WhatsWeFaceTelKaLiVibeSnap Pay: comparison of messengers’ payment functions

Eighteen months ago, Mark Zuckerberg announced an unofficial messengers’ race for better and faster monetization of a customer base by integrating remittances and payments. How have the players succeeded so far?

By Igor Pesin, Partner at Life.SREDA

Taking into account that new functions and changes are being introduced every three-six months nowadays, messengers haven’t gone far for the past year. Those (fewer than all) that have managed to integrate payments, made them available just in one country with only basic functions. Let’s see in detail:

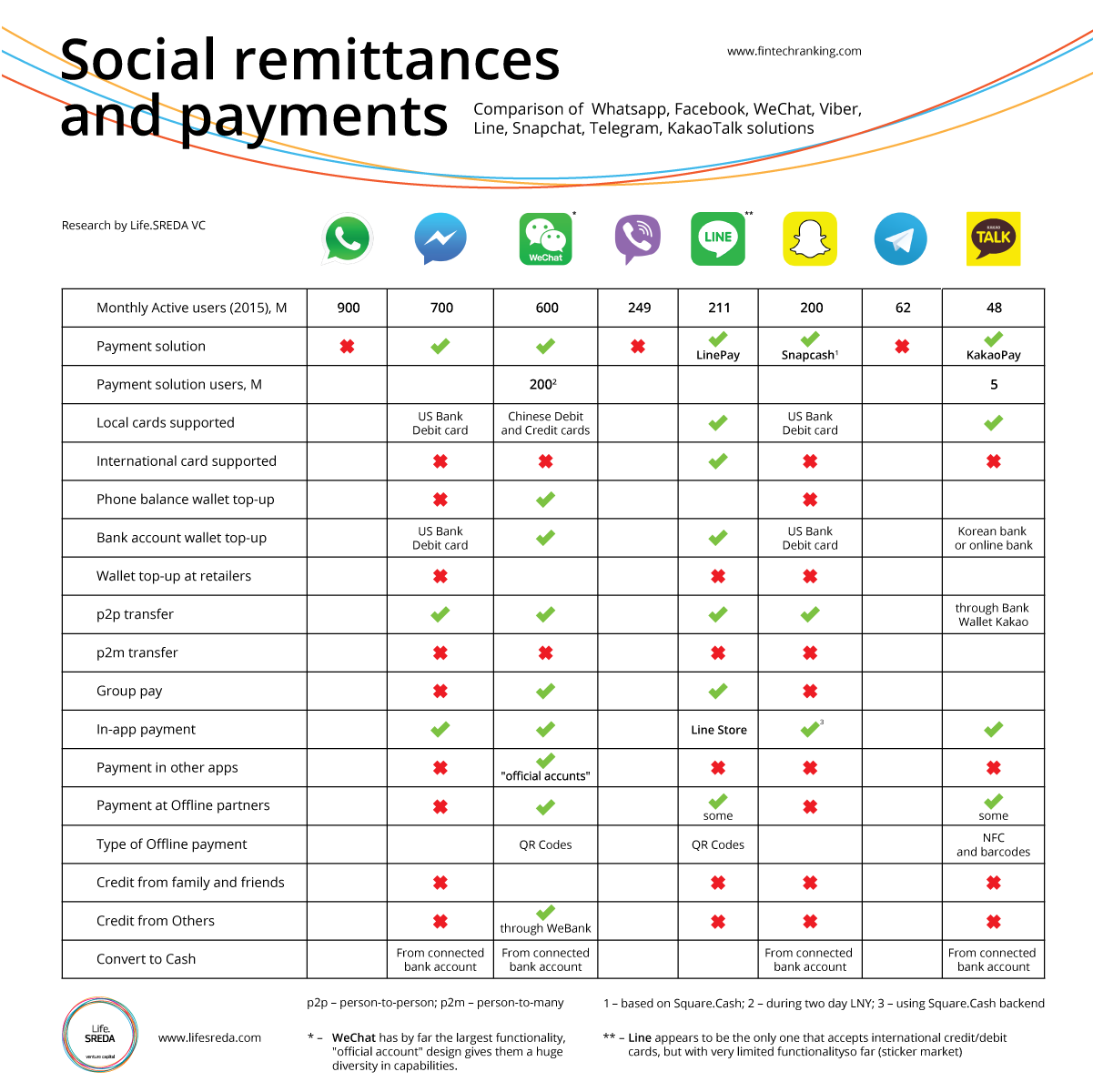

I am attaching a table with the info I was able to find. (If the cell is empty it means I could not find anything or it was too ambiguous.) Clearly, WeChat is far ahead of the competition, but like all other solutions – it is local, for all practical purposes.

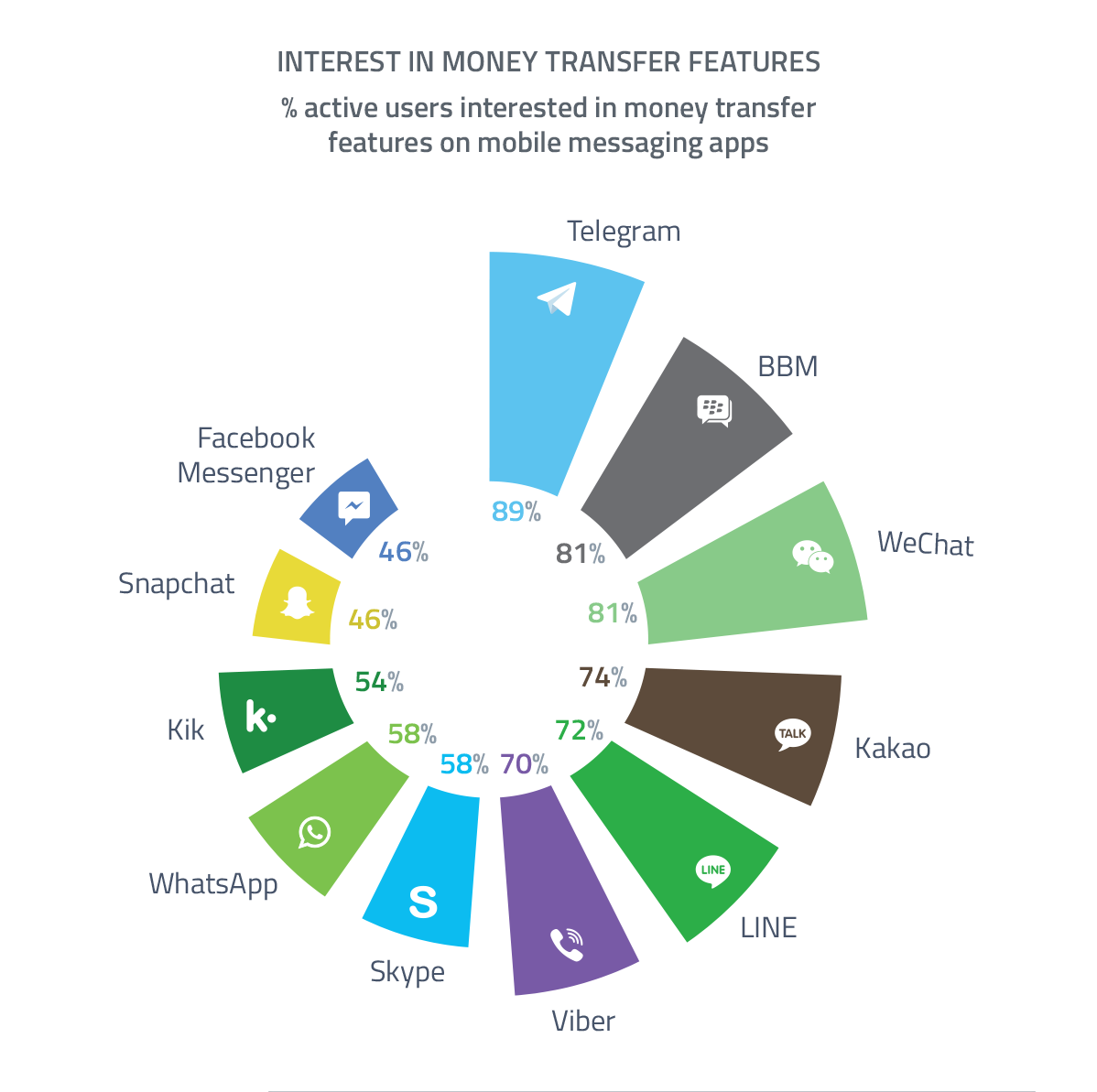

This infographic from Global Web Index (April 2015) captures global interest in mobile money transfers as determined by usage on popular messaging apps around the world. Telegram (89%), WeChat (81%), and BlackBerryMessenger (81%) came out on top respectively, which speaks to the popularity of mobile payments and m-commerce in regions outside North America and within APCA in particular – with more than 8 in 10 in each group saying they are very or quite interested in this function. With online payment processors like Alipay already more popular than credit cards in China, it’s not surprising to see consumers look to WeChat as an easy way to transfer money between friends. Mobile is quickly becoming the hub for not only social but for commerce in China. And while it’s certainly striking that Kik, Snapchat and Facebook Messenger come at the bottom of the table, it’s still around half of their respective user bases who express an interest in a money-transfer service – indicating the size of the potential audience for Snapcash as well as Facebook Messenger’s rival feature.

WHATSAPP & FACEBOOK

In April 2014 The FT reported that Facebook is looking at e-money services — including the ability for people to make peer-to-peer money transfers using money that is stored on Facebook itself — and has applied for an e-money license in Ireland as part of that. Facebook made the rounds in London in December 2013, and it spoke to several consumer-facing payments companies, including the three mentioned in the FT’s report: TransferWise, Moni Technologies and Azimo. “It was mainly about market discovery,” said Mike Laven, CEO of Currency Cloud, the London-based startup that powers payments at the back end for all three of these companies, as well as several of their competitors. That also provides the imperative for why Facebook should look for other revenue streams — not just to diversify revenues but to help it meet different expectations from different consumers.

In that regard, while offering money transfers through Facebook’s main desktop and mobile apps are definitely two places for such a service to exist, there is another where it could make even more sense: the messaging juggernaut WhatsApp. And yet Zuckerberg has said WhatsApp could be worth a lot more money one day. Put these together and you can see why Facebook might also be looking very seriously at how it could move into remittance. WhatsApp is already used as a communications network between people in different countries, and is particularly strong in developing countries, touching users that Facebook does not. WhatsApp, it should be noted, also has made a strong case for expanding its platform beyond basic messaging to gain a bigger share of users’ mobile “wallets.”

The FT reports that another aspect of Facebook’s financial services ambitions is based around getting an e-money license, which would allow Facebook to “issue units of stored monetary value that represent a claim against the company.” In Europe, carriers that have made moves to take on more mobile payment services also obtain e-money licenses — pointing to another area where Facebook potentially would try to flex its financial services muscles.

In June 2014 Facebook’s poached PayPal’s president David Marcus to run its Messenger unit. Marcus joined PayPal three years before when it acquired his mobile payments company Zongfor $240 million in cash. In a Facebook post announcing his move, Marcus wrote: “While I was in the middle of my thought process about what was next for me, Mark Zuckerberg and I got together. Mark shared a compelling vision about Mobile Messaging. At first, I didn’t know whether another big company gig was a good thing for me, but Mark’s enthusiasm, and the unparalleled reach and consumer engagement of the Facebook platform ultimately won me over. So… yes. I’m excited to go to Facebook to lead Messaging Products.” Using Marcus’ expertise could one day help Facebook earn significant revenue from developing nations and the parts of the world it’s trying to connect to the web through Internet.org. Mobile payments for digital and physical goods are starting to become popular in developing nations. Meanwhile, many migrants send money they earn back to family members in their home countries, but are forced to endure extortionate fees. Facebook could use the ubiquity of its mobile apps, including Messenger and WhatsApp, to disrupt the current players in mobile payments and remittance, earning those fees for itself. In the developed world, this might help friends settle up for group dinners or shared taxi rides. But in developing countries, remittance through Facebook could become popular if it costs less and were easier than existing solutions.

[su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Facebook to offer mobile payment service: [/su_youtube]

In March 2015, as many believed was inevitable, Facebook has entered the personal payments space. The company announced Facebook Messenger will now let you send and receive money. Facebook was only making it available to U.S. users for now. The process to send money is as follows: message a friend, tap the $ icon, enter the amount you want to send, and tap Pay in the top right. Receiving money is of course much simpler: Open the conversation from your friend and tap Add Card in the message. If it is your first time sending or receiving money, you’ll have to add a Visa or MasterCard debit card issued by a U.S. bank to your account. Once that is done, you can create a PIN that will be required the next time you send money. For those who want to take extra precautions, add more layers of authentication to your Facebook account and/or enable Touch ID if you have an iOS device. Facebook claims the money you send is transferred “right away,” but the company warns you should expect delays: “It may take one to three business days to make the money available to you depending on your bank, just as it does with other deposits.” In other words, this payment solution isn’t unique other than the fact that it’s on Facebook. The big question is whether Facebook users will trust the service enough to handle their monetary transfers between friends and not just payments to Facebook.

Among WhatsApp’s competitors, WeChat has made a strong move already into offering peer-to-peer payments on its network, with services like red envelope. “WeChat payment registered users reportedly jumped 5 times given the viral effect of the red envelope app,” analysts at investment bank CLSA (Crédit Lyonnais Securities Asia) noted in March 2014 in a recent report, where they valued WeChat at some $65 billion in part because of the success of these services. (Heads turned when Facebook forked out $19 billion for messaging service WhatsApp in February, and eyes popped when Facebook CEO Mark Zuckerberg said it was probably worth even more.) Analysts Elinor Leung and Terry Chen make the case for how WeChat should be worth at least two to three times the value of WhatsApp, which they had previously valued at $35 billion. Although it looks like WeChat has less users — around 300 million today to WhatsApp’s 465 million — it has more revenue streams. “WhatsApp only generates US$1/download,” they write. “WeChat could generate revenues from mobile games, advertising, eCommerce, O2O, mobile payment and Internet financing. Asia leads the global smartphone game market especially Korea, Japan and China. eCommerce, online to offline payments and mobile payment are unique business opportunities in China given the poor offline infrastructure.” One specific area is payments. Tencent has launched apps to such as red envelope (for “real money” P2P transfers) and taxi apps, which it is also integrating with WeChat. (Users provide bank, credit card or debit card account details to WeChat to register, and then enter a password and verification code (sent by Tencnet via SMS) to complete transactions for things like paying bills, buying things, red envelopes and subscriptions.

[su_youtube url=”https://www.youtube.com/watch?v=MzXAOpF93OM “][su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

In August 2015 Connie Chan from Andreessen Horowitz wrote, that much has been written about WeChat in the context of messaging app trends, but few outside of China really understand how it works — and how it can pull off what for many companies (and countries) is still a far-off vision of a world managed entirely through our smartphones. So why should people outside of China even care about WeChat? The first and most obvious reason is that it points to where Facebook and other messaging apps could head. Second, WeChat indicates where the future of mobile commerce may lie. Third, WeChat shows what it’s like to be both a platform and a mobile portal (what Yahoo could have been). Most notable, however, for anyone in the tech business is WeChat’s average revenue per user or ARPU, which is estimated to be at least $7 USD — that’s 7X the ARPU of WhatsApp, the largest messaging platform in the world. How did WeChat do it?

Along with its basic communication features, WeChat users in China can access services to hail a taxi, order food delivery, buy movie tickets, play casual games, check in for a flight, send money to friends, access fitness tracker data, book a doctor appointment, get banking statements, pay the water bill, find geo-targeted coupons, recognize music, search for a book at the local library, meet strangers around you, follow celebrity news, read magazine articles, and even donate to charity … all in a single, integrated app.

That portal takes the form of the WeChat “Wallet”, which is not a traditional wallet but a menu of carefully curated, pre-selected service providers that users can transact with after inputting their payment credentials. It’s the Trojan horse that allows WeChat to quickly onboard user payment credentials that then unlock new monetization opportunities for the entire ecosystem. To get a sense of how pervasive and successful this approach has been: At least one in five active WeChat users are set up for WeChat “Payments”, a process that begins in the Wallet menu by linking a banking or credit card to the user account. Being set up for WeChat Payments means instant, frictionless ability to transact on the WeChat Wallet services, all official accounts that sell products or services, and any associated promotions or campaigns. In this sense, WeChat gives us a window into the potential evolution of Western social networks and buying behaviors if they, too, succeed in convincing users to embrace payments on their platforms.

[su_youtube url=”https://www.youtube.com/watch?v=0D6LgzH_kL0 “] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

In China, meanwhile, usage of the WeChat Payments platform is growing so quickly that WeChat is experimenting with processing payments offline via QR codes at brick-and-mortar stores, live events, vending machines, restaurants, and hotels. The network effects are obvious and substantial: The more places that accept these payments, the more users will jump on board (and it goes both ways, both offline and online) … benefitting everyone all round.

Widespread adoption of WeChat Payments didn’t happen overnight; it was seeded through lots of proactive promotion. For example, earlier this year, Tencent launched a Chinese New Year campaign where third party advertisers gave away 500M RMB (~$81M USD) of free cash in red envelopes to WeChat Payment users in a single day. WeChat has also been busy creating tools so that official accounts can open e-commerce stores that accept WeChat Payments — essentially making every business, including mom-and-pop shops without advanced tech or e-commerce resources, an instant obile store. Beyond these promotions and resources, Tencent architected, and in some cases, subsidized the payments system in WeChat’s early days. The resulting user adoption and portal model has given Tencent a kind of “kingmaking power” for Chinese apps (and by association, internet startups in China) because partner companies selected to be part of the WeChat Wallet portal get instant exposure to hundreds of millions of users. Who knows what’s coming next?

VIBER

The successful integration of social media and payments (as discussed in previous Mondato Insights), has been demonstrated by the massive growth of Venmo in the US and of TenPay in China, among others. While simply incorporating payments into social media will not of itself create success, social’s success stories have clearly shown that a large market, particularly among young consumers, exists for payment and money transfer options that are integrated into their social media experience, and by extension into their daily lives.

It is perhaps slightly surprising then, that commentators and markets reacted in a generally negative fashion to the news, just five days before Facebook announced its 11-figure acquisition of WhatsApp, that Japanese e-commerce conglomerate Rakuten had snapped up the VOIP and messaging service Viber for USD $900 million. While not necessarily widely known outside of Japan, Rakuten is Japan’s largest online retailer. The purchase of Viber (with a unique customer base of 300 million at the end of 2013, which Rakuten claims has grown to over 400 million by mid-2014) appears to be a very smart move for an e-commerce entity with a focus on markets in Asia, where social media adoption and usage is high and mobile and online payment options are low. Add into that mix both the relatively high numbers of significant international remittance channels and the very high volumes remitted in a number of them (e.g. into the Philippines and India, out of Singapore, and between Malaysia and Indonesia), and the potential exists to create a strong Rakuten ecosystem of international remittances, domestic P2P transfers, and e-commerce payments. Rakuten Bank, part of the same group as Viber, is now offering a P2P transfer service using Facebook, parent of WhatsApp, as the proxy. Rakuten now potentially has a sand box in which to experiment.

Despite the fickle preferences of North American and European youth, however, Facebook still has strong growth in many emerging markets, such as in India, where the social network now has over 100 million users, and Indonesia, where at the end of Q2 2014 it could count on 69 million active monthly users. Not entirely coincidentally these markets are also of great interest to Rakuten: at the end of June 2014 the Japanese e-commerce Titan announced its first foray into India, 12 months after it launched its online shopping site in Indonesia, following on the heels of the establishment of a presence in both Singapore and Malaysia in 2012. All three markets (plus its Spanish site) are processed from a new unified server, and “have already experienced a foreign exchange rate adjusted 703.1 percent increase in sales”. With large, young populations that are highly active on social media and with growing hunger (and means to pay) for online experiences and products, it is largely the same dynamics that make these markets attractive to both of these online giants.

In June 2015 were some rumors that Viber is secretly working on a mobile payments system to be released in the Philippines. The payment system will allow Viber users to send virtual money to each other and perhaps also pay for services and online shopping. It’s also possible Viber is targeting the over 12 million Filipinos abroad that sends over $25 billion in annual remittances. Since majority of the active Viber users are ones abroad communicating with relatives in the Philippines, they have a captured market. Globe GCash is said to be the platform that will power Viber Pay. Being the biggest online messaging app in the Philippines (Viber has 35% share followed by WeChat at 30% and Line at 20%, story here), Viber is poised to make a significant push in mobile commerce in the country. But rumors still stay rumors.

LINE

In September 2014, Line postponed its IPO in order to focus on growing its revenue and profit. In December 2014 popular mobile messaging platform Line officially rolled out a new Line Pay service around the world. Line Pay let users connect their accounts with a credit card to make digital payments anywhere, directly from their phones. Initially, however, the service restricted to a handful of affiliated services and shops, such as Line’s own online store. The new mobile payment service is a key part of its plan to expand Line beyond its core revenue streams. Though it is currently enjoying strong revenue growth, Line continues to compete with other popular messaging apps, including WeChat, KakaoTalk, and WhatsApp, and is seeking to diversify its services. Line Corp’s latest features, including Line Pay, Line Wow, a food delivery service in Japan, Line Maps, Line Taxi, and an upcoming streaming music service, are part of an effort to turn its messaging app from a communication tool into a platform that encompasses almost every facet of its users’ digital lives.

Over time, the plan is for Line Pay to became increasingly embedded as an accepted method of payment in both online and offline stores. The company is also provided peer-to-peer payments internationally, letting friends send money to each other and even “go halves” on bills in restaurants. Launching its own payment service does, of course, make sense, as it looks to ease the path from your wallet to its own coffers. And the fact that it’s looking to enable purchases in physical, bricks-and-mortar stores echoes a trend we’ve seen elsewhere across the online realm, with the likes of Google launching its own mobile payment system in the form of Google Wallet.

[su_youtube url=”https://www.youtube.com/watch?v=0KT3Us8bsV4 “] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

In August 2014 Line announced it will create a US$100 million fund the tentatively titled “Line Game Global Gateway” (for mobile games) in September. The fund managed under the Line Ventures. In February 2015 messaging app Line, which aspires to be more than just a communication tool, announced that it will launch an investment fund to grow its network of services. Called LINE Life Global Gateway, it is worth about 5 billion yen (or $42 million). LINE Corp, the messaging app’s owner, will use it to invest companies that provide online-to-offline (O2O), e-commerce, payment, media, and entertainment services. The fund is a key part of Line’s strategy to make sure that its future earnings does not depend too heavily on its messaging app or connected games platform, which the company currently derives most of its revenue from. In September, Line said it was delaying its initial public offering to “expand the business globally.” Then during a company conference the next month, Line COO Takeshi Idezawa (who was recently promoted to CEO), declared “the keyword of our future is ‘life’… Line is the smartphone gateway for your life.” Line is the top messaging app in Japan, Taiwan, and Thailand. Line wants to increase its presence in Indonesia, the Philippines, Colombia, and Mexico, as well as the U.S., but it’s important for the company to figure out how to make more money from its current key markets while tackling the uncertain process of growth in other countries. Offering an array of services in different verticals may be the solution. One of its most important recent launches is Line Pay. The Line Game Global Gateway fund operates independently from Line Ventures, although the latter company along with Line itself are the only two parties putting up capital. Although Line Ventures is supplying some of the money for Line Life Global Gateway, the new organization will be a completely separate subsidiary. Line does not use the same investment team for its three funds. Line keeps the funds and teams separate because they are focused on different things. While it is plenty common to have a single investment team at a single VC firm focus on multiple verticals, Line’s approach to arranging its investments is unlikely to ruffle any entrepreneur’s feathers. The company’s name brand is strong and it is investing both in Japan and without.

SNAPCHAT

In November 2014 Snapchat added a “Snapcash” payments option to its app through a deal with Square Cash. You can add a debit card, type a dollar amount into Snapchat’s text-chat feature, and hit the green pay button to instantly send money to a friend.

[su_youtube url=”https://www.youtube.com/watch?v=kBwjxBmMszQ”] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

Beyond p2p payments, the trademarks could prime Snapchat for ecommerce and payments to merchants as well. For example, the app could one day send you a Snap or show a Story ad from a merchant, and let you buy the product shown instantly through Snapchat. Depending on how its relationship with Square Snapcash works, Snapchat could also potentially cross-reference payments through Snapcash-users and Square-merchants connected accounts.

All their account details are held by Square Cash. Being featured in Snapchat will net Jack Dorsey’s company brand exposure and credit card numbers. There may be a financial agreement between Snapchat and Square, but they’re staying tight-lipped on that. Snapchat did say it was interested in possibly offering more payment methods such as credit cards or bank accounts, though Square only handles Visa and Mastercard debit cards for now. The Snapcash deal could be big for Square Cash’s competitive strategy as it tries to edge out Venmo, Google Wallet, and more for the p2p payments market. None have gained widespread consumer adoption, even though they can be extraordinarily helpful. Snapcash could inject itself into the lives of people who never considered downloading a finance app – but we still wait…

[su_youtube url=”https://www.youtube.com/watch?v=R2KRwgcxUHk”] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

TELEGRAM

In September 2015 Telegram announced that now they delivering 12 billion messages a day through its chat service, according to its founder Pavel Durov. This announcement of a 2 billion increase from August comes with a shot against the market leader WhatsApp. The company last reported in May that it has over 62 million MAUs.

Durov also disclosed that one of the things that could be coming soon is a payments API, which would certainly help put the messaging service on par with the likes of Facebook Messenger. He said that Telegram probably won’t build the payments product itself, but would instead partner with third-party providers.

KAKAOTALK

In September 2015 South Korean tech company Kakao, which was rebranded from Daum Kakao at the start of the month, announced that its mobile payments platform KakaoPay has passed five million users in the first 12 months since launch. It’s not immediately clear whether these are monthly active users — the number more likely reflects the total registered user base, including users who have perhaps attached credit or debit cards, but not yet made a transaction on Kakao Pay.

[su_youtube url=”https://www.youtube.com/watch?v=0_USs_hpnxY”] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

Kakao said that 10 million transactions have been made through Kakao Pay to date, with one user sending $6,400 in a single transaction. 60 percent of its users are females, with 46 percent aged 20-29. “We feel five million users is a tremendous accomplishment considering the public’s usual reluctance to adopt new financial products. 5 million users equals nearly 20 percent of all credit card users in Korea. Our growth has accelerated as we continue to add popular and unique channels (airlines, movie theaters, delivery apps, donations, etc.) where people can use Kakao Pay. Building up a strong user base is particularly important to us because, instead of focusing on transactions fees, we are looking to build a comprehensive pay platform that includes utility bill payments, membership point management, automatic payments and more. We expect to release these new services within the KakaoPay platform by 4Q or 1Q 2016, and we think it will help us separate from competitors in a big way. As for other payment services, there doesn’t seem to be any direct competition as each service is focusing on specific areas of mobile payment. For example, Samsung Pay is looking more at offline payment with the goal of selling more mobile devices, while some domestic competitors, such as Naver Pay, are looking to build a payment service for their own shopping channels.”

Joe Seunghyun Cho, the Seoul-based founder and chairman of private investment group Marvelstone, told VentureBeat: “Kakao was very aggressive in marketing to make it happen. I think Kakao Pay is targeting the right target group — young females.” Beyond this, Cho pointed out that the “gifting culture” is also very important to Koreans, and Kakao’s payment offering falls nicely into that niche, enabling those kind of transactions between friends and relatives.

AN EXAMPLE OF INDEPENDENT PLAYER

Social payments are fast becoming a major topic after a number of companies services — including Facebook, Snapchat, Line, WeChat and Kakao Talk — introduced platforms of their own. Unlike those services, which are aimed at increasing user engagement and growing online-to-offline business models within each app, Singaporean-based Fastacash pitches itself as an intermediator for banks that want to get into social across multiple platforms.

Vince Tallent, chairman and CEO of Fastacash, told TechCrunch in an interview in July 2015, that the company wants to make payments social in the same way that Mastercard and VISA have pioneered credit and debit cards. That, he said, means providing a technology that allows people to make payments to friends — and, in the future, retailers — via the platforms that they use on a daily basis, be that Facebook Messenger, WhatsApp, Twitter, SMS, email, etc. “We’re an agnostic hub that sits between the financial and social worlds providing transaction capabilities and connecting people,” Tallent said. That’s the thesis behind Fastacash, a Singapore-based fintech startup that announced in July a $15 million Series B funding round led by Rising Dragon Singapore. Life.SREDA, UVM 2 Venture Investments, and undisclosed existing investors also put money in. The company previously raised $8.5 million. Product-wise, the company is keen to go from B2B2C and into customer-merchant payments. Coupons, QR codes and other features are slated to be added to the service in the near future, Tallent revealed. Fastacash is aiming to secure 50 partnerships with banks, remittance firms and other organizations over the coming few years, around one-third of which are scheduled for this year.

[su_youtube url=” https://www.youtube.com/watch?v=iUYdEUWtYg0″] [su_youtube url=”https://www.youtube.com/watch?v=0EcFqW0UqOs”]VIDEO Mechanism of WeChat Payment: [/su_youtube]

For example, in May 2015 Fastacash with India’s Axis Bank has released a mobile payments service called Ping Pay, which allows customers to send money to each other using Facebook, Twitter, WhatsApp, email or phone number. (Axis Bank is the third largest private sector bank in India. The bank is present in 1,708 cities and towns across India, and also has overseas offices in UK, Singapore, Hong Kong, Shanghai, Colombo, Dubai and Abu Dhabi.)

The bank says the service will help it to reach young consumers, as social media websites and smartphones become more widespread and accessible in India. Access to financial services has always been an issue in India, where 41% of households are completely unbanked, according to figures provided by the Bank of India. However, India has over 950 million mobile subscriptions, which equates to a mobile penetration rate of 74.6% according to WCIS stats for March 2015. At the same time, social media use is growing as internet access spreads. Facebook already has over 112 million users in India and Twitter has around 30 million. The bank says that it sees its new service as part of a step towards a cashless economy in India, which already has a large prepaid mobile market. The Ping Pay app also lets users send mobile top up to a recipient. Fastacash allows money, airtime and coupons to be transferred, as well as digital content.

The actual transfer of funds on Ping Pay happens via the immediate payment service run by the National Payments Corporation of India. The transaction limit is 50,000 Indian rupees per day, equivalent to about £500. Customers can send the funds even if the recipient doesn’t have an Axis Bank account. Axis Bank account holders can download the Ping Pay app and sign up for the service using their registered mobile numbers and associate their Axis Bank internet banking credentials or ATM/ debit card to send money and mobile recharges. When sending money, the user chooses a social or messaging channel and selects the name of the person to whom the money is to be sent. They enter the amount to be sent and set a “ping code” that is shared separately with the receiver. Upon confirming the transaction, the money is immediately sent and the receiver gets a message across the social or messaging channel selected by the sender. The receiver has 15 days to transfer the money to his/her bank account using IMPS. In the event, the receiver does not claim the money received within 15 days, the transaction would be auto-reversed to the sender’s account. Ping Pay also has ‘Ask for Money’ and ‘Ask for Recharge’ options, which would allow the receiver to put in a request for funds and also seek recharge from their friends and family.

[su_youtube url=”https://www.youtube.com/watch?v=uMfFkOhO19o”]VIDEO Ping Pay your share of the dinner bill, send money on WhatsApp, tweet your money, etc (Indian): [/su_youtube]

WHAT NEXT?

Money transfers are becoming less and less of a financial function and more of a part of communication, a language you can use to say something. When you are lacking the words you can shoot a movie, sing, dance, cook, paint, have sex … Messengers’ initial function was to transfer important information but over time they have become more and more emotionally intense, with their vocabulary, semantic and social codes. The same will happen to money transfers. You can say “I love you” by a hug, flowers or a burger from a nearby McDonald’s.

So what do we see after more than one year? Some messengers haven’t launched money transfers and payments (WhatsApp, Viber, Telegram), all solutions are operational in one country (except for Line) with a basic functionality (except WeChat). Some of the potential spheres for development of social payments and remittances are:

- Money transfer market is huge but the market of payments in offline points of sale is much bigger. If you get people used to your service (become top-of-mind) for money transfers, your application can later be completed by payment function (according to the example of some of the abovementioned players) and the service will gradually develop a full-fledged mobile banking functionality. While money transfers become an “anchor” to attract the customer base.

- How to transform from online-only and connect offline-experience with online-technologies (O2O), as WeChat has successfully done. But integration with current points of sale is not very high-tech and will take a lot of time, as they are not designed for this. You make your customer to perform an unnecessary operation if he has to scan digit-, QR- or bar- codes. What can be really useful is a service of contactless customer profile recognition and payment without having to provide any addition information or start an application. Such use case of contactless payments can be implemented, for example, by integration of such services with mPOS-acquiring startups or tablet-based cash registers (like Poynt, Shopify POS and Square Stand) – we’ll watch Snapchat and Square in this respect.

- There is a huge potential in the provision of such services to unbanked customers: their demand for and “pain” about remittances is much stronger, they are lacking access to bank services, and at the same time the penetration of cellular communication, cheaper smartphones based on Android, social networks and messengers is extremely high and constantly growing. In addition, a 3% commission for money transfers charged by Facebook in the US seems rather high and there are plenty of cheaper alternatives, but, for example, for the Filipinos, who are paying 10-15% for transfers now – 3% will be a gift from above.

- Development of transfers not only from person to person (P2P), but also within the groups (P2M) opens up great opportunities for crowdgifting, crowdfunding, charity, groupbuying… Talking about the latest one – just a few Western consumers imagine how e-commerce market looks like in Thailand or other Southeast Asian countries. It’s a bunch of small stores that sellers link to their accounts in social networks and publish pictures of goods, prices and phone numbers to communicate with them through instant messengers. Seller and buyers discuss the size or other characteristics, delivery address and payment method via messengers. Then the buyer usually goes to the nearest bank to make the payment and waits for the purchase. One can find here a great potential for social payments.

- Some unbanked countries – such as India, the Philippines, Vietnam and others – are lacking centralized credit bureaus. While their remittances market is huge. Money transfers (quantity and quality of recipients, objectives, geography, frequency and amount) can say a lot about the credit risk profile of the person (not only income, but also funds after all expenses, social environment, geographical activity, target transfers, lifestyle). This amount of data opens up tremendous opportunities for big data services like Lenddo: they can aggregate and analyze information not only on transfers, but also the data from social networks, smartphone manufacturers and mobile operators – in order to build hypothesis about your creditworthiness, to predict the demand for goods and services, to target advertising messages, to help recruitment agencies in the selection of the ordinary staff, to improve the quality and penetration of online-KYC and reduce fraud with online transactions.

- By the example of Fastacash we see that individual small companies develop more sophisticated products much faster than giants and launch them in more countries. We also evidence such interesting use cases as a request to borrow money (without interest) from relatives and friends. What’s remarkable about it? The demand for remittances is high but the return is low (and the margin is constantly shrinking), while lending business is much more profitable. On the other hand, in Asian countries the main players in the retail lending market are not banks, but rather pawn shops and microfinance institutions, and ways to attract customers are much more complicated and CPE is higher. People are constantly borrowing small sums from their relatives, friends or colleagues – how often they do it and how timely return, says a lot about their needs to borrow money and credit responsibility. If you make such regular requests to relatives and friends, then after an analysis of customer behavior, you can use these services and their data to build a huge lending business: at least sell these leads to the banks, as a maximum, to build on their basis large p2p-lending platforms like LendingClub.

As a result, you can see that all the giants (except WeChat) haven’t moved far in their product functionality development and in terms of the number of countries covered. Some «small giants» look much more interesting and agile against their background. My hypothesis is that in the coming year we will see a series of acquisitions of these players by messengers. When Apple launched ApplePay, its closest rival Samsung, which has been long trying to develop an analog in-house, eventually acquired LoopPay (currently Samsung Pay). Having acquired it, the giant has got not only cash cow, sales system and customer base (their own customer base is millions bigger and they can sell anything), but its unique team and Vision, product and the team’s skill to quickly integrate these technologies in different markets. The same logic would most likely be in new examples.