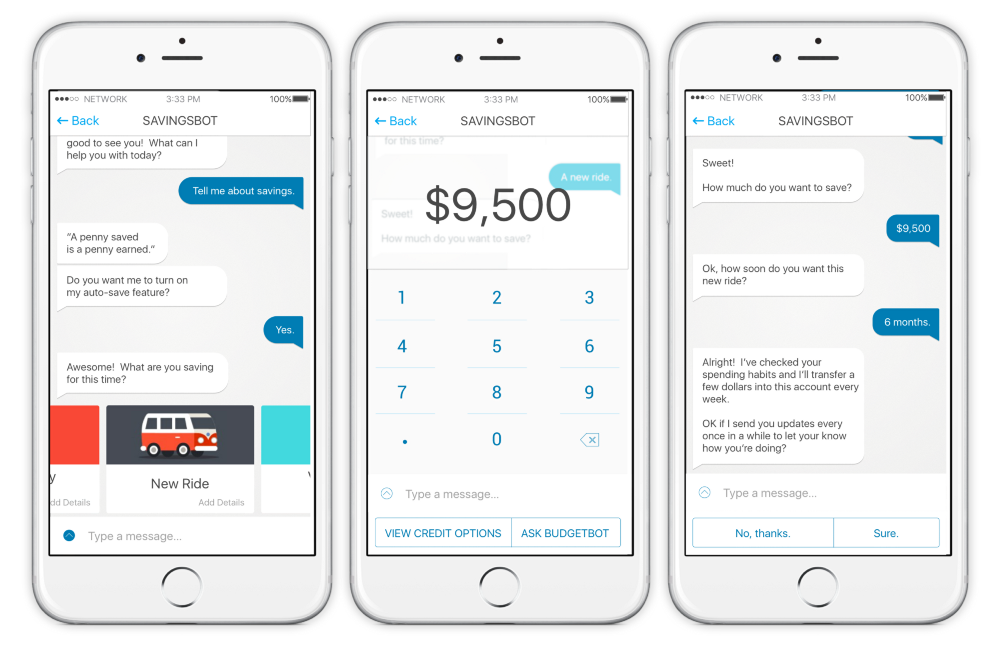

Here’s another example, a “savings-bot” can automate the process, remove friction, and provide context and updates (e.g. just before Friday, it can push me my budget for the weekend.).

Smart wallets such as Wallet.AI can monitor and learn users’ habits and needs, and then alert and coach users to alter their personal spending and saving behavior. AI can also provide oversight and tracking of employee actions to help with compliance, security, and monitoring.

Digitization has made the movement of large sums of money around the world even easier, but this has added to complex regulatory requirements and compliance costs. By monitoring discrete, repetitive data entry tasks over time, AI system can learn to verify data entry and test for specific events, assess risk, and find fraud. Regulation creates an opportunity for companies to deploy AI-powered employee and systems oversight.

Anything that could give rise to smarter-than-human intelligence — in the form of Artificial Intelligence, brain-computer interfaces, or neuroscience-based human intelligence enhancement — wins hands down beyond contest as doing the most to change the world. Nothing else is even in the same league. — Eliezer Yudkowsky

Future-Proof Your Business

While some AI dependent solutions are live, the widespread practical application of others is months away. The current state of technology and its use cases are just scratching the surface, like the early days of the internet itself. It is likely that the most useful future applications have not yet been imagined. Nonetheless, AI and VR/AR are here to stay, and financial services professionals need to start future proofing their businesses by leveraging the “new-tech” potential.

Look around and it is easy to see how AI has found plenty of use cases, not only in FinTech but also in our day to day activities.

Echo and Viv are good examples of products that enable human interaction with some form of machine intelligence instead of using, for example, web browsers when carrying out tasks like an online purchase. As this voice technology becomes less visible and more human-like in its capabilities, it becomes easier to use for everyone. The ambition for Echo and Viv, therefore, is to create a truly generalist AI assistant for all platforms.

Similarly, in its recently concluded annual I/O developer conference on 18th May, 2016, Google unveiled Google Home, its answer to Amazon Echo along with new messaging (Allo) and virtual-reality (Daydream VR) products, thus, doubling down on artificial intelligence and machine learning as the keys to its future.

In Conclusion — AI Will Emerge as “Utility in the Future.”

Although the companies shown in this article are a small selection, the examples illustrate the breadth of applications where AI will emerge as “utility in the future.” Much like we now use electricity or water to solve problems, it is expected that intelligence and computation will be a general resource in the same way.

No longer just the objects of fascination in science fiction, bots and artificial intelligence in banking have the potential to reduce costs, expand skills, and improve the customer experience working alongside (or replacing) humans.

The purest case of an intelligence explosion would be an Artificial Intelligence rewriting its own source code. The key idea is that if you can improve intelligence even a little, the process accelerates. It’s a tipping point. This way of looking at intelligent computation broadens the scope of what one can imagine.

Whatever the applications, we can surely say that combining big data with artificial intelligence will herald an age of new possibilities and astounding new breakthroughs and innovations in technology.

As AI progresses, every business must ask itself the central question — “How can we benefit from this?”

[Part 2 of this post will talk about some more AI solutions within Financial Services industry and the roadmap ahead.]

Thank you for reading! If you like the post, please hit ? and share with your friends. It helps other people discover the story. You can also find mehere on Medium or Twitter @gaurav1105.