Big banks plan to coin new digital currency

By Martin Arnold for FT

Four of the world’s biggest banks have teamed up to develop a new form of digital cash that they believe will become an industry standard to clear and settle financial trades over blockchain, the technology underpinning bitcoin.

UBS, the Swiss bank, pioneered the “utility settlement coin” and has now joined forces with Deutsche Bank, Santander and BNY Mellon — as well as the broker ICAP — to pitch the idea to central banks, aiming for its first commercial launch by early 2018.

The move, to be announced on Wednesday, is one of the most concrete examples of banks co-operating on a specific blockchain technology to harness the power of decentralised computer networks and improve the efficiency of financial market plumbing.

“Today trading between banks and institutions is difficult, time-consuming and costly, which is why we all have big back offices,” said Julio Faura, head of R&D and innovation at Santander. “This is about streamlining it and making it more efficient.”

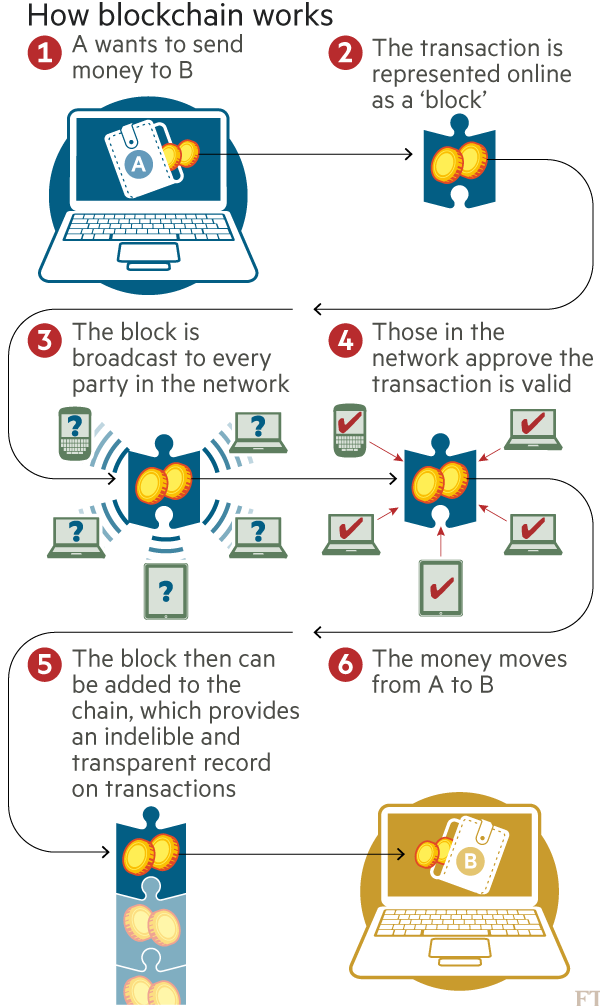

Blockchain technology is a complex set of algorithms that allows so-called cryptocurrencies — including bitcoin — to be traded and verified electronically over a network of computers without a central ledger.

Having initially been sceptical about it because of worries over fraud, banks are now exploring how they can exploit the technology to speed up back-office settlement systems and free billions in capital tied up supporting trades on global markets.

The total cost to the finance industry of clearing and settling trades is estimated at $65bn-$80bn a year, according to a report last year by Oliver Wyman.

There are several rival digital cash systems being developed. Setl, a London-based group founded by hedge fund investors and trading executives last year, also aims to settle financial market payments with digital cash linked directly to central banks. Citigroup is working on its own “Citicoin” solution, while Goldman Sachs has filed a patent for a “SETLcoin” to allow trades to be settled near-instantaneously. JPMorgan is also working on a similar project.

In depth

As interest in bitcoin increases, US officials are looking into how to regulate, rather than shut down, the virtual currency

The utility settlement coin, based on a solution developed by Clearmatics Technologies, aims to let financial institutions pay for securities, such as bonds and equities, without waiting for traditional money transfers to be completed. Instead they would use digital coins that are directly convertible into cash at central banks, cutting the time and cost of post-trade settlement and clearing.

The coins, each convertible into different currencies, would be stored using the blockchain, or distributed ledger technology, allowing them to be quickly swapped for the financial securities being traded.

“You need a form of digital cash on the distributed ledger in order to get maximum benefit from these technologies,” said Hyder Jaffrey, head of fintech innovation at UBS. “What that allows us to do is to take away the time these processes take, such as waiting for payment to arrive. That frees up capital trapped during the process.”

He said the project team would spend the next year seeking the approval and co-operation of regulators and central banks and aim for a “limited and low-risk” commercial launch by early 2018. The consortium members plan to argue that the system would improve transparency for regulators.

The US Federal Reserve, the Bank of England and the Bank of Canada are among central banks examining the potential benefits of digital currencies. But concerns include the security and the impact on banking stability.

David Treat, head of Accenture’s capital markets blockchain practice, said the technology was still at a stage of having “three to five years before we get things adopted at scale and several more years before it goes mainstream”.