Fintech doesn’t just disrupt banks, it makes them platforms

By Josh Constine for techcrunch.com

It’s easy to move your money between banks. What’s annoying is moving your apps.

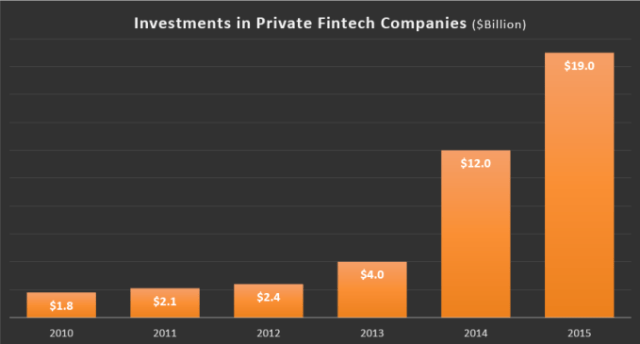

There’s been a recent explosion of fintech products in spaces like stock trading, wealth management, payments, loans, remittance and insurance. It’s been fueled by a massive uptick in venture investment in private fintech companies, which hit $19 billion in 2015 according to CB Insights. That’s up 58 percent from 2014 and over 1,000 percent since 2010.

There’s no doubt these startups disrupt particular services that the big banks provide or facilitate. If startups in all these spaces succeed, they could nip at banks’ revenue opportunities. Still, banks largely make their profits investing consumers’ money rather than on tertiary services.

But what many of these startups have in common is that they all rely on connecting to your existing bank to fund your accounts with them or receive money. Rather than shun the startups, the incumbents have built bridges to let you hook fintech products into your bank accounts.

The result is that while banking is changing rapidly, you might be more reluctant to change which bank you use, according to several fintech founders and VCs I spoke to.

Even down on the credit and debit card level, e-commerce products from Amazon to Uber have added friction to switching banks. You’d have to go in and update your accounts in each of these apps. Now if I lose a credit card, I’m more inclined to tell my bank I accidentally destroyed it so they send me a replacement with the same card number to avoid the hassle.

Now fintech is doing the same with apps jacked directly into your bank account. That could allow banks to focus more on new customer acquisition and upselling than retention, because users are inherently becoming entrenched with their existing bank.

Meanwhile, each individual fintech startup sees the banks as frenemies. They might compete over one service specifically, but as whole, the banks are their partners. Down the line, as the startups seek to expand into adjacent markets, that tenuous alliance might change. But for now, the banks that get it love the fintech startups more than you’d guess.

First appeared at Techcrunch.com